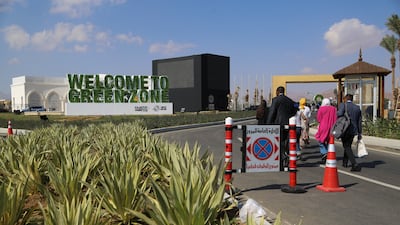

Global ports operator DP World pledged to invest up to $500 million to cut carbon emissions from its operations over the next five years during the Cop27 climate summit in Egypt.

The Dubai-based company aims to reduce emissions by nearly 700,000 tonnes, or 20 per cent, from 2021 levels, in the coming five years, Sultan bin Sulayem, DP World's chairman and chief executive, told the delegates at the conference which began in Sharm El Sheikh on Sunday.

DP World’s plans include replacing its fleet of diesel assets with electric, investing in renewable power and exploring alternative fuels.

“Global trade has been an enormous force for good, keeping our world connected and lifting millions out of poverty over the last few decades. But this growth is not without consequences — from the scale of energy required to make, move and use goods to the resource intensity of logistics and the challenges economic growth can bring,” Mr bin Sulayem said.

The move comes as delegates from nearly 200 countries gathered in the Egyptian seaside resort town to discuss the climate change crisis. Extreme weather events have struck countries in recent months, reminding governments to act quickly.

Shipping, which transports about 90 per cent of world trade, accounts for nearly 3 per cent of the world’s CO2 emissions.

In 2021, DP World pledged to become a carbon neutral enterprise by 2040 and achieve net zero carbon by 2050.

On Monday, the company said it would take on the Green Shipping Challenge (GSC) that was launched earlier this year by US Special Presidential Envoy for Climate Change John Kerry and Norwegian Prime Minister Jonas Gahr Store.

The initiative encourages governments, ports, maritime carriers, cargo owners and others in the shipping chain to come forward with measures that will help put the international shipping sector on a credible pathway this decade towards full decarbonisation no later than 2050, according to the US White House briefing statement on June 17.

Emissions from the shipping sector are significant, rising, and on a trajectory incompatible with the goals of the Paris Agreement. If shipping were a “country”, it would be the world’s eighth-largest emitter, the statement said.

“We will work with our global partners to develop an action plan to advance the goals of the GSC and encourage industry players to devise plans to address climate change,” Mr bin Sulayem said.

DP World is doing this through three methods: electrification of its ports and terminals equipment, investment into renewable energy and through research and development projects that will look into alternative fuels, vessels and vehicles across its portfolio, according to Mr bin Sulayem.

“Our ports and terminals business is making steady progress, by following the strategy of maximising efficiency, equipment electrification, supply of renewable electricity, low carbon fuels and carbon compensation,” he said.

In January, DP World partnered with the Mærsk Mc-Kinney Moller Centre for Zero Carbon Shipping, an independent, non-profit organisation, undertaking research and development to find practical ways to decarbonise the global maritime trade industry.

“Decarbonising the maritime industry requires the complete rewiring of the entire system, imagining new supply chains and structures. It is a huge undertaking, but one that we are ready to venture into,” Mr bin Sulayem said.

One of the biggest challenges comes from the marine services and logistics businesses that represent a major portion of DP World’s total carbon footprint through their fleets of vessels and lorries, the company said.

Addressing this will be an important part of finding solutions as the company pursues its net zero target, it said.

In addition to tech-driven solutions such as replacing vehicles and fuels, DP World is also working with local communities where it operates to establish carbon offset schemes, and carbon sinks such as mangrove forests, it said.