Yemen’s Houthi rebels are refusing to take the Covid-19 vaccine and distribute it in areas under their control, the country’s internationally recognised government said on Thursday.

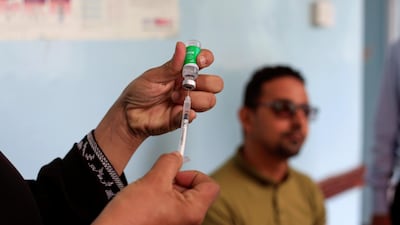

A vaccination campaign began last month in government-held areas after authorities received their first shipment from the global Covax vaccine-sharing scheme. The country has received 360,000 doses of AstraZeneca's vaccine and expects to get 1.9 million doses this year.

"The Houthis' refusal to receive the Covid-19 vaccine is threatening the lives of citizens in areas under their control," said Ali Al Walidi, the undersecretary of Yemen's Health Ministry, during an online meeting hosted by the World Health Organisation.

Mr Al Walidi said the war waged by the rebels since 2014 has led to the economic, health, and political collapse of the country as well as outbreaks of diseases.

Yemen's vaccine campaign began in the southern port city of Aden in late April, the government's interim capital in a six-year war.

WHO representative in Yemen, Dr Adham Abdel-Moneim, said the rebels had rejected a plan to implement a joint campaign to vaccinate medics in areas under their control.

“Initially they agreed, under insistence, to accept 10,000 vaccine doses, but those could not be delivered after they stipulated that they must be distributed separately from our supervision,” he said.

Dr Abdel-Moneim said the Houthis accepted only 1,000 doses that were intended to be given to 500 doctors, on the basis that they would be vaccinated under the rebels' supervision.

The Iran-backed rebels control most of northern Yemen, having ousted the government from the capital Sanaa in 2015.

The internationally recognised government's health ministry previously said the vaccines would be free and distributed across the country, where the Houthis control most big urban centres.

Covax is co-led by the Gavi Vaccine Alliance and the WHO to provide Covid-19 vaccines to low-income countries.

Yemen has recorded 6,593 coronavirus infections and 1,298 deaths, although the true figure is thought to be much higher. The war is restricting Covid-19 testing and reporting.

The authorities' aim is to vaccinate 70 per cent of the population. The health ministry said it had appealed to Saudi Arabia's King Salman Humanitarian Aid and Relief Centre to finance 50 per cent of the vaccines.

Mr Al Walidi praised Saudi Arabia’s efforts in supporting the country’s battered health system.