More frequent price changes for consumer goods in the United States along with increasing consistency in pricing due to the rapid growth of online retailers may be affecting inflation, a recent academic paper found.

But is the so-called "Amazon effect" also impacting the Middle East?

“Not yet,” says Nasser Saidi, the former chief economist of Dubai International Financial Centre. “Even the effect in the United States is a relatively recent phenomenon because of the scale of e-commerce and big companies like Amazon and eBay going into the retail sector.”

The US academic paper on the topic was written by Alberto Cavallo, an associate professor at Harvard Business School, who analysed how multi-channel retailers - those with brick-and-mortar and online outlets, such as Walmart - have reacted to the rise of Amazon. It found the Amazon effect was not only keeping prices low due to the higher volume of e-commerce platforms, but that traditional retailers had become more nimble on price, changing them more frequently and offering more consistency for the same items across different locations.

The study went one step further, indicating that Amazon’s ability to keep a lid on prices was also contributing to the low levels of US inflation seen in recent years.

Analysts say it will take time for a similar trend to happen in this region, mainly because pricing in this part of the world is handled very differently.

“The Amazon effect won’t happen here for some time because there needs to be a whole piece of work done here on pricing in general,” says Louise Conroy, general manager, e-commerce and digital, at Sun and Sand Sports, a UAE medium-to-large sports and lifestyle e-tailer. “The reason retail has suffered here is because it has not fallen in line with European, UK or US prices,”

Ms Conroy says brands have a different mark-up per region with UAE consumers charged more because market research has indicated that shoppers are more affluent.

“That illusion has now been shattered by the growth of e-commerce in this region because people can now see what others are paying for the same product in other markets. And with the freedom to ship across borders, consumers are starting to buy from overseas, so it was affecting local businesses.”

_________

Read more:

'Amazon effect' spurs price volatility for traditional stores

Amazon joins Apple in the $1 trillion club

Two thirds of UAE consumers now happy to shop online

Middle East's e-commerce majors focus on grocery for growth

_________

A June poll from global payments company Visa found that more than two thirds of UAE shoppers are now comfortable making purchases and paying bills online, with card payments the top method for online purchases.

However, many consumers are turning to overseas shopping sites, taking advantage of services such as Aramex’s Shop & Ship where users are given a postal address overseas to ship items, cutting the cost of delivery.

“Many global retailers now offer a direct delivery service to the UAE, with excellent courier service and low prices, opening the international retail space yet further to UAE customers,” says Camilla Hassan, the founder and managing director of the premium baby and kids store Five Little Ducks.

Ms Hassan, who spent 10 years working for e-commerce and retail for brands such as Souq.com and Dubizzle before setting up her own entity, says local retailers must factor this in when setting prices.

“There are still retailers whose prices remain typically high on international brands – assuming local customers will choose convenience and speed of getting their products over a lower price, but this is short-sighted,” she says.

While many UAE customers still do not trust the e-ecommerce experience, so swallow the higher price, says Ms Hassan, those open to online shopping are securing better deals. “Many customers who travel frequently also stock up abroad. In previous years, customers may have begrudgingly accepted the price differential and paid it; now, with all the online options, they are becoming more choosy."

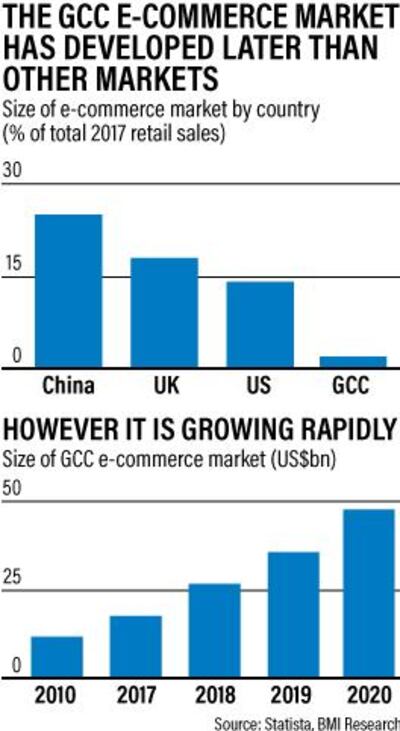

According to a report by Fitch Solutions Macro Research, a unit of Fitch Group, the Middle East’s e-commerce sector is growing at the fastest pace globally with online sales expected to double to $48.8 billion by 2021.

The study, released last month, also found that the sector will expand further thanks to a rise in grocery spending – a new segment of growth for regional e-commerce players. The UAE is set to be one of the leaders, with e-commerce spending in the country increasing 170 per cent to $27.1bn in 2022, from $9.7bn in 2017.

But that does not necessarily translate into lower prices for consumers on the shop floor because of the way retail has been set up in this region, says Mark Pilkington, an advisory board member for Smart Stores Expo, group chief executive of U-Mark and the author of Retail Therapy: Why the Retail Industry Is Broken - and What Can Be Done to Fix It due out in January.

Mr Pilkington says the historical supply chain that has existed since the industrial revolution had factories selling to brands, brands selling to retailers, then retailers selling through shops to customers.

“At each stage of the supply chain the company would mark up the product so that the product that ends up stores had a price of 7 to 8 times the factory cost,” he says. “In the [Arabian] Gulf, that is even more extreme because an additional step was added in - the cost of franchising - meaning products cost about 30 per cent more in the Gulf than they do in London and New York.”

__________

Read more:

Generation start-up: Mumzworld founder eyes faster delivery and growth

UAE mobile spend to reach Dh20bn by 2019, says report

How to cash in on shoppers with Instagram

Amazon sales lift Jeff Bezos's fortune by $12bn in a day

__________

While companies such as Amazon in the US miss out the retail portion of the supply chain, which is how they undercut brick and mortar shops, this places downward pressure on all retailers as they attempt to compete – with some firms going bankrupt in their drive to keep up.

"Then you have the big boys like Walmart and Target fighting back by reducing their prices putting further pressure on suppliers and that’s why inflation has been lower in the US because there is that price pressure,” says Mr Pilkington.

Despite internet penetration in the region sitting at 64.5 per cent, as of March this year, higher than the global average of 54.5 per cent, according to Statista, Mr Pilkington says e-commerce as a percentage of retail is still not as high in the Middle East as it is in the US and Britain.

“It’s much smaller in the gulf but growing extremely fast, so it’s only a matter of time before it puts the same pressure on as it’s done in the US,” he says. “The difficulty for the regional retailers that have their franchise pricing is that products will come into the region via Amazon and Alibaba dramatically cheaper. Therefore, the current price level will become unsustainable, putting downward pressure on prices over the next three to five years.”

There have been some big changes in e-commerce in the UAE and wider region recently. Emaar Properties chairman Mohamed Alabbar set the ball rolling in November 2016 with the unveiling of Noon, a $1bn e-commerce venture for the UAE and Saudi Arabia. It went live last year but has yet to raise its profile amid fierce competition.

In March last year, Amazon acquired Souq.com, the region's largest e-commerce venture, for $580 million, with many customers expecting a wider array of products and lower prices.

While Souq has retained its name to date, Ms Conroy says it is in a transition phase with Amazon planning to have all of its systems integrated within the next 18 months,

“They are starting to sell products from Amazon US on the Souq portal but until they are fully integrated they will still trade as Souq,” she says. “Once Amazon fully enters the market – it will have a rippling effect in general because it means you’ve moved from the status of an emerging market to a more established market.”

However, some regional economies may be better insulated against the force of Amazon. While the Gulf economies rely more on the franchise model, Mr Pilkington says others such as Egypt have a thriving local production scene and local brands in place.

“Certainly in Egypt the international brands have very low market share because the Egyptian spending power is lower and people just can’t afford international brands,” he says, adding that local stores offer better pricing.

He cites another big market, Morocco, where in a previous role as chief executive of the retail group Kamal Osman Jamjoon, the company went in with its ladies underwear brand Nayomi.

“There were only 12 international lingerie stores in the whole of Morocco for 40 million people so you had to reckon that 95 per cent of the market were buying Moroccan brands,” he says.

This focus on local brands in those countries is something Mr Pilkington believes the Gulf economies will also have to adopt to stay competitive.

“The big retail groups, the families, will realise that they are overpaying for product from the franchises and will have to start doing their own thing,” he adds.

Ms Conroy says it is also the responsibility of premium retail brands to adjust their global pricing strategy.

“Brands will have to realise they will not be able to achieve the margins in this market they have done through traditional retail because now people have had a lot more exposure to online and are able to do price comparisons market to market.”

While for now the Amazon effect is yet to show its true colours in this region, Mr Saidi says he would welcome it.

“It would mean greater transparency and introduce much more competition across the retail space,” he says. “In particular, it would be very good for Abu Dhabi and Dubai because they are big tourist destinations.”

While the hotel industry has global price aggregators that allow customers to shop around to find the best deal, Mr Saidi says the same needs to happen on the retail side in the UAE.

“Tourists do international comparisons … so, you have to be careful that the UAE remains competitive from that point of view.”