In analysing the US-UAE relationship, one mustn't be distracted by the ephemeral dance of diplomatic and political manoeuvring. Rather, the essence of this partnership is to be found in three historical dimensions, with implications far more profound than the fleeting headlines of the day.

The military co-operation that underpins the relationship is not a transient connection; it is a cornerstone. American hardware and software have deeply ingrained themselves in the UAE's military structure. Any significant change in this arena would be a generational undertaking that the UAE is not poised to pursue.

Abu Dhabi's determination to acquire the F-35 fighter jet is a testament to its unyielding commitment to enhance its military through American expertise. The pursuit of this state-of-the-art technology underscores the strategic value Abu Dhabi places on aligning its military capabilities with those of the US.

Documents released under the US Freedom of Information Act reveal the UAE's strategy to use American military expertise to help polish its robust capabilities. The UAE has become a prime destination for US veterans, attracting prominent figures such as former secretary of defence Gen Jim Mattis.

Further, the US-UAE security arrangement is far more than a conventional alliance; it's a vital bond that cannot be replaced or replicated with any other nation, let alone anytime soon.

The US and UAE, alongside India and Israel, recently announced the creation of the I2U2 joint business coalition, aimed at promoting economic development and food security amid global climate change. The grouping’s existence, and remarks made by top US government officials, underscore the strategic nature of Washington’s alliance with Abu Dhabi, highlighting the I2U2 as a forward-looking partnership with exciting projects under way, connecting regions in a way that aligns with broader US diplomatic and economic goals.

While the negotiations between the Biden administration and the UAE for a strategic security agreement have yet to yield results, the talks themselves, covering defence, security and trade, underline the continued importance of this alliance.

Finally, while the UAE may actively pursue economic opportunities in global crises, its core economic fabric is inextricably tied to the US, particularly through the Swift code arrangement, which is heavily dominated by American rules and codes. This connection is crucial to the UAE’s economic and trade-related activities and America’s interests in the region.

Any talk of the UAE drifting away from Washington is a misunderstanding that fails to contextualise the calculated manoeuvres on Abu Dhabi's side. Far from being a unique feature of UAE foreign policy, this hedging is emblematic of a global trend. Nations, allies of Washington included, are more reluctant to choose definitive sides in international conflicts.

India's stance, for example, regarding the war in Ukraine has been characterised by a refusal to condemn Russia's actions, while simultaneously increasing trade with Moscow, particularly in the form of purchasing Russian oil, albeit below the price cap set by western economies.

Israel is carefully managing its relationships with major global powers, notably the US, China and Russia, to safeguard its diverse interests. The planned visit of Israeli Prime Minister Benjamin Netanyahu to China, amid tensions between Israel and the US, underscores Israel's desire to expand economic ties and engage in dialogue about regional stability, while still emphasising its steadfast alliance with the US.

Simultaneously, Israel's acknowledgement of Moscow's importance, particularly in relation to its military activities in Syria, has led to its refusal to arm Ukraine against Russia, even when urged by Washington. This decision has been consistent across two governments and three prime ministers since the war began. Israel's foreign policy strategy involves a careful balancing act: building connections with China to explore economic opportunities, co-ordinating with Russia in Syria to counter Iran and its militias, and preserving its special relationship with the US.

This complex and multifaceted diplomatic approach positions Israel alongside other nations that are similarly managing their international engagements in a complicated global landscape, marked by a diminishing confidence in Washington.

In fact, doubts surrounding the US's dedication to the security of its allies are not without basis. The way the JCPOA negotiations were conducted has heightened concerns among US partners in the Middle East about Washington's understanding and regard for their security needs. These anxieties feed into a larger perception of the US withdrawing from Middle Eastern affairs. A similar pattern is evident in Asia, where South Korea's unease with US security commitments has led government officials and politicians to contemplate nuclear alternatives. These underlying worries represent widespread apprehension among US allies about the reliability of American defence promises.

However, the narrative that suggests the UAE is drifting away from the US alliance is not just an oversimplification; it is a profound misunderstanding of a partnership that goes beyond mere convenience or immediate political considerations.

In addition to playing a pivotal role in the war on terror and trailblazing peace with Israel through UAE's leadership of the Abraham Accords, Abu Dhabi is aligning itself with a crucial US foreign policy pillar through its focus on renewable energy. The UAE and US have forged an agreement to invest $100 billion in clean energy projects, aiming to add 100 gigawatts of clean energy globally by 2035. This agreement, crucial to the Biden administration's agenda on environmental sustainability, will stimulate both private and public sector investment in areas such as clean energy innovation, carbon management, advanced reactors, and decarbonisation of industrial and transport sectors.

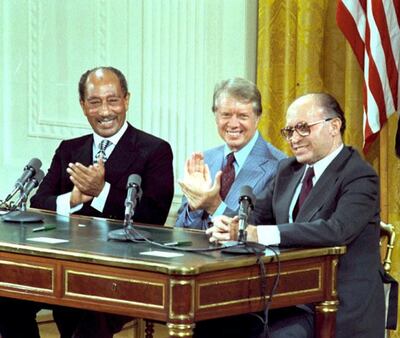

The US-UAE alliance stands as a beacon of adaptability and resilience in a region often adrift in uncertainty. It is, however, not impervious to the subtle shifts that define the geopolitics of our time. While we lack the drama of a “Sadat moment”, akin to Egypt's profound shift under Anwar Al Sadat from the Soviet sphere into America's embrace, we must not succumb to the mirage of stagnant realities. The UAE's political compass, once fixed and unswerving, may be exhibiting a quiet, incremental shift. This movement, almost imperceptible in its gradualism, could elude the vigilance of veteran diplomats.

In a world where allegiances are continually tested and realigned, the US-UAE relationship stands as a testament to the adaptability and resilience of international partnerships. Those seeking to understand this alliance would do well to look beyond the immediate headlines and consider the enduring strategic value that continues to bind these two nations in an ever-changing world.