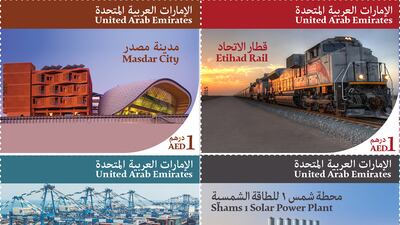

The commemorative stamps released by Emirates Post celebrating key projects initiated so far by Sheikh Khalifa will be welcomed by stamp collectors and residents. By marking these moments, Emirates Post is helping acknowledge these projects for prosperity.And the four chosen – Etihad Rail, Masdar City, Shams 1 solar farm and Khalifa Port – do reflect some of the most important steps forward during Sheikh Khalifa's presidency.

But while it is important to recall these projects as signs of progress, we should also remember that the greatest achievement of Sheikh Khalifa’s 11 years in power is not buildings or infrastructure, but the peaceful, prosperous and tolerant society we see all around us.

Etihad Rail may be on the stamp, but it is the people who live in the cities that will be linked by it who are the true success and wealth of this country.