The investment industry loves its jargon, and some of the phases it comes up with are sharper than others.

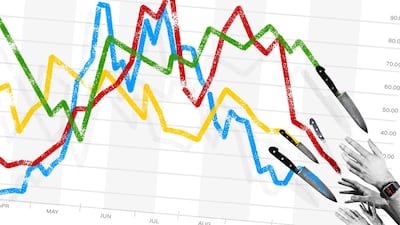

You may have heard a stock described as a “falling knife”, with investors feverishly discussing whether to catch it.

A falling knife is a company whose share price is plunging to earth, typically after a profit warning, criminal charges, mis-selling complaint or some other scandal or embarrassment.

While most investors stand clear some are tempted to try and catch the knife in the hope of snatching a bargain.

If the bad news has been overdone, and the long-term investment case for the company still holds strong, this can be a great opportunity to pick up its stock at a temporarily reduced price.

When the short-term panic subsides and the share price starts to recover, you could make a killing.

However, catching a falling knife is dangerous. Get your timing wrong and it could be bloody. So should you give it a go anyway?

First, a piece of safety advice. The vast majority of ordinary investors should not attempt such a dangerous feat. It requires skill, timing and luck, all of which are in short supply.

You are playing this game with real money, your money, and are likely to lose more times than you win.

Russ Mould, investment director at online fund platform AJ Bell, says would-be contrarian investors should heed the old stock-market adage “never catch a falling knife”, because the danger is that it will carry on falling. “What’s the definition of a stock that has fallen 90 per cent? One that has fallen by 80 per cent, then halved again.”

____________

Read more:

The thrill of investing in boring companies

____________

London-listed oil major BP was a classic falling knife in the days after the deadly Deepwater Horizon oil rig blow-up in the Gulf of Mexico.

Shortly before the disaster on April 20 2010, BP's stock traded at 655p. Within days it had plunged 25 per cent to 480p and investment writers were alerting investors to a potential buying opportunity. Those who heeded the call will have regretted doing so, as the scale of the environmental disaster became apparent and the compensation bill rocketed towards $60 billion.

The stock eventually bottomed out at 308p and its recovery has been slow. At time of writing, more than seven years later, it still languishes at around 456p, below its supposedly bargain price in the heat of the crisis. Catching a falling knife is dangerous. Mind your fingers.

However, get it right and the rewards can be massive. For example, after the technology bubble burst in 2000, online retailer Amazon's stock plunged from $107 to a low of $7. Today it trades an incredible 138 times higher, at $969.

Stories like that will always seduce investors, but while Amazon staged a brilliant recovery many more dot.com stocks sunk without trace, and would have taken your hard-earned money with them.

You're still tempted, aren’t you? If so, then Mr Mould says you need to shift the odds a little in your favour and work out whether the company's problems are temporary, say, due to a downturn in the business cycle, management error or plain bad luck.

“If so, they may be fixable, say, by making boardroom changes, cutting costs or selling assets," he says. "If the company has a strong balance sheet it may reward patient stock-pickers. Time is always on your side if a company’s business model and finances are ultimately sound.”

However, if the slump reflects more fundamental problems, such as structural changes within an industry, a weak competitive position or a serious strategic error such as an over-priced acquisition, then stand well back. “Particularly if the company has a big debt pile which it is struggling to service,” Mr Mould adds.

He picks out a number of high-profile falling knives includes technology company Apple, whose shares dropped by more than a third in the year to May 2016, from $133 to $90. “Profits fell for three consecutive quarters as analysts questioned whether it had compelling new products. However, Apple has fought back and its stock now trades at $160, rewarding investors who grabbed it at the right time..”

The entire commodity sector crashed in 2015 as oil slumped and demand from China faltered, with London-listed mining giant Glencore among the worst hit plunging from 350p to around 70p, amid fears over its $36 billion debt. Mr Mould says management turned things round by slashing borrowings, cutting costs, selling non-core assets and scrapping the dividend. "Investors who took a chance have been amply rewarded, with the stock now trading at 347p,” he says.

Japanese electronics giant Toshiba is another notable falling knife. Its stock fell from ¥470 ($4.17) to ¥185 between December 2015 and spring 2016 after the discovery of a financial black hole at its US nuclear plant building business Westinghouse. “Toshiba even dropped out of the Nikkei 225 benchmark but its shares have since rallied to ¥317, bringing gains to intrepid investors,” Mr Mould adds.

____________

Read more:

Europe is back: is now the time to invest?

The best specialist exchange traded funds to invest in

____________

He tips one falling knife worth watching right now: Danish drug developer Novo Nordisk, which has been hit by competition from cheaper generic rivals and President Donald Trump's crackdown on pharmaceutical pricing in the US.

Novo plunged from over 400 Danish kroner ($64) a share to barely 225 kroner but is fighting back to around 300 kroner, Mr Mould says.

Laith Khalaf, senior analyst at wealth advisers Hargreaves Lansdown, points out that many banking stocks that plunged in the financial crisis would have been bad buys. He says they still haven't recovered their lost value as they have been repeatedly hit by multi-billion-dollar regulatory fines for rate rigging and product mis-selling. Royal Bank of Scotland, for example, has still lost 95 per cent of its pre-crisis value. “Looking for stocks which have been oversold is a tricky game and one only to be attempted by experienced hands,” he says.

A plunging share price does not indicate a bargain if there are good reasons for the slump he adds: “You must conduct a full analysis of the company to gauge whether its stock is undervalued or reflects the diminished prospects of the underlying business."

Mr Khalaf warns that you will rarely catch that knife at precisely the right time. “You must also accept that some of your stock picks will never recover, and can only hope that the ones that do bounce back more than compensate.”

He says most private investors who are interested in this area should spread their risk by putting their money into something called a "recovery fund”, a type of actively managed mutual fund that attempts to make money by investing in bombed-out stocks with fight-back potential.

Options include M&G Global Recovery, which has returned 12 per cent over the last year and 82 per cent over five years, Schroder Global Recovery which grew 17 per cent over the last year, and R&M World Recovery, up 27 per cent over one year and 54 per cent over three years.

Sébastien Aguilar, co-founder of the UAE-based non-profit community, Common Sense Personal Finance and Investing, says too many people try to catch a falling knife because they wrongly believe they have spotted an opportunity nobody else has. "The reality is that the information you are basing your decision on is available to every other investor, which means the share price already reflects the risks and rewards.”

Do not make the mistake of thinking you are brighter or better informed than other investors, because you almost certainly are not (and some may be brighter than you).

Mr Aguilar says most investors – even active professional active fund managers – struggle to time the market. “You should shun falling knives to build a diversified portfolio of low-cost exchange traded funds (ETFs) tracking a variety of indices instead, then hold them for the long term.”

Sam Instone, chief executive of independent financial advisers AES International in the UAE, also advises caution. “I tell my children they should never catch a falling knife when emptying the dishwasher, and I would give the same advice to any investor. All the evidence suggests that those who try to time the market underperform over the long-term.”

If you are still tempted to catch a falling knife, well, it’s your money. Just do not chance more than you can afford to lose.