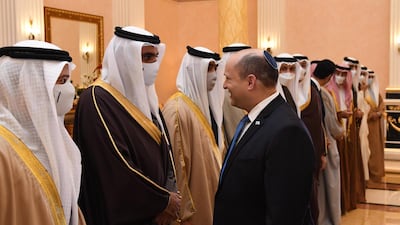

Israeli Prime Minister Naftali Bennett met Bahrain's King Hamad Al Khalifa at Al Sakhir Palace on Tuesday during his first visit to the Gulf state.

The pair discussed enhancing links in a variety of sectors between the two nations after the signing of the Abraham Accords in 2020. Crown Prince and Prime Minister Salman bin Hamad also attended the meeting.

Prince Salman said he was happy to welcome Mr Bennett.

"Peace should be the endeavour for all responsible peoples," an Israeli statement quoted Prince Salman as saying.

"Not that we have ever had a war, but relations between our two countries were not at a level that could be construed as normal. And I think that if we see a wider Middle East that is free from conflict, that is based on principles of mutual respect, understanding, and sharing responsibility towards security, we must do more to get to know one another and build upon the Abraham Accords, which have been such an historic agreement," the crown prince said.

The feeling of positivity appeared mutual, as Mr Bennett thanked Prince Salman for a "warm and generous reception".

"I think our goal in this visit is to turn it from government-to-government to people-to-people peace and to convert it from ceremonies to substance," he said. Sectors of interest, he said, were technology, trade and agriculture.

He spent the morning on Tuesday meeting Bahrain's Jewish community leaders in Manama.

“I come from Israel with goodwill, with warm friendship between the two peoples, and I am sure you can be a remarkable bridge between Bahrain and Israel,” he said.

Mr Bennett also met US Fifth Fleet Commander Vice Adm Brad Cooper during his visit and discussed military co-operation. The Israeli prime minister described the Fifth Fleet, which is based in Bahrain, as “a significant element in maintaining regional stability in the face of various security threats”.

Mr Bennett is scheduled to meet Bahrain's King Hamad.

Mr Bennett was welcomed by Bahrain's Foreign Minister Abdullatif Al-Zayani on Monday at Manama airport, which was decorated with the flags of both countries.

His visit is the latest such initiative after the US-brokered 2020 Abraham Accords, which ran counter to the long-standing Arab consensus that ruled out ties with Israel in the absence of a solution to the Israeli-Palestinian conflict.

The trip follows a visit to Manama by Israeli Defence Minister Benny Gantz this month, which resulted in the signing of a defence agreement by the two countries.

That deal covered intelligence, procurement and joint training, with Mr Gantz saying that it further solidified the fledgling diplomatic relationship.

The visit also comes at a time of regional tension over Iran's nuclear programme. Tehran is engaged in negotiations with Britain, China, France, Germany and Russia directly, and with the US indirectly, to revive the deal formally called the Joint Comprehensive Plan of Action.

Yoel Guzansky, a senior researcher at the Institute for National Security Studies in Tel Aviv, told AFP that Mr Bennett's trip was “absolutely” about Iran.

“In light of the talks in Vienna, it is a show of force, symbolism that the countries are working together,” he said.

Dore Gold, head of the Jerusalem Centre for Public Affairs, said Israel and Bahrain have been pushed towards closer ties because both are “under threat by Iranian actions".

He pointed to unrest in Bahrain blamed on Iran-backed opposition groups and the range of threats that Israel says Iran poses, notably its arming of the Lebanese militant group Hezbollah.

As part of their defence agreement, Israel is expected to post a naval official in Bahrain, which is the regional base for the US Navy's Fifth Fleet.

Mr Guzansky said that in several respects, Bahrain has been perceived as moving slower than the UAE in terms of consolidating ties with Israel.

He said allowing an Israeli military officer to be based in Bahrain was significant. However, he noted that Bahrain “does not want to be seen as an Israeli base in the Gulf". – AFP contributed to this report