European stocks have fallen sharply, out of fear of the looming recession, nearly wiping out their gains this week. London's FTSE market closed down 7.16 per cent, with the biggest movers the banking sector, which is still seen as vulnerable, and oil companies because of the falling crude price. HSBC was down 6.5 per cent, Shell lost 6.8 per cent and BP shed 7.3 per cent. Continental European bourses fared little better - the German DAX lost 6.5 per cent while the French CAC shed 6.8 per cent.

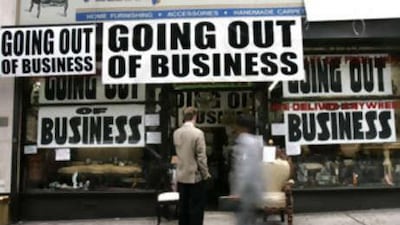

New York's Dow Jones was four per cent down at one stage, after a slew of poor economic news today. Retail sales fell 1.2 per cent in September to a seasonally adjusted $375.5 billion, the US commerce department said. It was the sharpest drop since August 2005 and far greater than the 0.7 per cent decline economists had expected. "We have an all-out consumer retrenchment under way," said National City Corp chief economist Richard DeKaser in Cleveland, adding he expected the economy to shrink in coming months.

The Labor Department said the producer price index, a gauge of prices received by farms, factories and refineries, dropped 0.4 percent in September, in line with expectations, as a further fall in energy costs eased price pressures. "The question on everyone's minds is how deep of a recession (will there be)," said Kathy Lien, director of currency research at GFT Forex in New York. "Today's (retail sales) number indicates a very strong chance of negative GDP growth for the third quarter."

*Reuters afoxwell@thenational.ae