US companies are becoming increasingly hooked on artificial intelligence spending, and questions are growing whether this investment boom is hiding a weaker economic picture.

Despite a contraction in the first quarter, following President Donald Trump's sweeping tariff announcement, the US economy has defied slowdown expectations this year, with estimations of 2025 GDP growth ranging between 1.7 per cent and 3 per cent.

While moderate increases in tariffs have partially contributed to these revisions, there is another engine behind US growth this year: AI.

Analysis from global investment firm KKR found that AI-related capex for the four largest hyper-scalers was more than $350 billion this year. UBS said it forecasts global AI capex spending to hit $423 billion in 2025 (up from its previous $375 billion estimate), before eclipsing $500 billion next year.

Tim Bajarin, a technology analyst who has served as a consultant for Apple, IBM, Xerox and Microsoft, said that there’s “cause for concern” as to whether the economic growth is substantive, but dismissed comparisons to the 1990s-era dotcom bubble.

“The fundamentals are strong compared to other hype cycles,” Mr Bajarin said, noting how AI tools such as Gemini and ChatGPT have hundreds of millions of users.

“The AI technology is richer, deeper and more focused." He added that the billions of dollars being poured into data centres have “lasting value”.

AI in the data

New projections released by the US Federal Reserve showed America's economy will expand at a 2.3 per cent pace next year, an increase of half a percentage point from its September forecast.

Part of this has been resilient consumer spending, Fed chairman Jerome Powell told reporters last week.

“And, to another degree it is … that AI spending on data centres and related to AI that has been holding up business investment,” he said.

The AI boom has led to strong growth in business equipment investment this year. Investment in equipment and software related to AI is forecast to grow by 9.9 per cent this year, according to the Equipment Leasing and Finance Foundation.

And while tariffs have weighed down exports and imports, Matthew Martin, senior US economist at Oxford Economics, estimated that imports for computers and semiconductors are up between 40 per cent and 50 per cent year-on-year.

“So the fact that imports are still growing there, despite increased tariffs, obviously shows that there's quite a bit of strength there,” he said.

With demand for data centres increasing, concerns are mounting over the rising energy costs for these large-scale infrastructure projects that require huge amounts of energy to function.

The International Energy Agency projects global electricity demand from data centres to more than double over the next five years, with the effects to be most felt in the US and Japan. Those rising energy costs, in turn, ultimately would be passed on to consumers in the form of higher electricity bills, potentially blunting economic growth and constraining spending.

“I think energy is a major constraint to the building of these,” said Sean McDevitt, a partner at global consulting firm Arthur D Little.

“We're not talking about megawatt data centres any more. These are gigawatt data centres. We're not talking about buildings … These things look like industrial zones now.”

Natalie Hwang, founding managing partner at Apeira Capital, said she believes energy costs define the AI story rather than weaken it.

“And the next phase of AI will be led by the companies and the regions that can deliver intelligence with the lowest energy footprint,” pointing in particular to the Middle East's energy abundance.

Record valuations

Concerns around rising energy costs have led to recent market turbulence, as has the future profit of companies relying on AI, testing market resilience that has ridden the investment boom this year.

AI spending has helped US markets overcome April's tariff blip to continue a remarkable bull run, with all three Wall Street indices closing at record highs on several occasions this year.

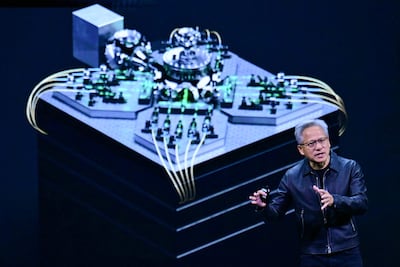

The top five companies in the S&P 500 – Nvidia, Apple, Microsoft, Amazon and Alphabet – make up roughly 30 per cent of the tech-heavy index.

The Fed, International Monetary Fund and other financial institutions have characterised these AI valuations as “stretched”, leading to new debate over the potential of a bubble and a possible market correction if productivity gains are not fully realised.

But economists and analysts also argue that, unlike the dot-com bubble three decades ago, the companies at the nexus of the AI investment frenzy are posting profits and have business models.

“If we see a correction next year, I believe it will clarify the investment opportunity in AI infrastructure, rather than weaken it. Because a market reset typically shifts capital from speculation to fundamentals,” Ms Hwang said.

Boom to continue

Hyper-scalers show no signs of slowing down their AI spending.

Alphabet, Amazon, Meta, Microsoft and Oracle have all raised their AI capex guidance, according to their most recent earnings reports. Private companies like Anthropic and OpenAI are also making large investment commitments.

And the increase in demand is expected to have compounding effects on the US economy with spending on construction, technology and energy required to bring those types of facilities online.

“AI is an industrial infrastructure story,” Mr McDevitt said.

The AI spending comes as the US exhibits some stagflationary behaviour, with the world's largest economy faced with higher inflation and lower job gains.

A US AI pulse survey released by accounting firm EY earlier this month found companies investing in AI are seeing AI-driven productivity gains. And, while some companies are making AI-related layoffs, the survey found most productivity gains are being reinvested to upskill talent and boost resilience.

Mr Martin said productivity gains could potentially weigh on hiring, as companies can now do more with fewer employees, but stronger economic growth could lead to higher job creation elsewhere. At the same time, it could be positive for the inflation outlook because companies can increase employees' wages without having to raise prices by a large amount.

“I think there's a lot of uncertainty, but ultimately, the increased productivity would be a very positive for the economy overall,” Mr Martin said.