New video obtained by a US civil rights organisation shows the arrest of Badar Khan Suri, a Georgetown University researcher who has been accused of having links to Hamas and threatened with deportation.

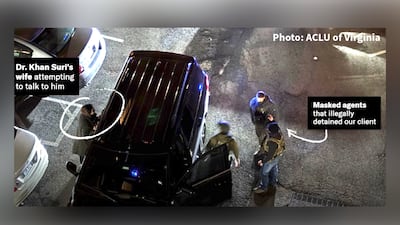

The brief video, recorded by Mr Suri's neighbour in Rosslyn, Virginia, shows masked federal agents surrounding him on March 17. Photos taken by the neighbour show Mr Suri, an Indian citizen studying in the US, attempting to speak with his wife, who was standing nearby, as he was detained.

According to the American Civil Liberties Union of Virginia, which obtained the video and is assisting with the Georgetown researcher's legal defence, Mr Suri was transferred to five different immigration and customs enforcement (ICE) facilities across three states over the course of just four days. "For almost two weeks, he was housed in a room without a bed and with a television blaring 21 hours a day," read a press release from the ACLU.

Hassan Ahmad, a lawyer for Mr Khan Suri, told The National that his client is now in a detention facility in Texas. A federal judge has ruled that he cannot be deported from the US while legal challenges are in progress. Meanwhile, his legal team is trying to move his case back to Virginia where they will then attempt to get him released on bond amid the legal challenges to his detention.

“Conditions are rough,” Mr Ahmad told The National in an email. “It's been a challenge getting and scheduling attorney calls, and he spent the Eid holiday in detention as many of the other Muslim students abducted by the administration have done.

“Our government abducted a man from his wife and children because one person didn't like the fact that he acknowledged the humanity of Palestinians. According to the immigration charging document, his presence in the United States is bad for foreign policy. If this is the guy our government thinks is a problem, then the problem is the government.”

A court hearing to determine whether or not Mr Khan's case will be moved to Virginia will commence on May 1. The Department of Homeland Security (DHS) has accused Mr Suri, of having “close connections to a known or suspected terrorist, who is a senior adviser to Hamas” leading up to his arrest.

Mr Ahmad hit back against those accusations.

"This is not about abusing the privilege of a visa as the administration repeatedly tries to justify. It's a clamp down on speech, on identity, and it should shock the conscience of every freedom loving American," he said.

Shortly after Mr Suri was detained, DHS spokeswoman Tricia McLaughlin claimed in a post on X that he was “actively spreading Hamas propaganda and promoting anti-Semitism on social media”. The DHS announced on Wednesday that officials would bar those who showed support for "anti-Semitic" content on social media from bring given visas or permanent residency.

The State Department has also said that Secretary Marco Rubio had determined the scholar's activities “rendered him deportable”. According to Mr Rubio, the State Department has probably revoked at least 300 visas, many of them belonging to foreign students, as it cracks down on people who have participated in protests against Israel's war in Gaza.

Politico reported that Mr Suri's legal team had alluded in court to the “Palestinian heritage of his wife”, Mapheze Saleh, a US citizen who is listed as a member of Georgetown's class of 2026, as a motive for his detention.

“Mapheze, a first-year student from Gaza, earned her bachelor’s degree in journalism and information at the Islamic University of Gaza, Palestine, and a master’s degree in conflict analysis and peace-building from the Nelson Mandela Centre for Peace and Conflict Resolution at Jamia Millia Islamia in New Delhi, India,” reads a biography of Ms Saleh on Georgetown's Centre for Contemporary Arab Studies website.

In February, Israel's embassy in the US posted on X that Ms Saleh was “the daughter of a Hamas senior adviser”. Georgetown has said that it was "not aware of him [Mr Suri] engaging in any illegal activity", adding that the university had not received any reason for his detention. Georgetown dean Joel Hellman said that he was deeply concerned about Mr Suri's arrest and detention.

“Like many in our community, Dr Suri has been exercising his constitutionally protected rights to express his views on the war in the Middle East. Georgetown has consistently protected such freedoms within the context of our long-standing Speech and Expression Policy,” he said. Students at Georgetown University have protested against Mr Suri's detention in recent weeks, demanding his release from prison and the reversal of the government's deportation efforts.