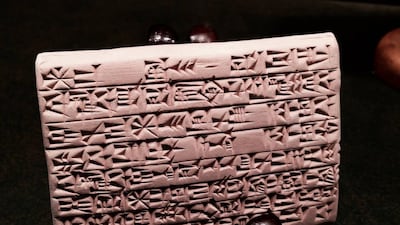

In Cedar Rapids, Iowa, 44-year-old Jeremiah Peterson makes painstaking incisions on clay tablets, writing messages in Sumerian, the world’s oldest known language.

The Assyriologist has been honing his craft of inscribing cuneiform on to clay tablets for the past six years, working from his home in the US Midwest — almost 12,000 kilometres away from Mesopotamia where the language originated.

After studying ancient Egyptian as an undergraduate and spending summers in Greece and Egypt on museum tours and at ancient sites, Mr Peterson discovered a new passion.

He completed his graduate degree in Assyriology at the University of Pennsylvania, which has a large collection of cuneiform tablets excavated from the ancient city of Nippur, in modern-day Iraq’s Al Qadisiyyah governorate.

“It was incredibly fun for me to read these tablets and reconstruct some of them back together,” Mr Peterson tells The National.

“It kind of feels like making history out of thin air when you make a significant join.

“Clay tablets tend to break, so there are many pieces to put back together, like a never-ending jigsaw puzzle.”

Mr Peterson started making tablets to learn about the process of writing in clay “so I could make more informed statements about cuneiform writing in my publications”.

Once he learnt the language, he began experimenting with different formats, but soon discovered just how difficult the art of writing on clay is.

“Just think if every page of a book had to be made from something much thicker than a piece of paper,” he says.

In addition, the messages on ancient cuneiform tablets are typically written using extremely small letters due to storage constraints.

And without any formal ceramics training, the entire process of learning how to make tablets themselves was a difficult one for Mr Peterson.

After finally getting the hang of it, however, he decided to share his talent with the world, setting up a store on the popular e-commerce platform Etsy.

“I started selling them on Etsy for a supplementary income. Cuneiform writing on clay is naturally beautiful and compelling in a way that has to be experienced in person to be fully appreciated,” he says.

Mr Peterson sells about 250 pieces a year, with items costing between $15 and $90.

His buyers are a diverse group, including academics as well as ordinary people who enjoy the aesthetics of these ancient replicas.

“Sometimes my customers are interested in using cuneiform art to decorate their professional space or homes. Some of my erotic poetry pieces are given to significant others as gifts.”

His work has also been featured in academic institutions.

“I’ve sold pieces to some museums and universities for display and educational purposes.”

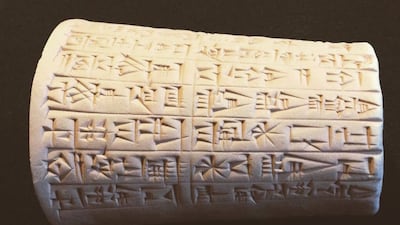

The piece Mr Peterson is most proud of is a four-sided brick-shaped text.

“Rather idiosyncratically, it is called a 'prism' by modern Assyriologists.

“It has a famous text called 'Shugi A', where King Shugi of Ur, one of the great luminaries of ancient Mesopotamia, boasts of his footrace from the city of Nippur to the city of Ur, claiming superhuman speed.”

The biggest challenge in making this piece, Mr Peterson says, was making inscriptions on the different sides of the brick while keeping the clay at the right saturation point.

First, he hammers out a clay tablet with a flat piece of wood, cutting edges with various potter’s tools or using a cookie cutter for rounded objects.

“Then I plan out the space of the text I put on it, either by eyeballing it or making a grid: this is a very important step that was clearly emphasised by ancient scribes on many occasions to conserve space,” he says. “Then I incise the signs.”

He even created a YouTube channel showing his method of inscription so audiences can have an idea of the work involved.

As a side project, Mr Peterson is working with a Enrique Jimenez, a scholar at the Ludwig Maximilians Universitat in Munich, to digitise ancient texts into an Assyrian electronic library.

“Thanks to digital photos and databases, I can make joins in the British Museum in my home in Iowa. It is tremendous fun for me.”