Tesla reported a 157 per cent year-on-year surge in fourth quarter net profit on the back of increased demand for its electric vehicles.

The October-December period marked Tesla’s sixth straight profitable quarter, but also missed analysts' forecasts for the first time since the second quarter of 2019.

Net profit rose to $270 million in the three months ending December 31. It was 18.42 per cent ($61m) less than the third quarter of 2020.

Revenue during the period increased 46 per cent to $10.74 billion, the first time the company reported $10bn or more in sales. It surpassed the analysts' estimate for $10.38bn.

"This was primarily achieved through substantial growth in vehicle deliveries as well as growth in other parts of the business," the company said.

"Despite unforeseen global challenges, we outpaced many trends seen elsewhere in the industry as we significantly increased volumes, profitability and cash generation … we believe that 2021 will be even more important,” it added.

Tesla's stock closed 2.14 per cent down at $864.16 per share on Wednesday. It fell another 5 per cent in after-hours trading to $820.39 a share.

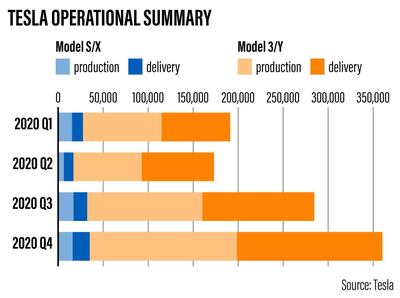

Tesla’s average selling price of vehicles declined nearly 11 per cent in the last quarter, as the company’s product mix continued to shift from Model S and Model X to the more affordable Model 3 and Model Y.

It delivered 57,039 units of Model X and Model S, almost 11 per cent of its total handovers, last year. The company sold 442,511 units of the Model 3 and Model Y last year.

Tesla, which joined the S&P 500 index last month, delivered close to 500,000 vehicles globally last year. It aims to increase its production to more than 750,000 units this year.

The company said it aims to achieve 50 per cent average annual growth in vehicle deliveries in the coming years and has "sufficient liquidity" to fund its "product roadmap, long term capacity expansion plans and other expenses".

"In some years, we may grow faster, which we expect in 2021 … the rate of growth will depend on our equipment capacity, operation efficiency, and capacity and stability of supply chain," it said.

The Covid-19 pandemic, climate change and emissions have increased the focus on the future of cars. Joe Biden’s triumph in the US elections and China announcing plans to boost the sector have also propelled the industry.

Among EV manufacturers, Tesla continued to dominate 2019 as market leader. It accounted for 16 per cent of the market, compared with a 12 per cent share in 2018, according to McKinsey’s EV index.

The company is currently building Model Y at its gigafactories in Germany and the US and aims to start deliveries from each location this year.

"In Berlin and Austin, we remain on track to start vehicle production this year," the company said.

"Our engineering team has made significant progress in full self-driving software, with a limited release to customers … we are excited to deliver our first Tesla Semi [truck] by the end of the year."