Thinking that they don't have enough money is the biggest thing holding people back from investing.

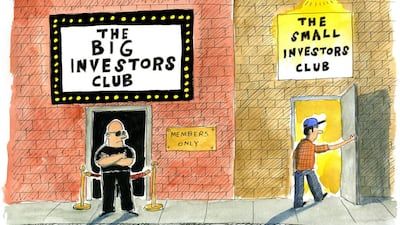

And that's fair enough, because on the one hand we've had "it takes money to make money" drilled into us, where the idea of money is a whopping figure with a few zeros to it. On the other had, if you override the above message and look for opportunities to join the investor club with very few, if any, zeros to your budget, you'll quickly see that there really isn't much on offer.

Where's the social justice in this?

Yes, you can start investing with little bits of money - but it mostly involves the stock market, either buying into mutual funds or the direct trading of stocks and shares.

But what if you don't have enough time or confidence to choose, let alone trade, stocks and shares? What if you're lucky enough to put a little bit each month into a managed tracker fund, for example, and want to invest in other things, too, but can only put in a little bit at a time?

Well good luck, because I just cannot see how what's out there helps make this happen. Sure, we should all be saving money and accumulate that down payment that'll get us into the club, but how about having options to invest in really interesting, tangible things a little bit at a time? In real estate, in farms, in businesses that make things?

In a world where 85 people own the same amount of wealth as half of the globe's 7 billion-plus population, how about giving the majority of people a chance?

These figures came about from research carried out by the charity Oxfam, and shared at the start of the year. I'd say the gap is probably getting bigger as I type - this week Forbes reported that the ranks of the world's billionaires has an additional 268 newcomers and now stands at 1,645. Note that you now need to be worth US$31 billion to be on the top 20 list - up from the $23bn entry point last year.

Well done to all those who earned their place on the list. I'm not knocking wealth, especially when it enables the likes of Bill and Melinda Gates or Oprah to do so much good in the world. But how about giving the little person a chance to grow too?

Social inequality led to the Arab spring, and many other revolutions are playing out across the world. Where are the tools that give people hope and help them to move up the socioeconomic ladder, to make a better life for themselves and their loved ones? The more I think about this, the more incensed I am that this key issue is simply ignored.

Here's what is needed:

Empower people to be paid-up investors. Enable them to build up wealth and create passive income, where the starting point is a relatively small amount of money, a lump sum that is manageable for the average man or woman to save, where people do not have to take on debt of any sort to make this happen, but can work with, and build on, what they have.

What will happen is that those who buy one "investment ticket" - let's call it that for the sake of this scenario - will buy more. Their way of life will change so that money is used mindfully. They'll have goals, be excited, look forward to going to work to earn the money that'll buy them their next ticket, and we will all rejoice over the new world order.

The sad truth is that many people don't bother starting on the road to saving and investing because they believe they'll never be able to afford it.

And because they don't have the stash of cash and can't see how they could any time soon, they blow whatever money they do have on - well, nothing important - and stay stuck, if they're lucky, but more often than not, end up in a deeper money hole as the years pass.

The sad truth is that the people most in need of building a solid financial base are the very ones being left out of the wealth creator vehicles.

We don't need to be mega-wealthy or tycoons to get a foot on the investment ladder. What we need is to stop accepting the status quo and to be brave and bold and take the majority of people on the road to financial freedom.

Nima Abu Wardeh is the founder of the personal finance website cashy.me. You can reach her at nima@cashy.me

Bringing investment power to the people

Nima Abu Wardeh: We don't need to be mega wealthy or tycoons to get a foot on the investment ladder. What we need is to stop accepting status quo and take the majority of people on the road to financial freedom.

Most popular today