As investors pour more and more money into funds that passively track stock indexes, Burton Flynn and Ivan Nechunaev are on a road trip to try to show that research and stock picking can pay off.

The two men, managers of the Evli Emerging Frontier Fund, hit the road in June with their wives and Mr Flynn’s then-2-year-old son to live in 12 countries over 12 months. They promised their investors they would meet face-to-face with executives of every company they buy stock in.

Besides testing the value of hands-on research, the trip also shines a light on how well companies in developing countries are addressing environmental, social and governance issues. The men are targeting smaller companies that usually aren’t in benchmark indexes, traded on exchanges from Indonesia to the Philippines, Saudi Arabia to Mexico.

“We’ve been flying into these markets for two or three days for many years now, but I’ve always felt like we were observing these economies and cultures at a superficial level,” Mr Flynn said by phone from Riyadh, Saudi Arabia. “Moving to a new country each month has been challenging for my family, and my son probably won’t remember anything, but we’re getting a life experience that is really valuable and unique.”

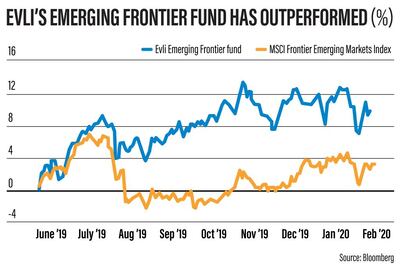

After eight months on the road, the trip has had benefits. The $81 million (Dh297.5m) fund has returned 10 per cent since the trip started, beating the MSCI Frontier Emerging Markets Index’s 3.4 per cent return in euro terms. Longer term, the fund has underperformed competitors, according to data compiled by Bloomberg.

The men, who work for Terra Nova Capital, majority-owned by Helsinki-based Evli Bank, may extend the trip to 15 countries in three additional months.

Mr Flynn and Mr Nechunaev aren't the first investors to immerse themselves in emerging markets. In 1990, Jim Rogers set out for a motorcycle trip through developing countries that lasted 22 months and resulted in the book Investment Biker. A second book, Adventure Capitalist, the result of a three-year trip to 116 countries, convinced Rogers that the 21st century would belong to China.

Investors could easily select cheap, emerging-market stocks with positive earnings forecasts from offices in Hong Kong or New York. But Mr Flynn and Mr Nechunaev say hitting the road has allowed them to peek into the underexplored corners of markets, finding companies that aren’t on the radar of most fund managers. Also, as ESG becomes a more important element for Evli’s clients, they wanted to build a proprietary database of companies.

Mr Flynn, a 36-year-old native of Salt Lake City, and Mr Nechunaev, a 29-year-old from Tomsk, in Russia’s Siberia, look for attractive valuations and good earnings prospects. They’re fine with companies that have little or no analyst coverage.

The 19 stocks selected in the first six months of the journey have contributed 8.8 percentage points to the fund’s performance during the period. Their purchases include Malaysia’s Pentamaster Corporation, which makes equipment for the manufacturing and semiconductor industries, television company PT Media Nusantara Citra in Indonesia, Pakistani technology services company Systems Ltd and Tipco Asphalt in Thailand.

They’ve interacted with more than 500 companies, including 237 meetings with CEOs plus several dozen more with stock exchange officials, regulators, local investors and an extended network that includes alumni of the University of Pennsylvania’s Wharton School, where both earned their MBAs.

The trip began in the Philippines, followed by Malaysia, Indonesia, Bangladesh, Pakistan, Thailand and Vietnam. After spending January in Saudi Arabia, they’re now in South Africa before heading to Turkey, Egypt, Argentina, Chile and Mexico. They’re still deciding what should be the 15th destination for the project, and said the coronavirus outbreak hasn’t affected their plans since they’ve already finished their travels in Asia.

On the their first day in the Philippines, in June, they met with Raul De Mesa, chairman of AbaCore Capital Holdings. After the chat, they decided to grab a taxi and travel for three hours to check out big chunks of valuable land the company owns in Batangas, one of the country’s fastest-growing provinces.

AbaCore is beginning to cash in, selling some of that land, and a local employee was waiting for them to show the premises. Back in Manila, the portfolio managers were able to ask questions of chief executive Regina Reyes and co-founder Hermilando Mandanas at an old colonial American members-only club. After that and some other meetings, they bought the shares.

The men have been living in short-term rental apartments, flying low-cost airlines and aim to arrange an average of five meetings per weekday, plus breakfast or dinner for some networking. They’ve also been blogging about their adventures, such as an attempt to talk their way into a meeting with Pakistan’s finance minister and their dinners with Donald Trump Junior in Bali, Indonesia.

Adding to the stockpicking challenge, they were determined to check how serious companies are when it comes to improving environmental, social and governance practices, a focus for investors in Nordic countries like Finland, where their fund is based.

They came up with 108 questions to be posed to all the 1,000 companies they expected to meet, on topics such as compensation, carbon footprint and employee satisfaction. While they don’t apply Nordic standards to emerging-market companies, they’re trying to build a proprietary database of companies and their ESG achievements, the men say.

In countries such as Malaysia and Thailand, companies are aware of ESG in part due to pressure from regulators and stock exchanges, while in others, like Pakistan and Bangladesh, many companies are hearing about it for the first time.

The men say they’ve gotten better at recognising “greenwashing,” where companies portray themselves as more environmentally and socially responsible than they actually are.

“As global managers, we will never be the most well-informed investors,” Mr Flynn and Mr Nechunaev said in an emailed response to questions.

“Local brokers and fund managers have the advantage there. But we have the ability to understand the range of markets and to own the companies where we see the greatest value.”