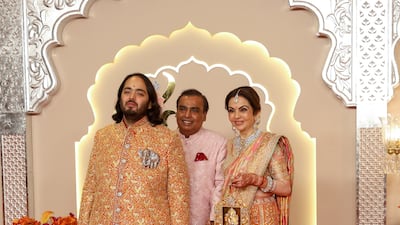

The wedding of Anant Ambani and Radhika Merchant has set a historic benchmark in extravagant celebrations, leaving a mark on the world stage. Over three days in Mumbai, the Ambani family orchestrated a lavish spectacle that drew elite participation from across the world.

Kicking off on July 12 with the Shubh Vivah ceremony, the festivities showcased a star-studded guest list, including names such as Kim and Khloe Kardashian, Gianni Infantino, Tony Blair, John Cena, and Priyanka Chopra and Nick Jonas. Mukesh Ambani, Asia’s richest man and father of the groom, ensured that no expense was spared.

Central to the event's immense budget was high-profile entertainment. Rihanna and Justin Bieber commanded fees of $9 million and $10 million respectively for their performances. By the end, estimates revealed the total cost of the Ambani wedding reached more than $600 million.

The extensive planning was evident in the 11 pre-wedding events, which included a luxury cruise that featured performances by Katy Perry and the Backstreet Boys. Reports indicated that about $300 million was allocated solely to these pre-wedding festivities.

Security measures further added to the financial costs, as the guest list comprised the who's who of celebrities and influential figures. The Ambani family implemented facial recognition technology to ensure guest authenticity, adding another layer of cost to the already substantial budget.

Lavish gifts for attendees became a hallmark of the celebration, with offerings such as luxury bags and designer accessories inflating expenses even further.

In comparison to historic weddings, the Ambani-Merchant nuptials far surpassed the costs associated with the wedding of Princess Diana and Prince Charles, which was estimated at about $163 million, when adjusted for inflation.

Mukesh Ambani, 66, is ranked as the ninth richest person globally, with a net worth of $116 billion, according to Forbes. He is also the wealthiest person in Asia.

His company, Reliance Industries, is a vast conglomerate that reports more than $100 billion in annual revenue, according to the Associated Press, and has interests in sectors such as petrochemicals, oil and gas, telecommunications and retail.

Anant, the groom, leads the conglomerate's initiatives in renewable and green energy and serves on the board of Reliance Industries alongside his siblings, Isha and Akash. He also manages a 1,200-hectare animal rescue centre in Jamnagar, Gujarat.

Mukesh's wife, Nita, directs the Reliance Foundation, the company’s philanthropic arm, and supports various arts organisations. She has established the Nita Mukesh Ambani Cultural Centre, recognised as a groundbreaking venue in India that integrates visual and performing arts in one location.