The PGA Tour has refused to grant releases for players seeking to play in the LIV Golf Invitational Series opener next month.

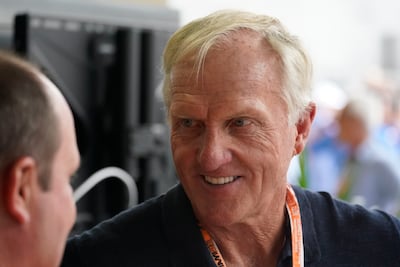

The Saudi Arabia-backed, eight-tournament series, which has former world No 1 Greg Norman at its head, is scheduled to begin on June 9 at Centurion Golf Club outside London – meaning it would conflict with the RBC Canadian Open on America’s lead circuit.

On Tuesday, reports emerged that the PGA Tour had sent a memo to its members saying no releases would be granted.

"We have notified those who have applied that their request has been declined in accordance with the PGA Tour Tournament Regulations," senior VP & chief of operations at the PGA Tour, Tyler Dennis, said in the email.

"As such, Tour members are not authorised to participate in the Saudi Golf League's London event under our regulations. As a membership organisation, we believe this decision is in the best interest of the PGA Tour and its players."

The PGA Tour, who have in the past granted releases for non-PGA Tour events, has maintained that those choosing to play in the rival LIV Golf series would face disciplinary action, opening the door to potential lifetime bans.

Six-time major winner Phil Mickelson is among the players who have requested a release to play at Centurion, along with three-time European No 1 Lee Westwood. Sergio Garcia, the 2017 Masters champion, is another said to have asked to participate in the tournament in England.

On Tuesday, Norman responded via a statement: "Sadly, the PGA Tour seems intent on denying professional golfers their right to play golf, unless it's exclusively in a PGA Tour tournament.

"But no matter what obstacles the PGA Tour puts in our way, we will not be stopped. We will continue to give players options that promote the great game of golf globally."

At present, the LIV Golf series will offer purses of $25 million per tournament, ensuring all eight events are more lucrative than the richest stop on the PGA Tour. Earlier on Tuesday, Norman, the LIV Golf CEO, said the series had recently secured an additional $2 billion in funding, for 10 events next year and a 14-tournament league in 2024.

"We're going to grow the game, give more opportunities to players, and create a more entertaining product for fans," Norman said. "We believe in adding new experiences and energy to golf, and that includes building out our future schedule in more global markets.

"We're creating an entertaining product that will increase golf participation and attract new fans across a broader global footprint. We realise it won't happen overnight, and we're excited for the opportunities LIV Golf will add to the game as we continue to grow."

Norman said 19 of the world's top 100 players and five of the top 50 were committed to the inaugural event at Centurion.