RELATED: About 70% of employees are 'out of practice' for office life, survey finds

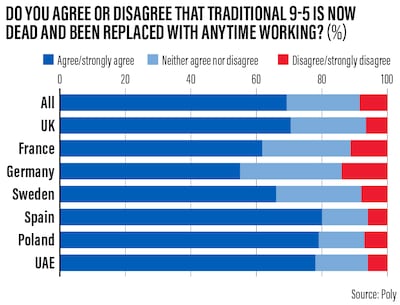

About 78 per cent of employees in the UAE believe the traditional 9-to-5 work routine is outdated and has been replaced with anytime working, a survey by US electronics company Poly found.

About 67.6 per cent of employees in the UAE believe they are more productive when working from home despite organisations increasingly returning to normal amid an easing of Covid-19-induced remote work arrangements, according to the survey.

The study interviewed 7,261 hybrid workers from the UAE, the UK, France, Germany, Spain, Sweden and Poland in August this year.

“Anytime working should not be confused with being always on,” said Paul Clark, senior vice president of Europe, Middle East and Africa sales at Poly.

“The organisations that promote a healthy work environment and empower anytime working will see a much happier and more productive workforce. This is especially important as we are experiencing the ‘Great Resignation’ phenomenon, where people across industries are leaving their jobs due to the pandemic.”

The widening disconnect between employers and employees about a possible return to the office after Covid-19 and the emergence of a new hybrid working model could lead to a wave of resignations and an increase in workers' disengagement, a report by global consultancy McKinsey said in July.

Globally, employees are leaving their jobs at much higher rates than normal. About 42 per cent of remote workers said if their company did not continue to offer options to work from home in the long term, they would look for a job that did, according to a March 2021 survey by financial services company Prudential.

Seventy-two per cent of UAE workers said the Covid-19 pandemic and working remotely caused work culture to change forever, the Poly survey said.

However, 60 per cent of workers in the UAE are worried that working remotely could impact their development and career progression, the survey found.

“While many are enjoying the benefits of hybrid working – the work-life balance, lie-ins and family time – others are feeling sidelined and disconnected,” Mr Clark said. “Sadly, the younger generation – many of whom entered the workforce during the upheaval – are feeling the strain strongly.”

In the UAE, 62.8 per cent of hybrid or home workers said they could be discriminated against or treated differently compared with employees who choose to be in the office full-time, the survey found.

Listing the biggest concerns about returning to office, 45.2 per cent of UAE respondents cited commuting, 37.2 per cent spoke of noisy phone calls, 36.4 per cent were worried about people looking over their shoulder at what they are doing, 31.6 per cent complained about noisy colleagues and 31.2 per cent were worried about being less productive, the survey found.

About 61 per cent of UAE respondents expressed concern that office noise levels would make them less productive. Fifty-seven per cent of UAE workers fear they will be more prone to outbursts in the office since they will not be able to mute themselves or turn their cameras off, the research found.

Meanwhile, 56 per cent of UAE workers said they had lost the art of small talk, while 53.6 per cent of people were worried that working from home had made them less confident in their ability to communicate with colleagues effectively.

Seventy per cent of those working from home in the UAE said they were worried about missing out on learning from peers and seniors, according to the survey.

“The role of the office and what people want to use it for is changing. It’s evident that people have craved human interaction since working from home and are looking forward to getting back to the office,” Mr Clark said.

When asked about the top three experiences workers miss about the office, respondents listed talking to colleagues about projects outside of their area of expertise, going to lunch with clients and colleagues and training opportunities, according to the survey.

But when asked what they would miss about working from home, 44 per cent highlighted time with family, 32.4 per cent cited more personal time and 24.4 per cent said wearing more casual clothes.

The benefits of hybrid work include having more time to spend with family, a better work-life balance and less stress, the survey said.

senior vice president of EMEA sales, Poly

In contrast, the top three drawbacks of working from home for UAE employees include a lack of IT support, having to keep their workspace tidy for video calls and difficulty in collaborating, according to the research.

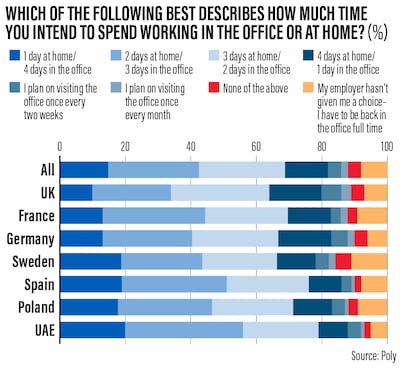

In an indication that the hybrid working model is here to stay, 36 per cent of UAE employees said they would spend two days working from home and the rest of the week in the office, while 23 per cent said they would work from home for three days and spend two days at work, the study found.

The main drivers for UAE employees to work in the office include access to better equipment and technology, attending meetings and brainstorming with colleagues.