Your financial needs will vary at every stage of your life, and planning for change is the only way to face the future with some certainty. Here, National Bonds Corporation, a Sharia-compliant savings scheme, offers financial advice for couples planning and saving for four of life’s biggest milestones. By being prepared for the costs associated with buying a home, getting married, starting a family and retirement, you can ensure you and your spouse can simply sit back and enjoy them when they happen. Remember, all of the monthly saving amounts are per person:

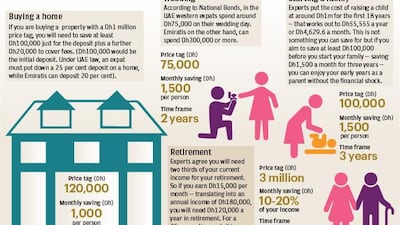

Buying a home

Price tag: Dh120,000

Monthly saving: Dh1,000 per person

Time frame: Five years

One small step on to the property ladder can involve a giant leap in your expenses. With the average home in the UAE costing upwards of Dh2.5 million, you may need to save wisely for many years before closing the door on rented accommodation for good. Although the average property price may be out of reach, there are plenty of cheaper options if you conduct your research and shop around. You may not be able to afford a villa in Downtown Dubai, but an apartment in Jumeirah Village Circle could be within your grasp. You may also be keen on investing in a property in your home country, or some other place in the world.

Once you have identified what sort of property you can afford and where, it’s time to put together a financial plan to help you make the purchase.

For instance, assume you have your eye on a one-bed apartment in an affordable area of Dubai. If the property comes with a Dh1m price tag, you will need to save at least Dh100,000 just for the deposit (that would be the initial deposit required by some housing developers. Under UAE law, an expat must put down a 25 per cent deposit on a home, while Emiratis can deposit 20 per cent). If you have a nest egg squirrelled away and can put down an even larger deposit, you will be in a better position to get a competitive mortgage rate.

This does not include fees paid to the solicitor, mortgage broker or estate agent. Depending on where you buy, taxes and fees vary all over the world, but you will need to be prepared to part with at least another Dh20,000 to cover such incidentals.

It may sound like a daunting amount, but a realistic savings plan is the key to your new home. If you are a couple needing to raise Dh120,000, you will each be required to save Dh1,000 a month for five years to reach your target. When you imagine walking through the front door of your very own home, the financial sacrifice will not seem that big a deal after all.

Wedding

Price tag: Dh75,000

Monthly saving: Dh1,500 per person

Time frame: Two years

We realise your wedding is probably the most expensive party you will ever throw. In the UAE, western expats spend an average of Dh75,000 on their wedding day. Emiratis, on the other hand, can spend up to Dh300,000 or more. In addition to the reception, you may have to pay for relatives’ plane tickets, or travel to your home country. And of course there’s also the honeymoon to factor.

So to gear up for the occasion, you will need to sit down with your intended and decide how much you are prepared to part with each month and for how long – this will allow you to arrive at the most appropriate budget for your wedding. To pay for a wedding of Dh75,000, you and your spouse-to-be will need to set aside roughly Dh1,500 a month over a two-year engagement period.

If the final figure is disappointingly low, remember that your perfect wedding isn’t about money. You will have an army of friends on hand who will probably be very happy to help. You may know an exceptional baker, a keen photographer or someone with a knack for arranging flowers. Using the talent of friends and family not only keeps costs down, but will give your wedding that much-needed personal touch. A wedding symbolises the start of a new life together, and you don’t want to do that mired in debt.

Starting a family

Price tag: Dh100,000

Monthly saving: Dh1,500 per person

Time frame: Three years

While it may be true that nothing can prepare you for having a child, this is strictly speaking not quite accurate. A healthy savings account will definitely help. Experts put the cost of raising a child at around Dh1m for the first 18 years – that works out to Dh55,555 a year or Dh4,629 a month. Of course, the cost will vary hugely depending on what part of the world you live in and what sort of lifestyle you lead. However, children will be the single biggest influence on your spending power and habits.

Unless you have a spare Dh1m lying around, you cannot start saving soon enough for children. And whatever you save will help you cushion those first few years while you build up your income. If you aim to save at least Dh100,000 before you start your family, you can enjoy your early years as a parent without the financial shock.

To achieve this cushion, you and your partner will need to put aside roughly Dh1,500 a month over three years. This might sound like an infringement on your spending power, but it will be less of a battle than suddenly having to find an extra Dh4,000 every month – especially considering that your earning potential may take a temporary slide if one parent decides to take a career break to care for the child.

Retirement

Price tag: Dh3m (as an example, the cost of retirement varies hugely between individuals, circumstances and regions)

Monthly saving: 10-20 per cent of your income

Time frame: 35-40 years

Finally, it is that time of your life when you get to enjoy the fruits of your labour – you have raised your children, bought your home, fulfilled your responsibilities … but what do you have to live on?

It is truly alarming how late in life many people ask this question. Financial advisers generally agree that you need to put aside 10-15 per cent of your income from the age of 30, some others say 20 per cent. In truth, it depends on you and the kind of retirement you want.

Do you see yourself living modestly and enjoying the simple things in life, or fulfilling those dreams and ambitions you never had the time to go after when you spent your days in the office? Questions like this will help you set your retirement goals. For example, if you would like to take a holiday every year in retirement, you will need to save an extra Dh110,000 to account for 20 or more holidays.

Even if you simply want to maintain your lifestyle, experts generally agree you will need two-thirds of your current income. So if you earn a salary of Dh15,000 per month – translating into an annual income of Dh180,000, you will need Dh120,000 a year in retirement. For a 25-year retirement, this means a pension pot of Dh3m.

It sounds like a staggering amount, which is why you need to save for 35 to 40 years. Of all your financial goals, it is important to remember that retirement is by far the most crucial. Although it may seem a long way in the future, once you start saving for your retirement your future has already begun – and it looks brighter.

pf@thenational.ae

Follow us on Twitter @TheNationalPF