When seeking to invest for the long term, it is all too easy to worry needlessly about the best investment opportunities - the available products, fund performances, risk levels, tax considerations and so on. While these issues are extremely important, all you should really worry about is getting started. And the sooner you start, the easier it will be to reach your targets. Of course, it is important that the savings vehicle you choose is suitable: there is no point, for example, in starting a 25-year contractual savings plan if you are uncertain about your ability to keep payments going for the whole length of the plan.

If you have any doubts, you should reduce the premium and/or the term to amounts you feel more comfortable with. Or you could choose a "non-contractual" plan that allows you to interrupt regular payments without penalty. Equally, it is important that the savings vehicle that you choose is appropriate - not only now, when you are living in the UAE, but also later when you move on, either back to your country of origin or elsewhere.

This is particularly important for Australians, whose national government is hostile to the ownership of offshore funds once its residents return to live in Australia. It's even more important for US citizens, whose government will generally not even allow them to continue funding an offshore savings plan after taking up residence in the US. For nationals of these countries, the best option is a non-contractual offshore plan that allows you to stop payments without penalty - or, very often (and especially so if you are contemplating just a short period as a non-resident) an onshore plan subject to tax.

Remember, there are times that it is easier and more cost-effective to pay it than it is to avoid it. So, having selected the best savings vehicle and an affordable level of regular premiums, you will probably then start to worry about the choice of funds. Should you invest in equities or bonds? In the US, China, other emerging markets, or the UK? How about commercial property, commodity or hedge funds?

Again, these are important considerations, but none more so than the actual act of investing itself. If you are worried about the volatile influence of these various asset types, you should perhaps pick an appropriate managed fund and let the fund managers worry about the asset allocation. Over long periods of time, equities have proved to be the best-performing asset class, enjoying annual growth rates generally around 10 per cent per year.

I know that the last decade has been difficult, beginning as it did with the dot-com crisis and ending with the credit crunch, but had you been investing your money monthly over that period you would not have lost money. You would not have made much, either, but this is not surprising given the magnitude of these two economic crises. I realise that many investors have made money in property during the last 10 years, but this last decade has been the only one in recent memory in which property has outperformed equities. During the last 20 years, equities in mature markets have performed much closer to the 10 per cent annual figure quoted above.

Now that you have sorted out a savings vehicle and an investment strategy, what's in it for you? Quite a lot actually, providing you keep at it. If you invest Dh100 a month for 20 years with a 10 per cent annual growth rate, your total contributions of Dh24,000 would be worth Dh72,200 at maturity. And if you leave it there for another five years after maturity, your investment will grow to Dh116,200.

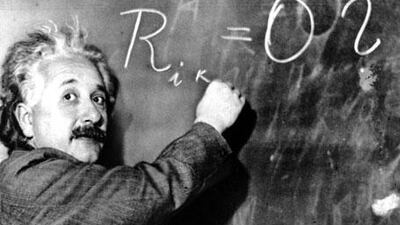

These figures indicate the power of compound interest - in short, your investment generates interest, which in turn generates more interest. Einstein famously joked that the greatest force in the universe was compound interest, and with these figures, you can see why he said this. When compound growth is at work, the sooner you get started the better. In the above example, delaying your saving activity by one year, so that you are saving for 19 years rather than 20, would result in a maturity value of Dh64,200.

So although you saved for 95 per cent of the time, you only earned 87.5 per cent of your potential return. Of course, for the model to work, you need to achieve an average growth rate of 10 per cent per a year. And for even this to be meaningful, that rate must beat inflation. It also needs to be high enough to pay for the product provider's charges, which for a 20-year plan will usually set you back around 1.5 per cent a year. Then there are the fund manager's charges, which could add another 1 per cent annually.

Despite these charges, long-term premium plans are cost-effective, provided you keep the payments going. It is not a good idea to stop contributing, even if your adviser tells you it is perfectly all right to do so. Bill Davey is a financial adviser at Mondial-Financial Partners Dubai. You can write him at bill.davey@mondialdubai.com