When is a bank not a bank? When this happens: Victoria helped a friend out with some money. The friend gave her a cheque to repay it. It was deposited and Victoria went on holiday. Victoria is very much on top of her finances. But while she was away she couldn't check things online because her bank (one of the largest in the land) needed a few days to clear her history. More on this later.

Back on UAE soil, Victoria finds out that the cheque did not clear. Her friend told her.

She calls the branch. Yes they can see that there's a cheque in the system, but they cannot tell her what the problem is – she must call her personal banker.

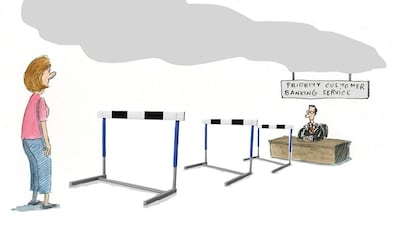

Now this is where the story goes off on a mini-tangent. Victoria was historically a priority customer but hasn't had a personal banker for two years now – one reason is the lack of trained staff. Victoria, who had been asking for a point of contact (a person) for a long time, explained that she would like to have a personal banker but doesn't and that in fact she is no longer a priority customer for whatever reason. She is told that she is a priority client and that there's a secondary banker allocated to her – the name is relayed. This was the first Victoria had heard of such an arrangement. Victoria calls the number, repeatedly, and gets through to a different person who said she can help. Information is pulled up and Victoria is informed that she has to go the branch where she deposited said cheque – she cannot be told what the issue is over the phone.

This all took several hours spread across three days. You can imagine the frustration.

Victoria goes to the branch, makes a beeline for the priority staff member and asks very nicely if he can help (she had been turned away by priority staff previously). He pulls up her account, and says: "Hold on a minute." He then walks to the other side of the room where the customer service staff are and comes back with the cheque. "Didn't anybody call you?"

"No" came the reply. Victoria had answered all her calls abroad and since – none were from the bank.

He said the bank was supposed to, adding "they rejected the cheque because of this".

Care to hazard a guess why? The most common reasons are that the signature doesn't match bank records (I have had my signature rejected with me standing there, passport in hand, having signed in front of them where they know me. No two are the same – isn't that what makes us human?), there isn't enough cash to cover it, numbers and words don't match, there is overwriting or it is older than the cut-off date to submit it.

I even came across a situation when a cheque was rejected because it was written out in Welsh – in Wales – where people can conduct their banking in their native language but there was no one to decipher the written Welsh word. This was resolved, along with a giant apology.

In Victoria's case, however, it was because the '4' of the 40 fils was slightly bolder than the zero.

I have seen this cheque. Everything matches up. There is no error. No mess. Just a 4 that stands out a bit more than the rest. The mind boggles. I want my bank to protect my money. To work in my interest. But how is what Victoria went through in anyone's interest? It got to such a painful point that the two friends exchanged heated words and Victoria said she no longer wanted the money.

Now imagine that the cheque deposit was needed to cover subsequent outgoings. Who would then be liable for fines and fees, or to redeem reputations and tarnished credit scores?

Back to the internet banking issue. Over the years, Victoria and her husband have had multiple accounts with this bank. Some joint some not. They were closed properly when no longer needed. But it turns out that this bank has not (ever it would seem) cleared related online history. It all came to a head just before the holiday, which is why there was no internet banking while they were away. This is how they discovered there was a problem:

A new online account was being created for Victoria's husband, but the system kept saying there was an existing one. The call centre said yes, they could see the information online and that a change of password and login was needed. Done.

And when her husband's spanking new online account came to life – lo and behold – Victoria's details stared right back at them.

After days of calls, the decision came to wipe all their online banking history clean.

I'll share why they had multiple accounts in another "banking moment" story. When is a bank not a bank? When we, the depositors, the founding members of banks and what they're for, are left reeling.

We are accountable for any error on our part, and it would appear any error on the banks' part too. As for Victoria, she doesn't have any banking to do today. She is very happy.

Nima Abu Wardeh is the founder of the personal finance website cashy.me. You can reach her at nima@cashy.me.

Follow us on Twitter @TheNationalPF

When a bank cheque fails in the UAE, your number’s up

Nima Abu Wardeh shares the sorry saga of how a rejected cheque highlighted serious flaws in a bank’s customer service.

Most popular today