The US and UK are likely to offer a measured response to the drone attack on an oil tanker in the Arabian Sea last week, analysts said.

The attack, which Washington and London blamed on Iran, killed a Briton and a Romanian.

Any response will be heavily influenced by the fact that the attack happened before a new round of nuclear deal negotiations and the inauguration of a hardline president in Iran.

Charles Lister, the director of the Countering Terrorism and Extremism Programme at the Middle East Institute think tank in Washington, said it was hard to imagine the UK and allies responding in kind, through an equally significant military action.

But a punitive response is certainly possible.

“To respond in the Gulf, or Iran itself, would arguably align with something more 'appropriate', but it would markedly raise the risk of uncontrollable escalation," Mr Lister told The National.

"In acting asymmetrically, the IRGC [Islamic Revolutionary Guard Corps] enjoys a substantial advantage in this equation.

“We could feasibly see a more pointed set of strikes against Iranian proxies in Iraq and Syria, perhaps bolstered by a targeted set of multinational sanctions on IRGC entities.

"Whether the IRGC intended to kill a British citizen is academic at this point — deploying a suicide drone against a civilian shipping target is an extraordinary violation of any basic red lines.”

US Secretary of State Antony Blinken and Israeli Foreign Minister Yair Lapid said on Sunday that they would consider the “appropriate next steps” with international partners.

Israeli Prime Minister Naftali Bennett said Israel had intelligence connecting Iran to the attack.

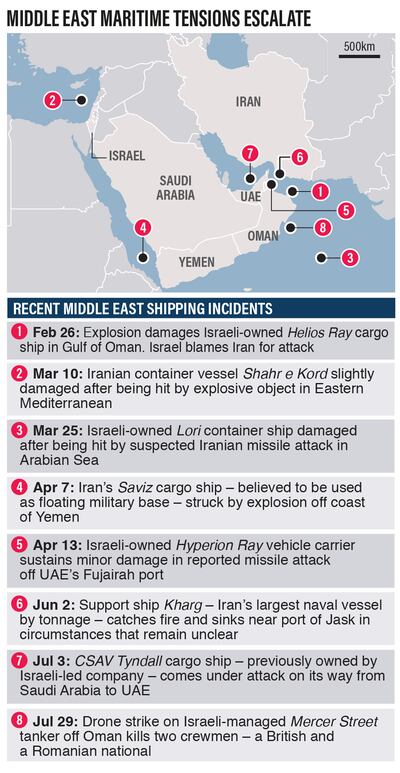

The Israeli-managed Mercer Street was attacked on July 29 off the coast of Oman on its way from Dar Es Salaam in Tanzania to Fujairah port in the UAE.

Images show damage caused by what analysts said were explosive-laden drones that punctured the Japanese-owned and Liberian-flagged vessel.

The two deaths are the first of civilians in a series of similar attacks in the region in recent months, all blamed by Israel on Iran, which denies any responsibility.

Saudi Foreign Minister Prince Faisal bin Farhan accused an “emboldened” Iran on Tuesday of threatening the freedom of international navigation.

On the same day, the Panama-flagged tanker Asphalt Princess was hijacked by armed men in the Gulf of Oman.

No one has claimed responsibility for the attack, which happened near the Strait of Hormuz, through which about a fifth of the world's seaborne oil exports pass. But ship tracking services showed the vessel being sailed towards Iran after the incident.

Possible unilateral action

For Israel, domestic politics will factor into any response, said Michael A Horowitz, head of intelligence at Le Beck International, a Middle East and North Africa security consultancy.

“Israel's new government likely feels like it needs to prove it is up to the challenge after being accused of being weak by former PM [Benjamin] Netanyahu,” Mr Horowitz told The National.

The Israeli foreign minister said he discussed the crisis with his British and American counterparts to formulate a substantive international response to the July 29 attack.

“This could give Israel enough diplomatic room to manoeuvre, should it choose to respond forcefully,” Mr Horowitz said.

“I think this attack really crossed a red line for Israel, with the question being whether Iran did seek to inflict casualties or not.

"From the initial elements we've got, including pictures of the impacts and the fact that some Iranian outlets have depicted the attack as a response to the death of an IRGC officer in Syria, I am inclined to say that this was deliberate, and that Iran was looking to up the ante.”

Citing unnamed sources, Iran's state-run Al Alam TV said on Sunday that the attack was carried out by “resistance forces” as retaliation for last week's suspected Israeli air strike on Al Dabaa Military Airport in Syria.

The Iranian foreign ministry categorically denied the attack and demanded Israel, the UK and the US show proof of Tehran's complicity.

It called the accusations “groundless propaganda”.

Tension in the Arabian Sea has been high for months after several attacks on oil tankers.

There have been also periodic confrontations in recent years between IRGC and the US military, which accused the Iranian Navy of sending fast-attack boats to harass US warships as they transit the Strait of Hormuz.

There are further concerns about the approach of new Iranian President Ebrahim Raisi towards negotiations with the US and European powers to revive the Joint Comprehensive Plan of Action.

The deal imposed stringent restrictions on Tehran’s nuclear programme in exchange for lifting sanctions.

Washington's desire to reach a new agreement seems to inevitably be reaching a limit, as an increasingly hardline Iranian state displays its lack of interest in diplomacy, Mr Lister said.

“As successive previous administrations have discovered, this is what 'pivoting away from the Middle East' looks like – malign actors sense a vacuum and diplomatic weakness, and they pounce in pursuit of advantage,” he said.