Across the globe, hot days are getting hotter and more frequent, though some regions have been hit harder by the soaring temperatures than others.

In the Middle East, residents are used to seeing the mercury rise above the 50°C mark, for a few days at least, in the peak of the summer.

Just last week, temperatures in Kuwait broke the 50°C threshold, making it the hottest place on earth.

Last year in the UAE on an afternoon in early June, residents living in the Sweihan area of Al Ain had to cool off indoors as the temperature soared to 51.8°C.

And nearly 20 years ago to this day in 2002, the UAE’s temperature reached its highest on record - a sweltering 52.1°C.

Recorded inland, away from the breezy coast, weather forecasters were forced to send advisories to residents to take shade and drink plenty of fluids to keep safe during the bout of hot weather.

Heat rising globally

Record-high temperatures in the summer are commonplace now as the atmosphere continues to hold on to increasing amounts of heat. As global warming continues to accelerate at an alarming rate, it isn't likely to change any time soon.

This week, Spain was hit with its first heatwave of the year - and highest temperature for the time of the year in over a decade - when temperatures climbed above 40°C in some areas of the country. And in the UK, a nation usually fraught with grey skies and rain, residents were out in their droves as the mercury rose to the early thirties during the hottest day of the year so far.

Here, The National has listed the top 10 hottest cities around the world as per the recorded temperatures on Thursday at noon local time. Temperatures forecast for the western world were taken into account.

Hottest cities in the world:

Doha, Qatar - 45°C

Kuwait City, Kuwait - 42°C

Riyadh, Saudi Arabia – 42°C

Lahore, Pakistan - 41°C

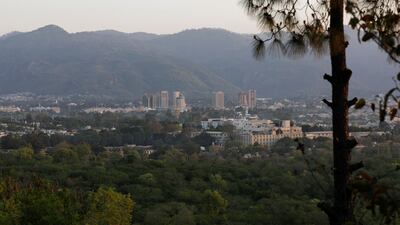

Islamabad, Pakistan – 41°C

Abu Dhabi in United Arab Emirates - 40°C

New Delhi, India – 40°C

Baghdad, Iraq – 40°C

Tashkent, Uzbekistan – 37°C

Kolkata, India - 35°C

source: timeanddate.com