By 2020 it is predicted that we will use mobile apps for banking 10 times more often than we will physically visit a branch.

According to a study by CACI Consultancy, the number of branch visits in the UK is expected to drop to 268 million by 2020, while app usage will rise to 2.3 billion.

With banking apps such a crucial feature for our smartphones, you would expect them to be cutting edge, yet independent banking research firm MyPrivateBanking said in a report last year that most global banks were “not responding adequately” to clients’ digital expectations nor innovating enough, particularly for millennials.

While most have a “solid track record” for must-have features such as an account overview and payment methods, they are lacking chat and messaging, interactive educational content and digital tracking and forecasting tools, the report said.

According to a mobile banking survey run by Nielsen late last year, facial recognition software and cheque scanning and deposit technology are the features mobile users most want to see in future banking apps.

But the future is already arriving thanks to some innovative apps. We round up five of the best internationally, and inspect the features they offer that we hope will be coming to a UAE banking app near you very soon.

Chase

Chase has been voted the best mobile banking app in the US for the second year running by MagnifyMoney, which has run the study for five years based on user rankings from the Apple and Android app stores. Bill Wallace, head of digital banking, says Chase wants to offer convenience and “remove friction”.

The app includes fingerprint sign-on, mobile cheque deposit and views of deposited cheques, as well as standard features you would expect like a branch and ATM locator and bill payments.

What we liked

Person-to-person payments with Chase QuickPay with Zelle, which allow customers to send and receive money in minutes, transacting with 86 million customers of a dozen financial institutions.

User comments

Google Play user: “This is by far the most used app on my phone. It's so easy to use and understand and not to mention convenient. Say goodbye to going into the bank from here on out (unless of course you need to make withdrawals).”

Could be better

One user complains on Google Play that online deposit of cheques does not work properly as the photo of the back of the cheque tends to fail, while another says the monthly deposit limit by phone (which varies by account) is too low.

Competitors

Capital One only just missed first place and Citibank’s app was judged most improved. In the UK, Moneywise has shortlisted Barclays, First Direct, Halifax, Metro Bank, NatWest and Royal Bank of Scotland (RBS) for its 2017 best app award. RBS and NatWest offer a neat feature – a temporary four-digit passcode if you are at a cash machine and realise you’ve forgotten your debit card to get £250 (Dh1,200) a day out.

Atom Bank

Atom is one of the UK’s "challenger" digital-only banks. Launched in 2015, it does not have any high-street branches and operates purely via a smartphone app, offering fixed-term savings accounts and mortgages. Current accounts, debit cards, overdrafts and instant access savings planned soon.

It’s squarely aimed at millennials and Black Eyed Peas musician will.i.am, a strategic board adviser to Atom, says it has a “progressive” approach to banking and is trying to educate young people about saving.

What we liked

Atom is one of the first banks to offer biometric security – you can log in via face, voice or fingerprint recognition. It has gone for a very simplistic interface, with floating bubbles showing your account balances and a vault for your documents. Some of its features are purely gimmicks, such as choosing your colour palette or having your own named bank after login.

User comments

Google Play user: “Wholly impressed, not sure what's not to love. Very modern, good-looking app that seems to do what it's meant to do. No issues with it whatsoever. Highly recommended for intelligent people.”

Could be better

The voice recognition fails regularly.

Competitors

Starling, Tandem and Monzo in the UK, Simple, Moven, Discover in the US.

iAllowance

Dubbing itself Piggy Bank 2.0, iAllowance is a tool where you can set and track your children’s chores then pay out their pocket money based on what they complete. You can even track screen time. iAllowance claims it has been used to complete 20 million chores and pay 12 million allowances.

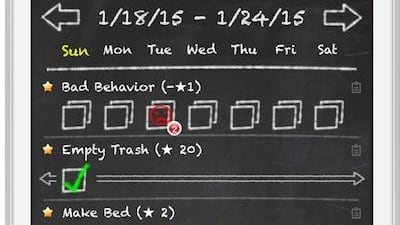

Start off by setting up weekly or monthly allowances, savings and even charity accounts then add chores from a list (empty trash, make bed, put away groceries plus negative chores like bad behaviour or talking back) and schedule them. There are more than 50 listed and you can also add custom chores. You can incentivise with stars instead of money – and convert to cash later if you change your mind.

What we liked

iAllowance supports 150 currencies and you can mix and match them between banks – so this is one you could start using now. You can also turn on parental controls so your children can view only rather than tinker with the results. The app syncs across devices and DropBox.

User comments

MyMacMommy.com: “I use most all of the banking features and my second-grader has a pretty clear picture of his total net worth right now – which is more than I can say for many college grads.”

Could be better

Usability could be improved – it takes a while to work out how to set up the system. You will need to pay US$3.99 to upgrade to the pro version for more than one child.

Competitors

Allowance Manager, Tykoon (US), GoHenry, Osper (UK)

Money Dashboard

This free budget planner for UK users aggregates all your bank accounts and credit cards in one secure portal. It won best personal finance app at this year’s British Bank Awards.

You add all internet-enabled bank accounts and credit cards by inputting your login details. Money Dashboard then creates a read-only service that allows you to see all your income and outgoings in one place. Most transactions are automatically tagged – for instance, groceries or public transport – and you can tag those that the app does not recognise or create custom tags.

The app shows you what categories you are spending money in, and your balances and spending today versus last month. If you set financial goals, the budget planner can tell you what you are "allowed" to spend (for instance on dining and drinking) or how much you can save.

What we liked

Graphs are colourful and easy to read. You can filter transactions to view only outgoings, one account or category, or sort by date, description or amount.

User comments

Google Play user: “This does the trick for me. I haven't had any problems as such… but the team have been excellent at responding with genuinely helpful information.”

Could be better

Not all banks and cards can be added. If you transfer savings to an account not in your dashboard, it will skew your balances.

Competitors

OnTrees, Mint.com, Wally.

Bitcoin Wallet by Coinbase

Bitcoin is still seen as the Wild West of currencies – mainly thanks to being the ransomware currency of choice – but with one Bitcoin today worth over $2,400 (almost Dh8,900), many are looking to transact in the new cryptocurrency. The Dubai government aims to move all its transactions to blockchain (the technology behind Bitcoin) by 2020, so it’s worth getting clued up now.

Coinbase is probably the leading platform on which to buy and sell Bitcoin and says it has assisted $20 billion worth of digital currency exchanges. It is available in 32 countries, mostly Europe and North America, although Singapore is included; you must reside in one of these countries to buy, sell and create a local currency wallet connected to your bank account, debit or credit card. But even in the UAE you can send and receive funds using Coinbase or store Bitcoin securely in its vault.

What we liked

You can create recurring buys and sells of Bitcoin every week or month (dollar cost averaging) to slowly buy Bitcoin, purchasing more when the price is low and less when the price rises.

User comments

A Google Play user: “My go-to. Fees suck for instant purchases... However Coinbase has allowed me to purchase Bitcoin with near zero in fees when I plan ahead.”

Could be better

You need to take care to secure your wallet; Bitcoin.org recommends two-factor authentication, backing up and encrypting your wallet, keeping only small amounts of Bitcoin in your wallet and keeping an offline (cold storage) wallet that is not connected to the network. It also warns you to tell your family the locations and passwords of your Bitcoin, possibly as part of your will.

Competitors

Coin Jar (UK), Xapo, Mycelium, Bitcoin Wallet by Blockchain Luxembourg