UAE Founding Father, the late Sheikh Zayed bin Sultan Al Nahyan, once said: “The book is a container of science, civilisation, culture, knowledge, literature and arts. Nations are not only measured by material wealth but also by their civil authenticity. The book is the basis of this authenticity and a key factor in the confirmation of its civilisation.”

This profound insight underscores our leadership’s philosophy and the belief that our nation’s greatest asset is its people. And to nurture their skills, we must start with the fundamental building block: reading. We are now halfway through National Reading Month 2024 in the UAE, and I am filled with a deep sense of appreciation for the transformative power of reading. I hope that the initiatives and activities planned for this month enable us to actively engage and connect with the community.

The value of reading cannot be overstated. Whether novels, newspapers, journals or magazines, reading provides us with the tools necessary for personal and intellectual growth. It is through reading that we cultivate critical thinking, analytical skills and a nuanced understanding of the world around us. It also opens the door to myriad cultures, fosters empathy, broadens our perspective on any given topic and offers insight to human experiences beyond our immediate surroundings. In fact, so much of what we know about our world has been learnt through reading, rather than via first-hand experience. Perhaps most importantly in an increasingly polarised world, reading helps us understand the lives and experiences of others.

National Reading Month in the UAE has grown bigger with each edition. This year, too, ministries, government institutions and the private sector are collaborating to present various activities. Among them is an initiative to republish rare books, thereby protecting their legacy from being lost. The Ministry of Culture has partnered with the Emirates Writers Union to bring 12 such books back to life. In addition to this, we will also translate a collection of Emirati literary pieces into different languages. The reading month in the UAE is a community event and this year it coincides with the Holy Month of Ramadan, providing us with an opportunity to bring culture, literature and tradition together.

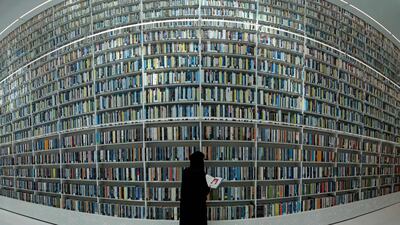

Books have been an integral part of the UAE’s journey. Every emirate is connected through an extensive network of public libraries, which are home to some of the most valuable and rare books. Built over the years, these treasure troves of knowledge are not just places of reading but also hubs for knowledge sharing and cultural activities.

Take, for example, the Qasr Al Watan Library, which was launched during National Reading Month in 2019. With more than 50,000 titles on science, the arts and other fields, this library spotlights how the UAE’s National Strategy of Reading and National Reading Month have been instrumental in reminding us of the significance of books. The National Library and Archives Abu Dhabi is another great example of how libraries contribute to this legacy and play a central role in building the country’s strong knowledge infrastructure. The National Library and Archives are currently working on digitising books about the UAE, the Gulf and the Arab world to offer an accessible platform and resource to researchers at the local, regional and global levels.

In Dubai, we have the Mohammed bin Rashid Library, which marks its 10th anniversary this year and houses hundreds of thousands of books from all over the world, covering different genres and languages. Al Safa Art and Design Library was revamped and opened to the public during National Reading Month in 2019 and hosts a remarkable collection of books on design, calligraphy, architecture and the arts.

Sharjah has been instrumental in positioning the UAE on the global cultural map since the 1970s, and this is evident through initiatives such as the Dr Sultan Al Qasimi Centre for Gulf Studies, which houses a rich collection of centuries-old maps, manuscripts and books. The House of Wisdom is yet another cultural hub that places books at the forefront of community engagement offering a massive library and space for people to appreciate, critique and discuss books.

National Reading Month 2024 provides us all with a welcome reminder of the value of reading and an opportunity to discover or rediscover it for ourselves. I encourage you to utilise the initiative and activities this month to make reading a habit. Look for topics that interest you and read every day to open up endless possibilities of discovery and learning.

I am sharing some recommendations from my personal library to help you get started: Nuthum Al-Fara’id in the Legacy of Ibn Majid by Sheikh Dr Sultan bin Muhammad Al Qasimi, Ruler of Sharjah; Letters to a Young Muslim, a collection of letters addressing the complexities of being a Muslim in the modern world, by Omar Ghobash; and Celestial Bodiesby Jokha Alharthi, winner of the 2019 International Booker Prize.