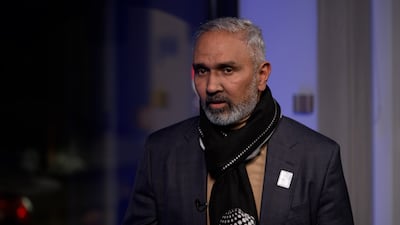

Abu Dhabi's International Holding Company is placing India at the core of its global investment strategy while cautiously expanding its footprint in Europe, chief executive Syed Basar Shueb has said.

The chief of the UAE's biggest company by market capitalisation offered a more optimistic assessment of European opportunities than those presented by US President Donald Trump at the World Economic Forum in Davos.

Mr Shueb told The National that India represents a long-term priority for the Abu Dhabi-listed conglomerate, targeting over $100 billion over a five-year investment plan which is already in place.

“We are pretty significantly investing in India,” Mr Shueb said on Friday at Davos.

He outlined a broad portfolio of investments across energy, industrial and real estate sectors, underlining India’s role as a strategic rather than opportunistic allocation.

“We are investing in renewable solar power projects. We are investing in battery solution. We are investing in nuclear, we are investing in aluminium smelter and real estate development,” he said.

Mr Shueb did not provide a target figure for future investment but confirmed that India would remain a key focus as IHC looks to invest between $16 billion and $36 billion globally over the next 18 months.

The group applies a strict diversification framework, limiting exposure to any single country or business to no more than 25 per cent of total holdings.

Defying the odds

Alongside India, Europe is once again attracting IHC’s attention, despite political and economic headwinds that have prompted caution among some global investors.

At Davos last week, Mr Trump delivered a critical assessment of Europe’s economic environment, warning that high regulation, energy costs and trade practices were making the region a less attractive destination for capital.

This took place amid his contentious territorial dispute with Denmark that rejected proposals to cede control of Greenland, a semi-autonomous territory, to the US.

Mr Trump described Europe as “very unfair” to the US and unfit for capital growth.

Mr Shueb took a different view, arguing that Europe remains investable provided assets are carefully selected.

“I think Europe is investable, and I think there is a lot of opportunities,” he said.

“One has to look in depth that what you are buying, if it fits with your current strategy. And if it fits with your investment criteria, we should go for it.”

IHC completed three European transactions last year and is currently in advanced discussions on acquisitions in two further jurisdictions, Mr Shueb said. These investments are focused on large-scale infrastructure and consumer-facing businesses.

“For me, healthcare is also infrastructure,” he said, explaining that the company applies a broad definition that extends beyond traditional assets such as transport or utilities.

Consumer-oriented sectors are expected to feature more prominently in future European investments.

“My top agenda in Europe will be something to do in the consumer sector,” Mr Shueb said, citing healthcare services, clothing brands and packaging businesses.

The group’s approach reflects a preference for acquisition-led growth rather than public listings. Despite frequent speculation around potential initial public offerings, Mr Shueb said IPOs are not currently a priority.

Liquidity criticism

When asked about IHC's dominance in the Abu Dhabi market − at 40 per cent of total market capitalisation − he said criticism was inevitable and that improving liquidity should focus on broadening the market rather than limiting large players.

“When you are in a market, you have to be ready for the criticism,” he said. “I want them to bring more and more companies and put it in the stock market so we become smaller in size compared to the 40 per cent [now].”

Mr Shueb said that IHC is looking to diversify its operations in Abu Dhabi by building new businesses.

In October, IHC sold its 42.54 per cent stake in Abu Dhabi property developer Modon Holding to L’imad Holding for an undisclosed sum, in line with its policy of limiting exposure to any single sector to no more than 20 per cent.

In an interview the following month, Mr Shueb told The National that the firm will be doing divestment and reinvestment every 18 months to achieve its targets.

That approached is increasingly evident in IHC's international deal making.

“IPOs are not on top of the agenda these days,” he said, adding that IHC plans to bring in new businesses by acquiring established platforms and entering markets through partnerships.

Banks, he noted, continue to play a key role in identifying suitable partners and accelerating market entry. “If they are bankable, then they are investable as well,” he said.

Earlier this month, IHC joined up with the US International Development Finance Corporation to co-invest in key sectors, in what the latter says is a “crucial step” in Mr Trump's foreign policy.

Beyond India and Europe, IHC continues to assess opportunities across multiple geographies, including emerging markets.

Mr Shueb said the group would not hesitate to move quickly if assets meet its financial and ethical criteria.

“Once we see an opportunity, it fits our criteria, it is ethical, we will be in,” he said.