Live updates: Follow the latest on Israel-Gaza

After months of frustrated diplomacy, President Joe Biden on Wednesday finally got the Middle East success he had staked much of his reputation on – a Gaza ceasefire agreement between Hamas and Israel, but his successor-in-waiting Donald Trump moved quickly to steal the limelight.

Mr Biden described the historic deal, which takes effect on Sunday, as being essentially the same as the one he announced on May 31 and said it had been made possible through his resolute support of Israel as it attacked Hamas, as well as through his team's non-stop political efforts.

The deal is a “result not only of the extreme pressure that Hamas has been under and the changed regional equation after a ceasefire in Lebanon and weakening of Iran – but also of dogged and painstaking American diplomacy”, Mr Biden said.

Yet even before the agreement was officially announced, president-elect Trump sought to take credit for the accord, arguing it was only thanks to his election in November that Israel and Hamas they finally agreed on a deal.

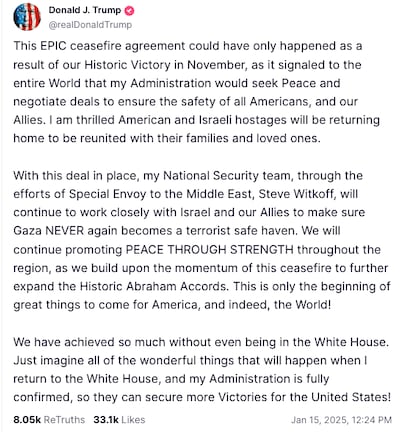

“This epic ceasefire agreement could have only happened as a result of our historic victory in November, as it signalled to the entire world that my administration would seek peace and negotiate deals to ensure the safety of all Americans, and our allies,” Mr Trump said on Truth Social.

He added that he would use momentum from the ceasefire to expand the Abraham Accords.

Mr Biden said he had directed his team to co-ordinate closely with the Trump team to “make sure we're all speaking with the same voice, because that's what American presidents do.".

But when a reporter at the White House asked him if Mr Trump deserved credit, the departing President said: “Is that a joke?”

It is natural for rival presidents to cast competing narratives on crucial issues, but experts say more important is the remarkable fact that both the incoming and departing administrations worked so closely together in recent months on this issue.

“The co-ordination that has occurred is virtually unprecedented,” said Aaron David Miller, a former long-time Middle East analyst at the State Department. “This is really quite remarkable.”

Khaled Elgindy, an adjunct professor at Georgetown, said it made sense for both teams to be involved because the ceasefire will be implemented under the new Trump administration.

“It does set it up in a way that allows Trump to claim credit, and that will not be an absurd narrative,” Mr Elgindy said. “He should get some of the credit because he's the different factor. If what is on the table now, in terms of the content of the ceasefire deal, is not radically different than what's been on the table since May, then why hasn't Biden been able to clinch the deal?”

Mr Trump has repeatedly warned Hamas that there will be “hell to pay” if it does not free the remaining captives before his inauguration. Israeli Prime Minister Benjamin Netanyahu has also appeared more willing to listen to Mr Trump than Mr Biden, whose demands the Israeli politician has frequently brushed aside since October 7, 2023.

David Makovsky, senior fellow at the Washington Institute for Near East Policy, said the deal came about due to there being "a lot of pressure on Hamas, both on the battlefield, the isolation of Hamas with the decapitation of Hezbollah", as well as the weakening of Iran.

"I think this a rare moment of Biden and Trump kind of converging – I've never seen this before an incoming and an outgoing president in the same negotiation, having their representatives in the same negotiation," he told The National, adding that regional players wanted to "start a new page with the new administration".

Senator Marco Rubio, perhaps displaying his diplomatic skills, said at his confirmation hearing to become the next secretary of state that both administrations should be acknowledged for helping to secure a deal.

“Credit to both the Biden administration and the Trump Transition. They’ve worked side by side on helping this come about,” Mr Rubio said.

A senior Hamas official told The National that it was the election of Mr Trump and his appointment of Steve Witkoff as Middle East envoy that finally got things moving during negotiations.

“US pressures led by Donald Trump through his envoy to the negotiations succeeded in putting an end to the Israeli intransigence that tried hard to obstruct the agreement," the source said.

A senior official from the Biden administration praised the partnership with Mr Witkoff, describing the co-ordination between the two administrations as “almost unprecedented.

The official said the Biden team wanted a seamless transition to the Trump administration, which will oversee the implementation of the ceasefire after January 20.

Senator Chuck Schumer, the highest-ranking Jewish-American official in US history, said the deal “couldn't have happened without steadfast diplomacy and until the potency of Hamas was radically reduced, we will not rest until every hostage comes home".

Senate Majority Leader John Thune called the deal "a relief to a world on edge" and said he was hopeful the deal would lead to the return of all hostages.

State Department spokesman Matt Miller said the deal shows “that when Americans are willing to work together across partisan lines, as we were willing to do on this occasion, because it's in the national interest of the United States, there's a lot that we can get done.”