A Dubai company is making waves for bringing creative and customisable tattoos to the UAE. But, unlike traditional tattoos, there’s nothing written in stone with this brand of body art.

Le Inka, which launched in 2019, specialises in Jagua tattoos, made using the extract of genipa americana or jagua, a fruit commonly found in parts of South America.

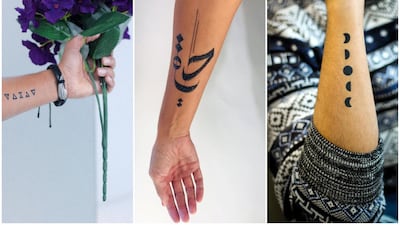

For a look at some of its designs, check out the photo gallery above.

The gel formula is vegan, plant-based and organic, and can be applied on the skin with the use of a stencil. The result is similar to that of a henna tattoo, except the application time is shorter – half an hour to an hour – while the final design stays on for one to three weeks, depending on the wearer.

For husband and wife founders Ishrath and Safa Hasmin, the idea to launch Le Inka came naturally, as Safa was already a well-known henna artist, and the founder of UAE's first online henna store.

“We used to get a lot of requests for black henna, however if you actually look into it, we discovered that black henna is dangerous as it’s mixed with harmful chemicals.

"So we started looking for natural, organic and harmless alternatives to black henna and that’s when we discovered jagua ink,” says Ishrath.

When he saw the final outcome of the design, he realised it didn’t have to be restricted to women. “I knew these would be a hit with men and women as tattoos,” he says.

Le Inka currently sells more than 300 stencils that customers can buy along with a bottle of the ink. A single 50ml bottle should allow a customer to reapply their stencil design 10 to 20 times – although that vastly depends on the size of the stencil, according to Ishrath.

The temporary nature of the tattoo also allows customers to get more experimental with their designs. As wearers don't need to worry about their body art ageing badly, some of the brand’s most popular stencils are quirky, funny or related to specific events or situations.

“We are constantly releasing new options or stencils to our customers," says Ishrath. "Ones to do with Mother’s Day, Eid and even breast cancer awareness have been really popular.

“We even launched Covid-19-themed stencils that did really well as they injected a little positivity and humour during a difficult time."

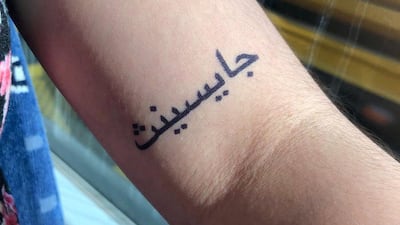

Arabic calligraphy and pets names are also popular options, he says.

The biggest selling point of having a temporary tattoo is the individuality it offers, he says. This is why Le Inka also offers customers a great degree of customisation. Those confident enough to do so can also buy a bottle of the ink and draw their own design onto their body themselves with a nozzle.

Those not comfortable going freehand – or are looking for something they can create consistently with little effort – can also send a design to the brand so they create a custom stencil. This option is becoming increasingly more popular, says Ishrath.

“Usually people go in for a standard design for their first or second try. But by their third tattoo, they want something that's unique to them.”

At the moment, 70 per cent of their business comes from the UAE, although Saudi Arabia is the next biggest market. Le Inka ships worldwide and has sold more than 55,000 tattoos to 15-plus countries, including Oman, the UK, US and Germany.

It’s not all been smooth sailing, though, as there are still misconceptions about what they’re trying to do. Permanent tattoos are forbidden in Islam, and so sometimes their products are seen with an air of suspicion.

“We’ve had customers ask us and we tell them we are Muslims ourselves and would not be doing this if it wasn’t allowed,” says Ishrath. “We know the sensitivities that revolve around the topic. But there is no use of needles, no danger of infection and no pain with these tattoos – after all, they are not permanent.”

In creating this niche brand, the pair have tapped into a new market for those who have always been interested in tattoos but put off by their permanence. “It’s becoming trendier these days, especially with millennials. People just want ways to express themselves.”