US chipmaker Nvidia has hit a market capitalisation of $5 trillion, confirming its status as the hottest stock of the artificial intelligence boom.

The California company's share price rose as much as 5.3 per cent to $211.63 in early trading on Wednesday, becoming the first stock to exceed $5 trillion in value.

The company had passed the $4 trillion mark in July, $3 trillion milestone in June. Nvidia and other tech giants have been the beneficiaries of an AI boom in recent years that has seen US markets reach new record-highs.

Nvidia is now well ahead of second-placed Microsoft, which has with a market cap of more than $4 trillion, with Apple joining the elite club when it breached that mark on Tuesday.

Google parent Alphabet and e-commerce giant Amazon are the only other companies with a market cap of more than $2 trillion.

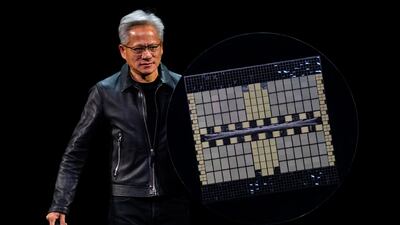

A large part of Nvidia's success – and meteoric rise – has to do with the rise of generative AI, as it continues to innovate with hardware and software.

Nvidia's corporate strategy has also supported its rise, according to analysts.

“The company is navigating the trade and political jungle with remarkable agility,” said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

“Its efforts to replace Chinese business with promising new partners – led by Europe and the Middle East – are already bearing fruit.”

And its business – and market position – would only receive a further boost if the US eases restrictions to China, amid its bruising trade war with America.

US President Donald Trump and Nvidia chief executive Jensen Huang have an amicable relationship. The Nvidia head has lobbied the Mr Trump for exemptions on restrictions of Nvidia chip exports to China.

On Tuesday, Mr Huang reflected on Nvidia's dominance and discussed competition from China in Washington at the company's flagship graphics processing unit technology conference.

He has sought to influence the Trump administration to relax chip export rules so that Nvidia can sell more of its CPUs and GPUs to China, and in turn, gain US influence in the region.

“We need to be in China to win their developers,” he said, pointing out the current difficulties of gaining market share and influence in China due to strict US chip export regulations.

“A policy that causes America to lose half of the world's AI developers is not beneficial for the long term and it hurts America more than it hurts them,” he said to reporters following his keynote address.

“There’s a chance tensions with China will ease. And Mr Huang is already looking beyond AI – to robotics – to stay ahead of the pack,” Ms Ozkardeskaya said.

“Nvidia offers an entire ecosystem for companies willing to take the AI leap.”

Nvidia's rise has also been fuelled by its AI infrastructure investments and high-profile partnership with ChatGPT maker OpenAI.

“Nvidia’s ascent … highlights the profound impact of AI-driven infrastructure investments on corporate valuation trajectories,” said Paul Hoffman, an analyst at trading platform Best Brokers.

“In contrast, Microsoft and Apple, while also advancing towards $5 trillion, exhibit more moderate growth rates, suggesting a significant divergence between front-runners and other tech giants.”