My Own Home takes you inside a reader-owned property to ask how much they paid, why they decided to buy and what they have done with it since moving in

After a decade of living together in Abu Dhabi, Nafisa Patni and her husband, Zeeshan Razzaqi, decided to make the move to Dubai and purchased a property in Damac Hills 2.

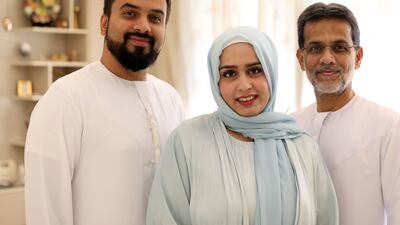

Mr Razzaqi was raised in the capital, but is now director at workplace solutions company Bisdesk, in Dubai. Ms Patni, a content creator, also runs her own marketing company, so it made sense for them to uproot.

Now, they live happily in their Dh2.1 million four-bedroom villa, which they bought off-plan, with their daughter and Mr Razzaqi’s father, Mohammad. While they have no intentions of moving just yet, Ms Patni has not ruled it out.

The National takes a look around.

Please tell us about your home.

We have four bedrooms upstairs, and downstairs, there is a hall, a maid’s room, a storeroom, a kitchen and a garden.

When did you buy the house?

Technically it was pre-Covid, but it was handed over to us after the pandemic. We bought it for Dh2.1 million and I don’t know the current value today.

What renovations have you done?

The storage capacity in the house is very poor, so we did renovations to add more storage options.

We got the garden renovated and did a little bit in the hall for a showcase, but overall we’ve done very few renovations.

How would you describe your interior design?

It’s very, very cosy with a lot of earthy textures and neutral colours – most of it is white. We have a lot of natural plants in the house. We love plants.

My garden area is a small, cosy place where we sit during the evenings inside the cabana so we can enjoy the weather. We have a lot of birds coming because we keep bird food everywhere. So, in the morning and evenings they come for the food and water and the sounds of the birds is very therapeutic and really relaxing.

My daughter likes to play outdoors and we have tea time, then after dinner we sit and chat. Then indoors is more of a calming place where we have nice, neutral colour palettes and a large collection of vintage items. My husband loves collecting, especially from Asia. We have some things that are more than 500 years old.

Why did you decide to buy in Dubai?

We were based in Abu Dhabi for more than a decade, then my husband started his own business in Dubai, and so they decided that it's time to shift to Dubai. When we started the business, the intention was not to go back to our hometown, because life in the UAE is definitely worth living.

My father-in-law had settled in Abu Dhabi, so my husband’s schooling and everything was done in Abu Dhabi. After all that time, they decided to invest in Dubai.

This was our first investment, because earlier we were in a rented house in Abu Dhabi. It didn't make sense to keep paying rent when we have an intention to settle here. So we decided Dubai was the best place to invest in, as this place is definitely developing day by day.

Why did you choose Damac Hills 2?

The ambience. When we looked at the plans, the entire layout and the community set-up was lush and green. Earlier, the name of this community was Akoya Oxygen, which meant lots of fresh air, water and greenery. So that is what my in-laws and my husband love, because it’s all natural.

The facilities are also amazing and we liked that it was far from the city. It has a nice, calming effect. We knew it was not going to be like a typical community. That it was going to be different. And it is – it gives us those nice, resort-style vibes.

Even though it’s far from the city, once you enter the community it’s a whole different world.

What facilities do you have?

We have an amazing pool. There are several playgrounds around the community. Every cluster has their own pool and play area. There is a basketball court, a gym, a cricket pitch and a tennis court. We have outdoor gyms, as exercise equipment is installed everywhere.

We have Malibu Bay, which is a huge pool with the lazy river, slides, kids’ splash area and cabanas. On weekends we enjoy the lazy river and sitting by the cabanas, reading books or having a nice time with the family. We also have a barbecue section.

We even have our own private boating area in the community. It’s a man-made lake where we can go boating.

There are several supermarkets inside the community. We have a laundry service. Everything in the community is accessible.

How long do you plan to live in this property?

It’s been three years since we moved in to this house, so we have no plans to move out any time soon. If we have something better than this, maybe in future, inshallah, we will see, but for now this is our home and we love it.