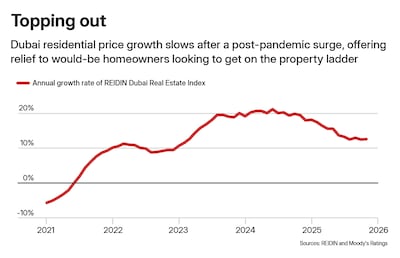

The pace of growth in the UAE’s property market is expected to taper off in the next year to 18 months, but developers and banks are well-positioned to absorb the impact of any slowdown, Moody’s Ratings has said.

After nearly five years of extraordinary growth, price growth and volume of transactions in the country’s real estate market are expected to decrease, Moody’s said in a report on Tuesday. It did not specify how much it expects the market to cool.

"Moody’s Ratings expects a modest cooling in UAE residential prices and developer sales over the next 12 to 18 months as new supply comes online. However, market fundamentals remain strong, supported by population growth and continued inflows of high‑net‑worth individuals,” said Lisa Jaeger, vice president and senior analyst at Moody’s Ratings.

Large developers in particular can weather the decline well and their credit quality will hold. Strong cash flows can help them expand into new segments, the ratings agency said.

"Rated developers are well positioned to absorb a moderate slowdown, given strong revenue backlogs, front‑loaded payment structures and solid balance sheets," Ms Jaeger said.

Consistent growth

The UAE's real estate market has maintained robust momentum since bouncing back from the Covid-driven slowdown. Government reforms, including residency permits for retired and remote workers, and the expansion of the 10-year golden visa programme, have helped in sustaining the boom.

Population growth, as well as the influx of wealthy individuals, has also pushed up prices and home rents, particularly in the high-end luxury segment.

The volume and value of real estate transactions in Dubai hit a high last year, with nearly 130,000 new investors entering the market in 2025, Dubai Land Department data showed.

The number of transactions in Dubai’s real estate market climbed more than 20 per cent annually to 270,000. The value of transactions also rose 20 per cent year-on-year to reach Dh917 billion ($250 billion), making it the market’s "best year to date”, DLD added.

In Abu Dhabi, property deals during the first nine months of last year surged by 43.3 per cent annually to Dh94 billion, with total volume of transactions up 48 per cent to 29,400, latest data from Abu Dhabi Real Estate Centre showed.

New deliveries

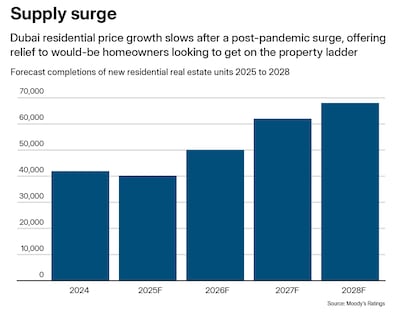

Moody’s said that since 2021, developers have been capitalising on high prices to sell an increasing number of homes off-plan for completion several years later. This will drive a surge in new deliveries between 2026 and 2028 in Dubai in particular, totalling around 180,000 homes over the three years.

“This averages about 60,000 units annually, much higher than the historical average of 30,000 to 40,000 per year over the previous five years,” the Moody’s report said.

Although the surge in completions will be largely absorbed by sustained population growth, Moody’s expects it will slow price gains overall.

“Modest outright price declines are probable in the apartment segment, especially within the more affordable mid-market studio and one-bedroom categories, where supply remains elevated,” the report said.

“The slowdown will prompt developers to scale back the launch of new projects and lead to lower new sales values over the next 12 to 18 months, a trend we expect will persist for several years."

However, the anticipated cash generation by developers over the next two to three years is expected to exceed domestic reinvestment opportunities.

“This is shifting the focus towards geographic diversification and expansion into new non-core sectors, which can be supported by higher dividend distributions from UAE operations,” Moody’s said.

Though financial positions remain strong, sustained cash extraction could gradually weaken local operating companies, “while smaller developers remain more exposed to funding and execution risks”.

Banks’ exposure

Strong regulatory measures in past property market cycles have also reduced exposure of banks to construction and real estate sectors. Lenders have previously had to write off bad debts related to the sector.

This will “shield their asset quality in a real estate market downturn, while we expect them to maintain strong solvency and liquidity buffers”, said Francesca Paolino, assistant vice president and analyst at Moody’s.

Developers, who in the past had relied heavily on bank loans to finance projects, were able to find alternative funding, issuing close to $12 billion of sukuk, bond and hybrid debt since 2023.

Other substantial finance sources include customer instalments on off-plan projects, joint ventures with landowners and third-party shareholders providing equity to projects, Moody’s said.

A drop in interest rates and a weaker US dollar – which boosts purchasing power for non-residents – are also reshaping the real estate market and banking dynamics. Lower rates make mortgages more affordable for residents, but weigh on the margins banks earn from home financing.

“We expect banks’ lower levels of non-performing loans, together with their strong solvency and liquidity buffers, will help absorb the impact of a potential softening in the real estate market,” Moody’s said.