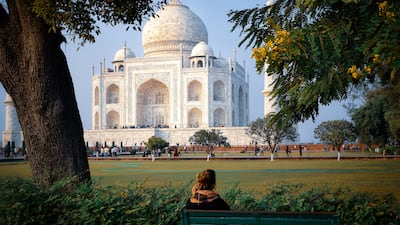

India’s Taj Mahal is the most popular Unesco-listed World Heritage site.

The famed marble mausoleum in Agra ranks first in a new study listing World Heritage Sites that people around the world most want to visit.

Zitango Travel, travel agents and destination specialists, studied online search data to find out which Unesco sites were the most searched for.

The Taj Mahal was the most coveted, with an average of 1.4 million searches per month.

Widely considered one of the most beautiful buildings ever created, the mausoleum in the state of Uttar Pradesh was built nearly 400 years ago and is a must-see destination for many tourists around the world.

Travellers in the UAE were particularly keen on the landmark, with the Indian mausoleum complex the most searched for, totalling an average of 8,300 searches per month. Saudi Arabia, Oman and Bahrain travellers also searched for the Indian attraction, more than any other in the world.

The Indian dedication to Mumtaz Mahal ranked first across Asia, being the most searched for heritage site in almost half of the countries across the continent.

Elsewhere in the Middle East, Jordan’s Petra ranked first for search traffic in Palestine, Qatar and Israel. The ancient capital of the Nabataean empire was declared a heritage site by Unesco in 1985, and listed as one of the new seven wonders of the world in 2007.

People in Lebanon and Jordan preferred to look to Turkey, with Cappadocia which is famed for its hot-air balloons and cave dwellings the most searched for in both countries.

The 10 most popular Unesco World Heritage Sites

- Taj Mahal, India

- Machu Picchu, Peru

- Rio de Janeiro, Brazil

- Yellowstone National Park, United States

- Stonehenge, UK

- Statue of Liberty, United States

- Petra, Jordan

- Cinque Terre, Italy

- Palace of Versailles, France

- Chichen Itza, Mexico

Globally, South America’s most famous ruins were the second most searched for Unesco Heritage site, with 1,100,000 in global search volume for Peru's Machu Picchu, according to Zitango.

Ranking third for search traffic is Brazil’s historic city of Rio de Janeiro, which was added to the Unesco list in 2017. Travellers flock to the the seaside city for its annual carnival celebrations, Copacabana Beach, and the 98-foot Christ The Redeemer statue atop Corcovado mountain.