The value of cryptocurrency assets received by services in the UAE, particularly centralised exchanges and decentralised exchanges, between July 2023 and June 2024 reached $34 billion, representing a 42 per cent year-on-year growth, driven by increased institutional participation, regulatory innovation and expanding market activity, according to a new report.

Crypto activity in the Emirates, which is the Middle East and North Africa region's third-largest crypto economy, is growing across all transaction size brackets, signalling a more balanced adoption landscape, blockchain company Chainalysis said in a report on Wednesday.

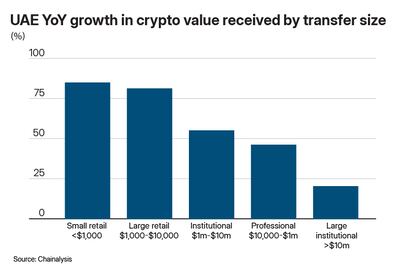

Large institutional (more than $10 million), institutional ($1 million to $10 million), and professional ($10,000 to $1 million) sized crypto transfers in the UAE posted annual growth of 20.13 per cent, 55.07 per cent and 46.3 per cent, respectively, it said.

“Financial institutions are starting to explore participation in the crypto ecosystem, including in the UAE, to diversify their portfolios and provide secure access to the asset class for their customers,” said Arushi Goel, policy lead for the Middle East and Africa at Chainalysis.

“Traditional financial institutions actively exploring their roles within the ecosystem will only add credibility and build trust in the industry, which will lead to mainstream adoption of crypto.”

Small retail (less than $1,000) and large retail ($1,000 to $10,000) crypto transactions in the UAE each increased by more than 80 per cent. This is in contrast to most other countries globally.

"It’s likely retail investors have been attracted by the strong returns that crypto investments have yielded in recent years. Our research has shown that last year, the UAE’s crypto community realised capital gains totalling $204 million from their crypto investments," Ms Goel said.

The UAE has been taking steps to regulate the virtual assets sector while promoting its growth. Dubai adopted the Virtual Assets Regulation Law in March 2022 to create an advanced legal framework that protects investors and provides international standards for running the industry.

It also set up the Virtual Assets Regulatory Authority to regulate the sector throughout the emirate, including special development zones and free zones, but excluding the Dubai International Financial Centre (DIFC).

The authority, which will also be responsible for licensing, has legal and financial autonomy over the virtual asset sector.

The UAE Central Bank issued a regulation on stablecoins in June that will only allow businesses and vendors in the Emirates to accept cryptocurrencies for goods and services if they are dirham-backed stablecoins.

The regulation will be implemented next year. Other digital assets such as Bitcoin and Ether, and US dollar-backed stablecoins like Tether or Binance USD will not be allowed for those types of payments in the UAE. However, financial free zones are excluded from this regulation.

In August, crypto company Tether announced that it plans to launch a dirham-pegged stablecoin in the UAE in partnership with Abu Dhabi-based Phoenix Group and Green Acorn Investments.

The Chainalysis report found that the Mena region received $338.7 billion in crypto value between last July and June, with Turkey and Saudi Arabia accounting for $136.8 billion and $47.1 billion, respectively.

The Mena region is ranked as the seventh-largest crypto market globally in 2024, accounting for 7.5 per cent of the world’s total transaction volume, the research found.

“Turkey’s high inflation rate, which has hovered near or above 50 per cent for the past year, has driven much of the country’s crypto adoption. Amidst this high inflation, citizens have turned to cryptocurrencies –particularly stablecoins and altcoins – to hedge against currency devaluation and seek higher returns,” Chainalysis said.

Saudi Arabia remained the fastest-growing crypto economy in the Mena region, followed by Qatar.

The report also found that stablecoins and altcoins are gaining market share over traditionally preferred assets like Bitcoin and Ether across the Mena region.

In Saudi Arabia and the UAE, the volume of stablecoins received was higher than the global average. The volume share of Bitcoin that was received in these two countries was significantly lower than the global average, according to Chainalysis.

“In the UAE, where the local currency (the dirham) is pegged to the US dollar, the growing adoption of stablecoins likely reflects their popularity as an on-ramp to broader crypto services and trading,” Ms Goel said.

"Altcoins, on the other hand, offer diversity and opportunities for investment outside of the dominant Bitcoin market. They often serve specific functions or industries, which makes them attractive to users seeking alternatives to Bitcoin’s limited utility. For instance, certain altcoins are used in decentralised finance platforms, which as we’ve seen, are popular in countries such as the UAE and Saudi Arabia."

Centralised exchanges (CEXs) remained the primary source of crypto inflows across the Mena region, indicating that most users and institutions still prefer traditional crypto platforms, but decentralised platforms and decentralised finance (DeFi) applications are steadily gaining traction.

Saudi Arabia and the UAE demonstrated high interest in decentralised platforms, with 30.9 per cent and 32.4 per cent of the transaction volume share in each country taking place over decentralised exchanges, the study found.

The UAE also shows higher DeFi adoption than the global average, probably attributable to its progressive regulatory stance, according to Chainalysis.