Last week, Mohammad Aamer received a compliment that he will probably cherish above all others. Aamer "is much cleverer than I was at 18", Wasim Akram, the Pakistan pace bowling legend, said after the wiry teenager had wrecked Australia in the first innings at Lord's with a four-wicket haul. Accolades have been a constant since Aamer's arrival on the international stage and not a soul has remained unimpressed with his virtuosity. And yet the journey seemed unlikely when the teenager suffered stress fractures as a 15-year-old and was plagued by a back problem on his return. A bout of dengue then robbed him of the chance to star at the youth World Cup of 2008.

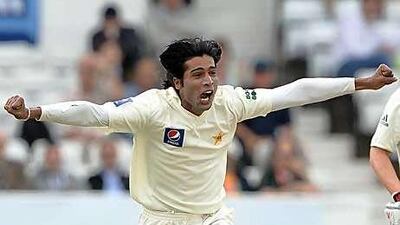

Battling through those adversities, Aamer today seems destined for greatness, his character defined by the resilience he has shown through those troubled times and a conscientiousness rarely seen in one so young. Today, in fact for some time now, he has been regularly compared to Akram, one of the greats of the game and someone he reveres. To hear your idol say something like what Akram did could easily give any youngster a bloated head, especially when you happen to be the new darling of a few million in the subcontinent. But Aamer stays rooted, doing what he does best and enjoys so much. His smile, every time he beats the outside edge, is a testimony to that. And he was smiling most of the day in Headingley yesterday, at least until Steven Smith's (77) sensational onslaught added 103 runs after the fall of the seventh Australia wicket to take Pakistan's target to 180.

Angling the ball away or making the ball dart in, from a probing length, Aamer gave a stern early test to Australia's two most accomplished batsmen, Ricky Ponting and Michael Clarke, in the morning. Chewing vigorously on a bubble gum that, oddly, was the cause of great mirth for Rameez Raja in the commentary box, he brought back memories of the great Akram. With his quick arm action and ever-growing bag of tricks, he had the two Australia veterans in much discomfort.

His first success of the day, though, came through luck. Ponting, looking sure with his long stride from outside the crease, fell chasing the widest delivery of his innings - an unconvincing jab that landed into the hands of wicket-keeper Kamran Akmal. Michael Hussey, however, was a victim of Aamer's impressive repertoire. Released with a wobbly seam, the ball cracked Mr Cricket on his gloves and looped towards the younger Akmal, Umar, at second slip. Hussey looked down the pitch as he walked back, suggesting some demons there, but he was just done in by the bowler.

Marcus North made no such gestures, walking away after an inside-edge into his stumps. He knew he had made the wrong shot-selection, standing back in his crease and dangling his bat away. He was the fifth batsmen to be dismissed and Australia were still five short of Pakistan's first innings lead of 170. Those three blows in the pre-lunch session opened the doors for Pakistan to exorcise the demons of Sydney, and indeed the whole tour of Australia earlier this year, when much shame was brought on the nation by defeats in every game and the following enquiry by the country's cricket board.

Salman Butt, forced into donning the role of captaincy following Shahid Afridi's resignation after the defeat in the first Test, could well become one of the few to taste victory in his first game at the helm. He has done well in the job, looking a lot more positive than some of his predecessors in the role. If Pakistan can get the 40 runs needed today, it will be their first Test win over Australia since 1995; they have lost 13 on the trot before this. That would just be the boost their cricket needs, following the recent happenings and Aamer, like Akram, could be an inspiration for a new generation.

Last year, when he was asked where he wanted to be in five years, Aamer said, "I want to be the go-to guy for the team, someone the captain and the nation relies on to lead them to glory." He is getting there sooner than he expected. @Email:arizvi@thenational.ae