Real Madrid are confident that Jose Mourinho can bring a much-needed greater degree of stability to the Bernebeu and help the Spanish giants close the gap on their arch-rivals Barcelona.

Real have gained a reputation for preferring individual brilliance to teamwork as the 11 coaches they have employed in the past eight years have striven to bring more and more "Galacticos" to the club.

Florentino Perez, who is in his second spell as the club president, having two years ago reassumed the role he relinquished in 2006, has watched a succession of big names come and go in their attempts to keep one of the world's most famous teams in the vanguard of the global game.

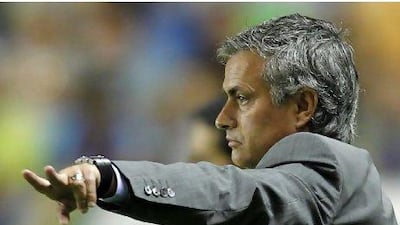

The president believes Mourinho can stay longer than most and build on the trophy-winning days he has spent with Porto, Chelsea and Inter Milan.

"Jose is the best," Perez said during a visit to Abu Dhabi to open the club's latest academy at the capital's Baniyas club yesterday.

"We want him to stay as long as possible and help us to get where we want to be."

Where exactly that is was lost in translation as Perez's Spanish comments were turned firstly into Arabic and then English, but further inquiries prompted him to admit that Barca currently hold the balance of power in what has been a prolonged battle for domestic and international supremacy.

Real trail Barca by five points with 15 Primera Liga fixtures remaining of the season.

Mourinho, in his first season in charge, has turned the Bernabeu into a fortress, engineering victories in all 11 home games, but a weakness on their travels has seen them surrender ground in what, again, is a two-horse title race.

Perez has not yet given up on the possibility of bridging that gap on the men from Camp Nou and extending a record haul of league titles to 32, but he conceded that knockout competitions, principally the Champions League, may now represent the most likely route to silverware.

With the team preparing for next week's last 16 encounter at Lyon, Perez, whose club have been crowned champions of Europe a record nine times, said: "The European Cup has always been close to our hearts and it still is, but we cannot afford to put that ahead of any other matches we face at this stage of the season.

"The aim at our club is to win every match in every competition we play in and that is still the case. At this moment we are in the middle of several competitions and we have to treat them all seriously."

Real, according to their president, have no intention of slowing down in their pursuit of world record transfers such as Zinedine Zidane, Kaka and Cristiano Ronaldo but yesterday's venture may one day, Perez believes, produce signings at the other end of the financial scale.

Asked whether the launching of a UAE branch of the Real Madrid Foundation to rival the academies already set up in the country by Barcelona, Manchester United, Arsenal and AC Milan, Perez said: "Players of all colours and all religions are welcome in Madrid.

"Our only concern is the quality of the player. If somebody from this new academy proves, in the distant future, to be good enough to play for Real Madrid, we will sign him."

"The aim when we set up these academies in all parts of the world is to reach the children and help to educate them in how to play the game to a high standard. We hope that proves to be the case in Abu Dhabi."

Real were welcomed to the capital by Wael Tawil, the chief executive of Baniyas Holding, parent company of the Abu Dhabi club.

He said: "The efforts of the academy will be employed for the benefit of stimulating all cultural aspects relating to sport. The intention is to develop local talent and prepare those talents for a brighter future.

"That will enable us to assert the UAE's position as a regional sports hub."