Today, life in the Emirates moves in the fast lane. In a regular series to mark the 50th anniversary of the UAE, 'The National' takes a trip back in time to examine how much the country has changed.

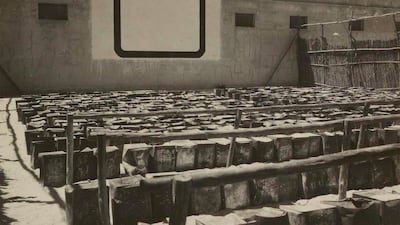

People sitting on old petrol tins, ‘Sharjah Paramount’ written on the wall and open-air screenings: this was the cinema in 1940s Sharjah.

It is believed this open-air theatre at the RAF base was the first cinema in modern-day UAE, catering to British personnel and staging screenings for the public.

But by the 1970s, stand-alone cinemas had flickered into life across the UAE.

From Dubai to Sharjah to Abu Dhabi, they screened the latest blockbusters from India but also showed films from Hollywood and the occasional one from Lebanon and Egypt.

Bur Dubai’s Plaza was among the most popular. Built in the 1970s, it was redolent of a golden age of cinema when these smaller theatres provided the only show in town.

The Plaza was also built in the happening centre of old Dubai, close to the bus station and the Creek opposite, where Al Ghubaiba metro station stands today. It was not only a cinema but a landmark and a popular meeting place.

The older photograph was taken after it was renamed Golden Cinema. The building was torn down in 2015, a casualty of changing tastes and the rise of the multiplex. Many other small standalone cinemas such as The Strand and Al Nasr in Dubai and Abu Dhabi’s El Dorado are also closed.

But the final curtain has yet to fall on the Plaza. It featured in exhibitions in 2017 and 2018 at Alserkal Avenue in Dubai and NYUAD in Abu Dhabi by Emirati artist Ammar Al Attar. His work documents the intriguing – and often overlooked history – of smaller cinemas across the UAE, from Kalba to Umm Al Quwain. It was also the subject of a podcast from Kerning Cultures.

But it has a more physical legacy, too. The founders of Cinema Akil rescued several of its old seats before it was demolished and installed them at the art house cinema in Alserkal Avenue, allowing a new generation of film buffs to time-travel through several decades. The building may be gone but the final credits have not yet rolled.