For James Binding, a 30-year-old British expatriate living in Dubai, setting up an offshore bank account had been on his to-do list for a few years. But it wasn't until this year that he finally got around to doing it.

Like many expatriates who move to the UAE to work, Mr Binding, the founding partner of Binding Partnerships, an executive search recruitment firm with offices in Dubai and Abu Dhabi, says he is here to accumulate wealth.

"I set up my offshore bank account eight months ago," he says.

"I should have done it earlier. As soon as I set foot on soil here, I should have taken it more seriously with the mentality of moving as much money offshore as possible because anything can happen.

"Whether it is a personal crisis or a political crisis, you don't know what is going to happen from one day to the next. And just from speaking to directors at different companies and through my network of people, nobody keeps their money onshore. It just doesn't make sense."

Offshore banks have traditionally been used by the ultra-wealthy to stash their millions - or billions - to avoid paying tax in their home countries. But for the average person, having an offshore bank account was a pipe dream simply because they believed they weren't rich enough to have one.

This mindset, however, is a myth - at least in this day and age - and Mr Binding, who moved to the UAE in 2007, is typical of the type of person who opens an offshore bank account these days.

Efforts by the Organisation for Economic Co-operation and Development (OECD) to introduce global transparency and tax standards in the once-secretive world of offshore banking have opened up the sector in more ways than one.

The OECD has released a white, grey and black list of offshore havens around the world. Countries that appear on the white list, such as Guernsey, the Isle of Man, Jersey, the UAE and US Virgin Islands, have implemented the OECD's internationally agreed tax standard and are considered "safe" jurisdictions.

According to the OECD, offshore jurisdictions on the grey list, including the Bahamas, Cayman Islands, Gibraltar, Monaco and the Cook Islands, lack financial transparency but have committed to change.

Currently, there is no country on the black list. However, in April last year, Costa Rica, Malaysia, the Philippines and Uruguay were deemed unco-operative tax havens and were on the black list. They joined the grey list in June 2009.

The US has also been on a drive to prevent offshore tax evasion by its citizens. According to a report by the Associated Press, the US and Switzerland last year agreed to increase the amount of information they share to clamp down on tax evaders. The US Treasury has also entered into tax-sharing agreements with Gibraltar and Luxembourg.

Caroline Dredge, an Abu Dhabi-based wealth manager for GlobalEye, says she recommends to clients the offshore banking jurisdictions of Guernsey, the Isle of Man and Jersey, where banks such as Lloyds, Barclays and HSBC operate.

"They are independent jurisdictions under the crown of the UK," she says. "They have been used as offshore banking centres for about 40 years, are politically stable and have a depositors' protection scheme in place, which covers you to £50,000 [Dh287,890] or the currency equivalent.

"[These] offshore accounts work the same way as British banks, so it is easy to send money to them."

Opening an offshore bank account is a good way for expatriates to keep their financial lives in order, Ms Dredge says.

"For a seasoned expatriate, it is a good idea," she says.

"They keep your money tidy and secure and you don't have to open a local bank account when you move to another country. You can have your salary transferred to your offshore account, you can have your credit cards with them, even a mortgage and life insurance."

Setting up an offshore account is simple, but easier if you ask a wealth adviser to organise it for you. Offshore accounts can also be set up by directly dealing with your bank. In the UAE, banks such as HSBC, Standard Chartered and Barclays all offer offshore accounts in a variety of jurisdictions, such as the Channel Islands, Guernsey and Jersey.

You are required to provide the bank with a range of documents, including up to three months of bank statements, three months of pay slips and/or a letter from your company confirming your employment and salary.

You will also need a copy of your passport and visa. The process takes two to three weeks, according to Ms Dredge. You can choose the currency you wish to operate in. If you are living in the UAE, for instance, Ms Dredge says you can have a pound, euro or US dollar account as well as a dirham account.

"It is easy to move money around the accounts and you can play around with exchange rates - there are no fees for that," she says.

Another advantage is that the bank issues clients with ATM/debit cards to match their currency accounts. "You can withdraw whichever currency you need depending on the country you are in," she says. "When you are holidaying abroad, your card will not be stopped because the banks expect you to travel."

Offshore banking customers earning about Dh20,000 a month can open an account with as little as £100 and maintain a savings account with a minimum of £5,000. Accounts are accessed online, but you can also visit the bank in person - if you happen to be passing through the jurisdiction it is based in. Account fees vary, as do interest payments, so it is best to check these with the bank you are dealing with. Customers are also assigned a client relationship manager.

Mr Binding has a US dollar offshore account with HSBC in Jersey, as well as a UAE bank account, which his credit cards are linked to.

"It gives you an open platform to move your money between accounts," Mr Binding says. "And also, which I am about to do, if you have offshore US dollar and UK accounts, you can wire money back and forth to play the FX market and make interest on that. It is easy money if you know what to do."

Spencer Lodge, the regional director of the deVere Group, says different nationalities prefer different offshore havens.

"The British prefer the Channel Islands," Mr Lodge says. "This is most likely due to the similarities of the two banking systems and the presence of many British banks there.

"Switzerland has always been seen as the most confidential of jurisdictions, making it a popular place with a broad international set, including residents from the Middle East and Africa. South Americans bank in Montevideo, Uruguay's offshore centre.

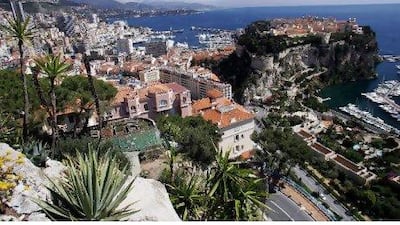

"Monaco has always been one of the most prestigious tax havens and is a popular for the ultra-high- net-worth individual."

Mr Binding believes there are no disadvantages to having an offshore account, despite them offering lower interest rates compared with banks in the UAE.

"For me, there are only advantages," he says. "Your money is safe and it is protected."

What is an offshore bank account?

It is a bank account that is held in a variety of jurisdictions, such as the Isle of Man, Jersey, Guernsey, Switzerland, Monaco and Luxembourg.

What are the major differences between an offshore and a local bank account?

The account is usually held in dollar, euro or sterling currencies. You have the usual banking facilities and the same access as a local account. However, you are protected by a depositors' protection scheme. Many people feel safer with their money in a jurisdiction outside of the UAE. You also have your own relationship manager.

What are the advantages/disadvantages of having one?

Advantages include the ability to freely move between your different currency accounts, and if you have an account with the same bank in dirhams they usually allow free transfers between dirhams and your other currency accounts. Another advantage is that you can continue to hold your accounts wherever you go in the world rather than having to open new accounts when you move countries. The disadvantage is that the interest rates for offshore accounts are not quite as high as UAE rates at the moment.

Are there any tax issues people must keep in mind when they decide to set one up?

Offshore accounts are not for avoiding tax, but simply to put you in control of your tax circumstances. Interest is paid gross and should be declared if you are residing in a taxable jurisdiction. If you are a resident for tax purposes in the UAE, then there is no liability.

Are they restricted to certain nationalities?

There is no restriction on nationalities. A US citizen can have an offshore account. However, you should always declare interest earned on your account as relevant to your taxable status.

Caroline Dredge is a wealth manager at GlobalEye