Chubb, the global insurance business led by Evan Greenberg, proposed an acquisition of Hartford Financial Services Group for about $23.2 billion in cash and stock in what could be one of the industry’s biggest deals in years.

The New York-listed insurer’s offer – mostly in cash – values Hartford at $65 a share, Chubb said late on Thursday in a statement. That is a premium of about 13 per cent to Hartford’s closing price on Wednesday of $57.41. Hartford shares surged past the offer price to more than $68 apiece after Bloomberg reported that Chubb had approached Hartford about a deal.

A combination “would be strategically and financially compelling for both sets of shareholders and other constituencies”, Chubb said in the statement. The firm is “looking forward to constructive, private discussions in order to expeditiously consummate a fair transaction.” Chubb said it hasn’t received a response from Hartford.

Hartford confirmed the news later on Thursday and said that its board is reviewing the proposal with advisers.

Shares of Hartford have more than doubled over the past year, to a market value of about $24bn as of Thursday. The stock jumped as much as 20 per cent on the Bloomberg report. It settled at $68.15 at the close of regular New York trading, for a 19 per cent gain.

Chubb shares have gained 68 per cent in the past 12 months, hitting all-time highs recently and valuing the business at $76bn. Shares fell 3 per cent on Thursday.

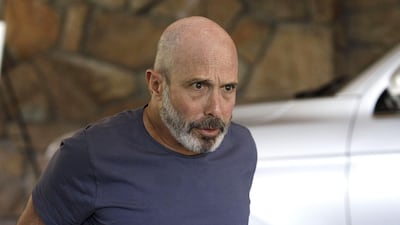

Mr Greenberg, 66, built the business into a mammoth insurer by combining Ace, the company he ran, with Chubb Corporation in an almost $30bn deal in 2016. The son of former American International Group chief executive Maurice “Hank” Greenberg, he has transformed Chubb into a firm with huge footholds in both personal and commercial lines. The company calls itself the world’s largest publicly traded property and casualty insurer, with operations in 54 countries and more than 30,000 employees, according to its website.

Hartford has long been considered a potential takeover candidate for the biggest insurers in the US, including Chubb, which could reap sizeable cost savings, as well as major players in Europe, such as Allianz and Zurich Insurance Group. The Swiss insurer agreed in December to buy MetLife’s US property and casualty business for $3.94bn.

A representative for Allianz didn’t immediately respond to a request for comment. A spokesperson for Zurich declined to comment.

The property-casualty insurance sector has been an active area for mergers and acquisitions in recent years. Allstate Corporation struck a deal last year to buy National General Holdings for $4bn in the insurer’s largest purchase on record, and Axa bought XL Group for more than $15bn in a 2018 transaction.

Hartford, led by chief executive Chris Swift, traces its roots back more than 200 years. It offers a range of property and casualty insurance, including automobile policies, homeowners’ coverage and small-business insurance. Hartford reported last month that fourth quarter core earnings rose 22 per cent to $636 million, beating estimates.

“An acquisition could be complementary for Chubb, an established consolidator that integrated the $28.3bn Ace/Chubb deal and emerged with industry-leading margins. Hartford could more than double Chubb’s premiums among US small-to middle-market clients, a sector where competition is heating up," said Bloomberg Intelligence insurance analyst Matthew Palazola. "Hartford’s personal lines’ profitability has been improving and may fill gaps where Chubb isn’t active.”

Hartford would help Chubb expand further in sectors including car and home insurance, as well as small business insurance and employee benefits. The company is a much more streamlined version of the business that took a bailout in the financial crisis. The insurer drastically reduced its exposure to annuities, a product that hit operations hard during the credit crisis, through a series of sales of a business later called Talcott Resolution Life Insurance.

The deal makes sense, David Havens, a credit analyst at Imperial Capital, said in a note to clients. “Hartford is a bit sub-scale, and Chubb could benefit from beefing up US scale.”

RBC Capital Markets analyst Mark Dwelle said in a note to clients that Hartford’s car and home business that targets mass-market customers differs greatly from Chubb’s high net-worth focus.

“Hartford has an attractive small business insurance franchise which would be additive to Chubb’s platform, but their specialty and middle-market businesses are considerably less profitable than Chubb’s and likely would require substantial re-underwriting,” Mr Dwelle said.

The Connecticut-based company ranks as the second-biggest provider of workers’ compensation insurance in the US, according to AM Best. It also has a mutual fund arm with about $139bn under management, its website shows.