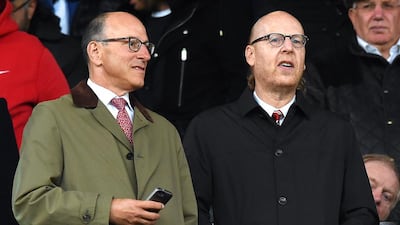

The Glazers are unlikely to ever be liked, let alone loved, by fans of Manchester United.

The fiercely private American family that bought the famous English football club 10 years ago has been widely depicted by the team’s fans and the British media as seeking to bleed the club dry after leveraging it up with debt.

Yet the Glazers are now assuaging some of their critics as the club says it will bankroll new player signings and is in a position to return to Europe’s biggest cup competition after failing to qualify last year for the first time in 19 years. Crucially, their transformation of United into a huge cash cow may give them an advantage over rivals.

There have been modest signs of hope for investors in the club’s New York-listed shares, which in a recent change of pace have outperformed the S&P 500 so far this year, gaining 2.3 per cent against the index’s rise of 1.7 per cent as revenue and cash flow are expected to climb. The shares have lagged the market since United’s initial public offering on August 9, 2012.

"My view is Man United are better off for the Glazers' ownership. Building the commercial engine they have built will continue to serve the club well," said Philip Hall, the managing partner at Spotlight Equity Partners, which advised other US investors on purchases of Liverpool and Sunderland football clubs.

Last week, the consultancy Brand Finance declared that Manchester United had regained its position as the most valuable football brand in the world in annual rankings, moving up from No 3 last year and knocking Germany's Bayern Munich from the top spot.

__________

Premium brands

■ View the top 50 football clubs by brand value

__________

The value of its brand had risen 63 per cent in the past year to US$1.2 billion as its executive vice chairman Ed Woodward and the Glazers “capitalised on the brand’s growing power to establish a worldwide fan-base and a range of sponsorship deals unrivalled in their number and value”, according to Brand Finance chief executive David Haigh.

This is the first time Brand Finance has assessed a club’s brand value at more than $1bn.

“Ed Woodward clearly understands that the commercial and competitive sides of the club cannot be run in isolation,” Mr Haigh said. “Manchester United have not had a great season but they have almost disengaged their on-the-pitch performance with their commercial performance.”

However, he added: “You can only do that for so long if you are unsuccessful before the brand begins to degrade, but they seem to have persuaded sponsors to stay.”

United and the Glazers – the family rarely make public statements – declined to comment for this story.

On the pitch, this season’s performance improved enough to get United fourth place in the English Premier League, up from what for United was a shockingly low seventh in the 2013-14 season. While still unacceptable to fans given that the side has been synonymous with winning trophies for much of the past two decades, the improvement is enough to secure a play-off round for the Uefa Champions League, Europe’s blue-ribbon competition. With that comes more match-day revenue from extra games, increased sponsorship money, additional merchandise sales, and a boost to TV income.

But crucial to growth is the way in which United is using the allure of what it says are 659 million people following the club around the world to secure sponsorship deals.

Last year’s world record £750 million (Dh4.26bn) 10-year kit deal with Adidas underlined United as the commercial leaders in football. That followed a seven-year $559m shirt branding deal with General Motors’ Chevrolet.

Commercial income will eventually make up more than half of revenue, up from 29 per cent when the Glazers arrived, brokerage Jefferies says, pointing to the club’s 17 global sponsors now versus 10 in 2012, and 95 total categories earmarked for marketing from 40 three years ago.

That could give it a leg up on rival clubs because the increased commercial revenue allows United to push up wage and transfer bills while remaining within its means. That satisfies new regulations designed to prevent clubs from spending more than they earn in attempts to buy success.

The club’s fortunes are being shaped at sales offices in London and Hong Kong.

At an unmarked building near the Ritz hotel in London’s affluent Mayfair district, United employs about 60 people to win new commercial deals. The club’s sponsorship appeal stretches from beverages and watches to tyres, paint, noodles and office equipment – across partners in many countries. It even has telecommunications company sponsors in Azerbaijan and Thailand.

As part of the Adidas deal, the club has retained retail rights to its own store, online sales and product licensing and will likely expand, outsource to third parties and take a royalty, Nomura analysts say.

A new digital media platform is also on the stocks.

United’s commercial progress led the club to raise its full-year earnings forecast last month. And Jefferies’ analysts foresee the club’s revenue growing by a third to £521m in the year to June 30, 2016.

That could help the shares rise above mid-table. Credit Suisse began coverage of the stock this month with an “Outperform” rating. However the shares have not impressed since their launch three years ago. Since then they have returned 5.4 per cent a year (based on Friday’s close), compared with 15 per cent a year for the Standard & Poor’s 500 index.

The New York-based hedge fund manager Ron Baron, who owned 40 per cent of the shares not controlled by the Glazers at the end of last year, told the US network CNBC in January that he expected to double or triple his money on United over the next four to five years.

Some smaller investors are also hopeful. “There is always the chance that the solid and incalculable value of the Manchester United brand and related intangible worth will prevail, and ultimately reflect in the stock’s performance,” commented Steve Schmelkin, a senior director of Clutch Group, a New York-based legal services company, which owns a small stake.

Malcolm Glazer, the family patriarch who made his fortune in real estate and stocks, bought United in May 2005 for £790m, after entering the sports business in 1995 with a takeover of a National Football League team, the Tampa Bay Buccaneers.

The leveraged nature of the football deal – United took on loans of £525m to finance the acquisition – by a businessman and his family who were unknowns in the United Kingdom made many United supporters very angry.

An effigy of Malcolm Glazer was burnt in the street during mass protests, and his death last year was celebrated by some on the terraces. The three of his six children, Avram, Joel and Bryan, who have managed the investment since Malcolm suffered a stroke in 2006, have also had a bad reception. Fans chanted “die, die Glazers” at the club’s Old Trafford ground, forcing family members to escape in an armoured police van on one occasion.

A dip in performance after legendary manager Alex Ferguson retired in 2013 has not helped relations with some fans, who allege the club has been more interested in servicing its debt rather than investing in new players.

And despite the improved prospects, there is plenty that could go wrong. The worst-case scenario would be if expensive new players fail to perform, the club has an early exit from the Champions League and it again falls down the Premier League table. Player costs would bite into financial results and the club could fall into a longer-term decline.

For shareholders there is also a danger the Glazers sell United shares when they need to raise money, as has happened in the past. That could hit the share price.

In a statement to mark the 10th anniversary of the Glazers’ takeover, the Manchester United Supporters Trust, which has campaigned against the Glazers’ control, said that while it was impossible to imagine worse owners, there are signs the club is seeking to improve relations with fans.

“Despite the huge damage inflicted over the last 10 years, things are undoubtedly beginning to look positive again in 2015,” conceded the chief executive of the supporters trust, Duncan Drasdo. The thawing only goes so far, though. One investor in the stock declined to comment for this article because he feared being targeted by anti-Glazer supporters.

business@thenational.ae

Follow The National's Business section on Twitter