More than 907 million smartphones were sold in the first three quarters of this year, almost 94.5 million fewer than in the first nine months of 2019, according to the International Data Corporation.

This year is likely to be the fourth in a row that smartphone sales decline, analysts predict. Despite the drop, however, some models are continuing to perform strongly.

Here are the top six smartphones sold in the first three quarters based on global unit sales, according to industry watchers Omdia, Canalys and IDC.

iPhone 11

Apple sold more than 53 million units of its most popular model in the first nine months of 2020. Sales of the iPhone 11 significantly surpassed the previous best sales record of 32 million units for the iPhone XR in the first three quarters of last year.

The iPhone 11 was rolled out in September 2019 at Dh2,949 ($803) in the UAE, Dh230 less than the launch price tag of 2018’s low-cost iPhone XR. This was the biggest yearly drop in the iPhone's history for a new device of a similar spec to the premium model.

Offering a low-cost, entry-level iPhone allowed Apple to increase its presence in a wider array of price bands – a strategy that competitors Samsung and Huawei have been adopting for years.

Galaxy A51

In December 2019, Samsung launched the A51 as part of its budget-friendly Galaxy A series to attract more customers. Its new 5G variant was launched in April. The phone comes with a 16.5-centimetre display and weighs 187 grams.

The world’s largest manufacturer of smartphones sold close to 19.6 million units in the nine months to September 30.

Redmi Note 8 and Redmi Note 9

In July 2018, China's Xiaomi, which went public on the Hong Kong Stock Exchange with a valuation of $54 billion. It is known for its affordable devices that draw comparisons with Apple and Samsung phones.

The company managed to sell more than 19 million units of its Redmi Note 8 and Redmi Note 9 phones in the first three quarters of the year.

The Redmi Note 8 first went on sale in August last year priced at less than Dh500.

Xiaomi's low-end portfolio, particularly the Redmi 9 Series, did well in both India and China. It helped the company ship 46.5 million devices in the third quarter and grab the number three position in global market share, beating Apple for the first time with 13.1 per cent, according to IDC.

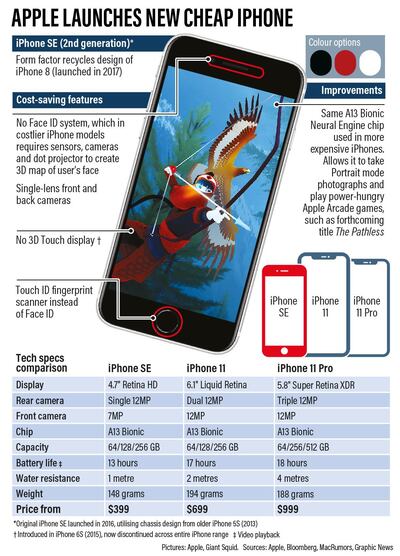

iPhone SE

In April, Apple launched its cheapest iPhone, priced at Dh1,699 to attract budget-conscious buyers as it attempts to wrestle market share from rivals Samsung and Huawei.

The strategy paid off and the company sold more than 18.7 million units in the first three quarters of 2020.

“The new SE found success as it managed to effectively target the lower-priced segment, which bodes extremely well for the vendor in this time of [Covid-19] crisis where consumers are shifting towards more budget-friendly devices,” said IDC.

It was the first time that Apple, which typically unveils its phones in September or October each year, launched a new phone without one of its showcase public events.

Galaxy A31

Starting from Dh700, Samsung’s Galaxy A31 comes with a 48MP main camera for better photos and videos. The company has sold more than 12 million units of the A31 since it was rolled out in March.

The South Korean manufacturer incorporated an 'alive intelligence' feature, which included functions such as intelligent searching within all apps, multilingual typing and the smart cropping of images. It also identified important and useful SMS messages, creating 'visual cards' so they can be more easily viewed.

“It’s not just a smartphone, it’s a smarter phone,” the company said.

iPhone XR

Apple's iPhone XR, which retails from Dh2,000, was the best-selling smartphone of 2019. It maintained this momentum in 2020, selling close to 12 million units in the first nine months.

The 2018 iPhone has a 15.5cm display and has 64GB and 128GB storage options.