Budget. What is it about that word that can send so many of us into downward spirals of denial, fear, resistance, and downright stupidity.

The B word explodes with emotion. The consequences can disable for life.

Here's what it means to so many: cheap; less expensive; not good quality; can't afford better.

Here's what it should mean: a way to know what we're doing with our money. A plan to help us live within our means. A guide to achieving goals.

From what I have read in many places, but haven't been able to verify the original source, the word budget was first used as an adjective to mean "inexpensive; suitable for someone of limited means" in 1958. And boy have we clung onto it.

The numerous adverts and branding linking "less money" with the word "budget" do little to help dispel the very emotional myth that to budget for something means that you cannot possibly afford to do that thing, or that you cannot buy that product. If you could, you wouldn't be budgeting for it.

People: to budget and to be well-off is not a contradiction in terms.

The problem is that there are massive emotional blocks associated with the B word. It's time for us to sort this out.

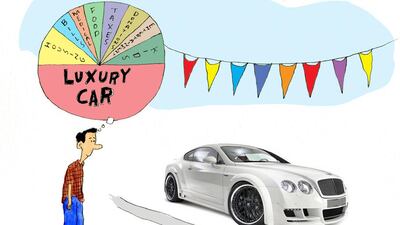

Here's an example of the mess we can get in. An immensely intelligent person believes he really did "budget" for a recent major purchase. He has no cash cushion, is permanently caught short and is not in a good place with his financial life.

He insists that he knows how to budget and has been doing so "forever" – both in a personal capacity and in the way of running a business.

From what I can glean, he means that he is great at adding up sums and making future projections. For him it's about income and expenses matching up. Monies not yet collected are included in spreadsheets as a given, and he is always paying for this month from next month's earnings.

He "knows" how to "budget".

He doesn't want to sit, look at what he spends where, and cut his cloth accordingly.

I wonder how it all started, what is triggered inside him when he is asked about money, being accountable and planning?

This is an example of someone being cerebrally intelligent, but emotionally not – not when it comes to money. "I can't afford", "I'm short", "just this month", are stock phrases that seem to somehow be part of who he is. For now.

An alternative extreme is someone who once budgeted to spend only Dh5 a day – for months on end – to save enough cash to buy his first professional camera. And he hasn't looked back.

He owns a thriving media business in the UAE. The Dh5 was after rent, utilities, and transport. This person went to one of the more expensive boarding schools in the UK and is due a windfall of an inheritance some day and so has access to money should he need it. But it was important for him that he get a lump sum together as soon as possible and start his own business, without handouts or getting into financial strife.

He comes from money. I don't know if the previous person I mention also had a comfortable life. But it's not about that. It's about what money comes to signify for us.

When we talk budget, the focus is on handling money and priorities. But that's not the real issue. It's actually about our emotional relationship with ourselves, which includes baggage we have taken on from others – such as family. It's very personal and can be very painful. And so when we talk budget, it boils down to what money means to us, along with a myriad of unacknowledged feelings, fears and phobias associated with it.

A bit of history now: it turns out that the origin of 'budget' is a Latin word for little pouch. It evolved from referring to the thing carrying objects, the bag, to the content of that bag, be it papers or arrows, for example. Its first connection with finances was in 1733 in "The Budget Opened" – a letter attacking Sir Robert Walpole – regarded as the first prime minister of Great Britain – over a taxation scheme he had proposed.

From what I read, "budget" started being used as a verb meaning planning expenditure in the 1880s. Then, as I mentioned at the start, became an adjective associated with 'inexpensive' in 1958.

I'm proposing we re-programme our brain to think positively about loaded money-words that can fill with dread.

So think this: budget equals: balance, benefit and bliss.

What does the word mean to you? And I don't mean just the money soup side of things – dig deeper and share. My email address is below.

Nima Abu Wardeh is the founder of the personal finance website cashy.me. You can reach her at nima@cashy.me

Follow us on Twitter @TheNationalPF

It’s time to rethink the big, bad budget word

Nima Abu Wardeh urges us to rethink how we define the word budget.

Most popular today