There must be wider access to health care if a surge in the number of cancer cases in the UAE is to be reversed, experts said.

That was among the chief findings of soon-to-be-published research in The Lancet Oncology, which was responding to the latest figures, released earlier this year, which showed a 60 per cent rise in newly-diagnosed cases between 2019-23.

The series paper, titled “Cancer Control in the United Arab Emirates,” co-written by leading UAE-based oncologists and global experts, called for an urgent and comprehensive national strategy to address rising cases, inequities in care and preventive services not being used enough.

The latest figures, released by the Ministry of Health and Prevention earlier this year, showed 7,487 new incidents of cancer were found in 2023, up from 4,633 newly diagnosed cases in 2019 and 5,830 in 2021.

oncology consultant, International Modern Hospital, Dubai

The figures come amid a growing population, but also due to relatively high obesity and smoking rates. Professor Humaid Al Shamsi, a leading medical oncologist in the UAE and visiting professor at Harvard University is the senior author of the study.

“Equity must be the cornerstone of cancer control,” said Prof Al Shamsi, who is head of Emirates Oncology Society.

“If we don't address disparities now, outcomes will worsen and costs will rise. We have the tools, talent and vision – now, we need co-ordinated execution to become a global leader in equitable, high-quality cancer care.”

Barriers to addressing the increased number of cases include low awareness, cultural stigma, limited insurance coverage for expatriates and lack of digital follow-up systems.

As the fifth leading case of death in the UAE, cancer is responsible for about eight per cent of all deaths. An ageing population, lifestyle-related risk factors such as obesity and smoking and better diagnostic capabilities have contributed to the sharp increase in cases, experts said.

The economic impact is also significant with cancer costing the UAE about Dh39.9 billion each year in treatments and lost productivity, about 2.7 per cent of GDP, Prof Al Shamsi said.

In the most recent National Cancer Registry figures from 2023, 94.8 per cent of cases were classified as invasive, or malignant. The majority of cancers, 56 per cent, were found in women, with 1,736 new cases found in the local Emirati population.

“When we try to interpret these figures we should not forget that more than 75 per cent of the population is expatriate, with different genetics, environmental exposures and also different cancer disease profiles,” said Dr Moustafa Aldaly, an oncology consultant at International Modern Hospital, Dubai.

“The main concern in the paper is about equality of cancer services, which I totally agree with. There is a need for national guidelines, and a national insurance code for cancer management. Due to the variation in insurance policies and approvals, access to early detection and screening campaigns can be a limiting factor.”

Lack of recovery networks

A lack of nationwide integration, home-care options and trained professionals were limiting the effectiveness of palliative care for cancer patients, the report found.

There was also an urgent need for more programmes providing follow up care and monitoring in recovering patients, according to the study’s co-author Dr Deborah Mukherji.

“The cancer journey doesn't end with treatment,” said Dr Mukherji, a consultant oncologist at Clemenceau Medical Centre Hospital in Dubai.

“We must build survivorship and palliative models that reflect the needs of both citizens and expatriates.”

Tackling the problem

The UAE’s cancer care landscape has grown significantly in recent years. In Dubai, the Basmah programme uses pooled insurance premiums to fund cancer treatments for expatriates who exceed their policy limits.

Now, there are more than 30 centres nationwide and five major comprehensive cancer centres but experts said there remained a variation in quality of care, particularly in more rural areas.

Due to open in 2026, the Hamdan Bin Rashid Cancer Hospital in Dubai will be the UAE’s first public comprehensive oncology hospital. It is expected to improve access to care, centralise expertise and increase the number of cancer specialists, especially surgical oncologists.

At the beginning of 2025, mandatory health insurance rolled out across the Northern Emirates.

Global pattern

While cancer survival rates continue to improve resulting from new drug combinations and more accurate blood testing, more people are being diagnosed worldwide.

According to Cancer Research in the UK, the number of people being diagnosed has increased by half in the past 50 years.

In 1973, about 413 people were diagnosed in every 100,000, but that number has also soared to about 607 per 100,000 in 2023, largely due to better diagnostics.

However, an NHS vaccination campaign for HPV, the virus related to cervical cancer, has been dealt a serious blow in recent years.

According to the UK Health Security Agency (UKHSA) more than a quarter of eligible children are missing out on the vaccine.

In contrast, the UAE has led the region in its approach to HPV and vaccinations.

Since its 2008 launch in Abu Dhabi and subsequent national roll-out, the programme achieved 82 per cent coverage in girls aged 13–14 by 2022.

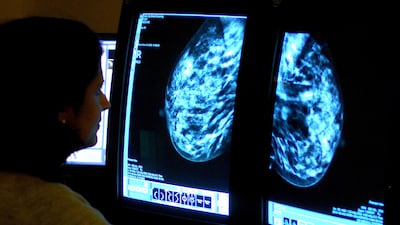

While breast cancer campaigns such as the Pink Caravan continue to boost breast cancer awareness, experts called for a similar national strategy for other cancers like colorectal and lung, particularly targeting non-nationals.

Dr Neil Nijhawan, a consultant in hospice and palliative medicine at Burjeel Medical City in Abu Dhabi said compassion must be at the core of all health care.

“Palliative care, which relieves suffering and supports quality of life, remains underdeveloped in much of the region,” he said.

“Too often, patients with terminal illness receive invasive hospital treatments rather than comfort-focused care surrounded by family.

“Compassionate care isn’t sentimental – it is clinically effective as it improves communication, patient outcomes, and reduces costs.

“In contrast, systems driven more by profit than people can lead to over treatment, distress, and moral injury for both patients and clinicians.

“The UAE can lead not just in medical technology, but in compassionate innovation – by funding palliative care, supporting hospice services, and training professionals in holistic care.

“This isn’t just good healthcare policy – it’s a moral obligation.”