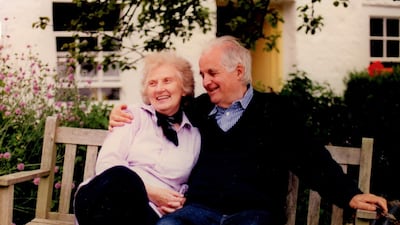

A little more than 50 years ago, as I took the first steps in London on what has proved to be a long journey of engagement with the Arab world, I had the good fortune to encounter a couple who had a profound impact on that journey. Patricia and Claud Morris had already established themselves as being active proponents of a better understanding of the region.

Claud, a journalist and publisher, had launched both Middle East International magazine and the newspaper Voice of the Arab World. He and Patricia, also an experienced journalist, provided me and other young activists with advice both on the ways of the British media and on how to try to influence parliamentarians and other opinion formers. Always tolerant of the mistakes born out of our youthful enthusiasm, they offered us ever-useful guidance, even if it was not always accepted.

Later, as I settled in the UAE, a country with which they were already familiar, their writings on the country gave me invaluable insights into its early years.

This week, with the news of the death of Patricia last month at her home in Cornwall, at the age of 96, I have been reflecting on the contribution that she and her husband have made to my understanding, and that of many others, of the UAE.

Patricia Morris, born Patricia Holton in New York in 1923, made her most important contribution through her book Mother Without A Mask, published in 1991 by Dubai's Motivate Publishing.

Accompanying her husband on many of his visits to the Emirates during the early and mid-1970s, she became close to an Emirati family, spending much time with them in Al Ain. The book, written under her maiden name, chronicled that intimate relationship.

Taking part in family events and accompanying the women of the family to a wide variety of social engagements, she was able to observe local customs and the way of life from the inside.

She was also able to offer answers to the many questions posed to her by her hosts about Britain, satisfying their natural curiosity about a world with which they were just beginning to become familiar. At the time, few other European visitors had enjoyed the same opportunity, and very few indeed had the same journalistic skills to record what they learnt.

By the late 1970s, this family was ready to send its teenage sons to London, to polish their English language and to learn, at first hand, about the British way of life. The sons were entrusted to Patricia and Claud, and, for several years of summer visits, she served in loco parentis, acting in the place of their mother.

Mother Without A Mask is the record of the early years of that friendship. Nearly 30 years after it was first published, it still offers unique insights into early days in the Emirates, as the new generation – and its parents – began to come to terms with a very different outside world.

Patricia last visited the UAE a decade ago, staying with her close friends in Abu Dhabi. But the relationship continued, with one of her local "sons" calling her a few days before she died.

Her continuing contribution to the Emirates is provided by that enormously important glimpse into a world that few outsiders are able to enter. That of Claud, who died in 2000, is of a different nature.

During those early days of the UAE, he interviewed many leading members of the government. The most important of these was Sheikh Zayed, the Founding Father, with whom he had many lengthy conversations. The result was the first-ever biography of Sheikh Zayed, entitled The Desert Falcon.

The book explains Sheikh Zayed’s childhood and his early days in Al Ain. It reports, in his own words, how he gradually came to develop his vision for the development of Abu Dhabi and the broader UAE along with the way his determination grew to use the wealth from oil for the benefit of the people. “Why," Claud quoted him as saying, "can’t we make this place a kind of paradise?”

In The Desert Falcon, we see Sheikh Zayed in the early years of his journey, explaining the path that he sought to follow. Asked about how he began to tackle the challenges that faced him on his accession as Ruler of Abu Dhabi, he told Claud: "All the picture was prepared. It was a matter, not of fresh thinking, but of simply putting into effect the thoughts of years and years."

With the benefit of four decades of hindsight, we can now look back on the achievements of Sheikh Zayed, assess them in the light of his stated objectives and recognise the nature of his inspired leadership. It is rare that one can do that.

For many years, I have used the books of Patricia and Claud Morris to test my own evolving understanding of the Emirates. Those who wish to learn about the UAE in its early days, whether newcomers or old hands, citizens or expatriates, might like to follow suit.

Meanwhile, the Morris family has continued their efforts to explain the UAE to the outside world. Their children, Ann and William, have for many years supplied the British media with news and information about the Emirates.

A grand-daughter, Loveday Morris, a former member of the staff of The National and now Berlin bureau chief for the Washington Post, has reported not only from Abu Dhabi, but also Jerusalem, Baghdad and Beirut. The 50-year family relationship with the UAE is still going strong.

Peter Hellyer is a UAE cultural historian and columnist for The National