Samsung Electronics has introduced retooled iterations of its foldable devices, as it seeks to cement its lead in the still niche but growing segment in the hotly contested smartphone market.

At its Unpacked event in Seoul on Wednesday, the world's biggest manufacturer of mobile phones unveiled the Galaxy Z Fold5 and Flip5, both of which now come with a redesigned hinge that eliminates the gap between their sides and makes them completely closed when folded.

While both devices have remained aesthetically similar to their predecessors and come with token upgrades, the clamshell-type Flip5 is arguably the bigger deal, as its cover screen is now up at 3.4 inches, which is nearly double its predecessors and will allow more flexibility and content to be shown.

The event is also noteworthy as it is the first time Unpacked has been held on Samsung's home turf, after the event that started in 2010 hopped to global cities including Las Vegas, Barcelona, Berlin, London, New York, Rio de Janeiro and San Francisco.

Both devices are now available for pre-order and will hit stores on August 11.

“We all crave human connection, maybe today more than ever, and mobile technology enables us to be truly motivated,” T.M. Roh, president and head of Samsung's mobile experience business, said in his keynote at Unpacked.

"When technology seamlessly adapts to the world around us, it allows us to be open to new ideas, new ways of thinking and new experience that otherwise we would never know."

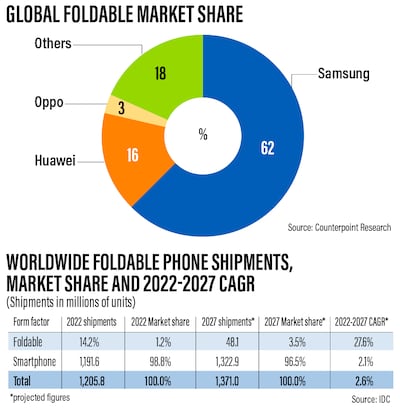

Foldable devices remain a minor category in the overall smartphone market, but manufacturers are working to bring more of these into the market as consumer preferences shift.

The growth in popularity of foldable smartphones has been attributed mainly to Samsung, which pushed the category into the mainstream, starting with the Galaxy Z Fold in 2019. The company followed that with the Galaxy Z Flip the following year.

Shipments of foldable smartphones are forecast to quadruple by 2025 as original equipment manufacturers focus on the premium device business, Counterpoint Research said in a report last week.

Original equipment manufacturers are expected to ship about 55 million foldable devices by 2025, into a premium smartphone segment that grew by 1 per cent last year, compared with the overall smartphone market's 12 per cent decline, it said.

Demand for foldable smartphones is projected to post a compound annual growth rate of nearly half until 2027, and a key factor that will drive this will be enhanced design – specifically, its mechanisms and hinge, Anshul Gupta, vice president analyst at research firm Gartner, told The National.

Other factors will include "form factor differentiation, new and innovative ways of content creation and consumption, operating system maturity and improved user interface", he said.

That would play to the company's advantage, as it already leads the segment "with innovative design and apps and service ecosystem", Mr Gupta said.

Still, foldables "have just started to emerge as a significant category", he added, implying it would take some more time – and more reasons for consumers to make the switch – to make foldables a real threat to the dominance of traditional smartphones.

That being said, Samsung is still primed for the opportunity, given its head start and continued push: it holds a 62 per cent market share, well ahead of second-placed Huawei Technologies with 16 per cent, latest data from Counterpoint shows.

Among other notable brands that have their own foldables in the market are Oppo, Motorola and Google, which launched its first Pixel Fold in May.

Apple, the maker of the iPhone and Samsung's chief rival on top of the smartphone market, has also long been rumoured to be developing its own foldable device.

president and head of Samsung's mobile experience business

Samsung, which is due to report its second-quarter results on Thursday, intends to maintain its lead.

"I can tell you that we are never satisfied. We obsess over details in a never-ending pursuit of perfection," Mr Roh said.

Pre-orders for the devices are now live globally and they will hit stores starting on August 11.

In the UAE, the Flip5 is priced at Dh3,899 and Dh4,349, while the Fold5 is priced at Dh6,799 and Dh7,249, for 256GB and 512GB, respectively. A limited-edition 1TB version of the Fold5 is priced at Dh8,149.

Samsung also introduced the Galaxy Tab S9 series, which has been further optimised for productivity, especially with the S Pen, and the Watch6 series comprises the Watch6 and Watch6 Classic, featuring refined capabilities for health and activity.