The US capture of Venezuelan leader Nicolas Maduro – praised by President Donald Trump as “stunning and powerful” – leaves behind uncertainty and questions over who is running the oil-rich country.

As part of the operation early on Saturday that knocked out electricity in parts of Caracas and included attacks on military installations, US special forces seized Mr Maduro and his wife, Cilia Flores, and flew them to the US.

Mr Trump on Saturday said the US would “run the country” until it can ensure a “safe, proper and judicious transition”. He also said the country's Vice President Delcy Rodriguez had been sworn in as acting president.

Under Venezuela's constitution, Ms Rodriguez becomes acting president in Mr Maduro's absence and the country's highest court ordered her to assume the role late Saturday night.

But shortly after Mr Trump's remarks, she appeared on state television accompanied by her brother, the head of the national assembly Jorge Rodriguez, Interior Minister Diosdado Cabello and Defence Minister Vladimir Padrino Lopez and said that Mr Maduro remained Venezuela's only president. The joint appearance indicated the group that shared power with the captured Venezuelan leader is staying united – for now.

“We call on the peoples of the great homeland to remain united, because what was done to Venezuela can be done to anyone. That brutal use of force to bend the will of the people can be carried out against any country,” she said as she condemned the US operation.

Mr Trump publicly closed the door Saturday on working with opposition leader and Nobel Prize winner Maria Corina Machado, widely seen as Mr Maduro's most credible opponent, saying she does not have support inside the country.

Who is Delcy Rodriguez?

Ms Rodriguez, 56, was born on May 18, 1969, in Caracas and is the daughter of left-wing guerrilla Jorge Antonio Rodriguez, who founded the revolutionary Liga Socialista party in the 1970s.

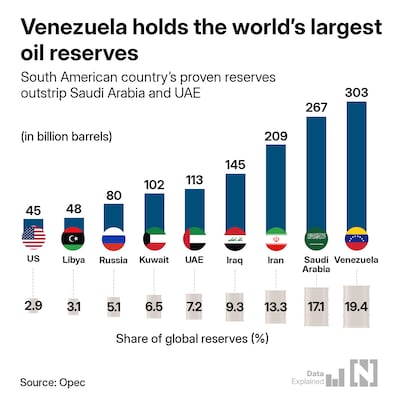

Her roles as finance and oil minister, held simultaneously with her vice-presidential post, have made her a key figure in the management of Venezuela's economy and gained her major influence with the country's withered private sector. She has applied orthodox economic policies in an effort to fight exaggerated inflation.

She is a lawyer who graduated from Universidad Central de Venezuela and rose rapidly through the political ranks in the past decade, serving as Communication and Information Minister between 2013 and 2014.

Ms Rodriguez was foreign minister from 2014 to 2017, during which time she attempted to crash a Mercosur trade bloc meeting in Buenos Aires, following Venezuela's suspension from the group.

She was named Vice President in June 2018, with Mr Maduro announcing the appointment on X by describing her as “a young woman, brave, seasoned, daughter of a martyr, revolutionary and tested in a thousand battles.”

Hours after Mr Maduro's capture and before she addressed the National Defence Council, Mr Trump said she had spoken to Secretary of State Marco Rubio. According to the US President, she appeared willing to work with Washington on a new phase for Venezuela.

“She had a conversation with Marco. She said, ‘We’re going to do whatever you need.’ I think she was quite courteous. We’re going to do this right,” Mr Trump said.

But some analysts believe she is unlikely to make any concessions to the US.