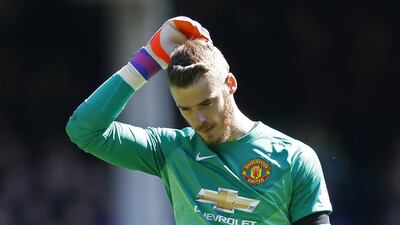

Louis van Gaal has confirmed David de Gea is still not mentally fit enough to play for Manchester United.

De Gea sat out United’s season-opening win against Tottenham Hotspur last week. Van Gaal felt he was unable to focus because of speculation linking him with a move to Real Madrid.

And Van Gaal has confirmed the goalkeeper will not feature in the club’s second game of the campaign, against Aston Villa on Friday night.

“No, it’s the same situation,” the United manager said when asked if De Gea would be in the squad.

Read more:

– Goalkeeper issues remain at large ahead of Manchester United’s trip to Aston Villa

United are refusing to sell De Gea unless they get Sergio Ramos in return or Madrid break the record fee for a goalkeeper, which stands at £32.6 million (Dh186.6m) that Juventus paid for Gianluigi Buffon 14 years ago.

Senior sources at Old Trafford say they are happy for the 24-year-old Spaniard to run down his contract, which expires next summer, and Van Gaal is OK with the idea that the player will not play for him until the transfer window shuts on September 1. “I have said that already,” Van Gaal said.

Sergio Romero deputised for De Gea in the 1-0 win over Spurs and the Argentina goalkeeper looks set to play at Villa Park.

“Normally, yes,” was the Dutchman’s terse reply when asked if Romero would keep his place.

Another player who looks set to stay at United is Adnan Januzaj. The Belgian was linked with a move to Sunderland after being left out of the matchday squad for the Tottenham game.

When quizzed on whether he would consider letting Januzaj leave on loan, Van Gaal replied: “He is still not for sale.”

Januzaj broke into the United team during David Moyes’s only season in charge, but has started just seven league games under the Scot’s successor.

Van Gaal insists he is happy with the player, however.

He added: “I have 28 players and I have to select every week, every three days.

“Last week I choose our players. He is doing his best. All the players are, I don’t have any complaints.”

Van Gaal has no new injury concerns ahead of the trip to the Midlands.

Marouane Fellaini is suspended, Phil Jones is out with thrombosis and Marcos Rojo is still lacking match fitness.

Van Gaal is looking to put pressure on United’s rivals by winning at Villa Park.

The Dutchman feels an improvement in away form will be vital to the club’s chances of challenging for the title.

“The key for success this season is improving away matches,” said Van Gaal, who won just six times away last term.

“We were one of the best last season at home, third.

“I want to create a fortress at Old Trafford, we did that but away we have to improve and we can improve because last year we were not good.”

Follow us on Twitter at NatSportUAE