A new trade route for energy supplies is opening up north of the Arctic Circle as some of the warmest temperatures on record shrink ice caps that used to lock ships out of the area.

This year is likely to rank among the top 10 for the amount of sea ice melting in the Arctic Ocean after heat waves across the northern hemisphere this summer. While that’s alarming to environmentalists concerned about global warming, ship owners carrying liquefied natural gas and other goods see it as an opportunity. Their cargoes have traversed the region for the first time this year without icebreakers, shaving days off shipping times and unlocking supplies from difficult-to-reach fields in Siberia.

More navigable waters are a boost for Russian President Vladimir Putin’s effort to expand his nation’s reach in the gas market and for energy companies such as Total and Novatek, which are leading Arctic developments. They also help reduce shipping costs for LNG, benefiting buyers and traders of the fuel from PetroChina to Gunvor Group.

“There is a growth trend for volumes transported via the Northern Sea Route this year,” said Sergei Balmasov, head of the Arctic Logistics Information Office, a consultancy in Murmansk, Russia. “The reason is an increase in LNG exports.”

While shorter shipping journeys reduce emissions, environmentalists are concerned that more traffic through the Arctic will add to the amount of black carbon - particles of pure carbon - settling in the snow from tanker smokestacks. When that soot darkens the surface of the ice, it speeds up the warming process by absorbing more of the Sun’s energy.

And with the shipping season through the Arctic starting earlier and ending later, tankers will spend more time in the area and spew more of their pollution onto the ice.

Turbulent weather in the area also churns the seas, making it almost impossible to clean up anything that’s spilled. The International Maritime Organisation is considering rules that would ban burning heavy fuel oil in Arctic waters, extending restrictions already in place in the Antarctic.

“It’s a major concern for us because as the ice melts we are seeing more and more shipping,” said Sian Prior, lead adviser for the Clean Arctic Alliance, an environmental group.

Scientists are seeing a rapid change in the Arctic. The Bering Sea between Alaska and Russia lost about half its ice coverage during a two-week period in February, while the most northern weather station in Greenland recorded temperatures above freezing for 60 hours that month. The previous record was 16 hours by the end of April 2011. The mercury topped an unprecedented 30°C north of the Arctic Circle on July 30 in Banak, Norway.

_______________

Read more:

The gas that came in from the cold

Ocean of problems awaits if Shell fails to sail with caution

_______________

“The ice has been retreating by about 10 per cent every decade during the last 30 years,” said Miguel Angel Morales Maqueda, senior lecturer in Oceanography at Newcastle University in northern England. “There is no other known explanation than climatic change. If it isn’t climactic change, then we don’t know what it is.”

LNG exporters are taking advantage of the open waters, most notably around the Yamal LNG gas liquefaction plant in northern Siberia. The project owned by Total, Novatek and their Chinese partners has custom-built ARC 7 tankers rugged enough to cut through whatever ice remains in the area.

That enables them to sail without help from icebreakers west to Europe year round and east to Asia during the summer months. In the coming years, more routes will open for ships to sail without an icebreaker.

The Northern Sea Route shipping lanes to Europe and North America from Asia are now in use by cargo ships and fuel tankers, and there is projected to be as much as a 500 per ent increase in traffic by 2025, from 2015 transit estimates, according to an International Council on Clean Transportation report for the US Committee on the Marine Transportation System.

The Yamal venture's Christophe de Margerie was the world's first icebreaking LNG tanker built and collected Yamal's first cargo to make the the trip westward through the Northern Sea Route.

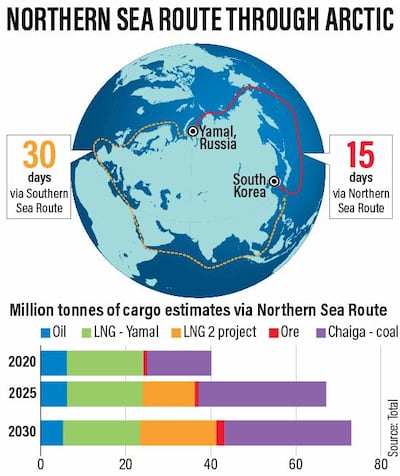

In early 2018 though, the Eduard Toll became the first LNG tanker to ever use the full Northern Sea Route in the winter. It travelled from a South Korean shipyard to Sabetta and collected a cargo there from the Yamal LNG plant, then delivered it to France. That shaved about 3,000 nautical miles off the traditional route through the Suez Canal.

In July China received two cargoes from Yamal from the first LNG ships to cross the Arctic without help from icebreakers. The net voyage time from the port of Sabetta through the Northern Sea Route to the destination the Chinese port of Jiangsu Rudong was completed in 19 days, compared with 35 days for the traditional eastern route via the Suez Canal and the Strait of Malacca. Newer ships should be able to complete the journey faster in both directions but the difference will remain the same.

Routes like that may save Yamal $46 million in shipping costs for the remainder of the year, those savings could quadruple by 2023, Bloomberg NEF said.

Then there is another planned LNG project the Arctic LNG-2, which might come online in 2023, with a similar LNG capacity to the Yamal project. Overall, 40 million tonnes of LNG might be transported by 2025, when both projects fully come online, according to Russia's PortNews.

Traffic is picking up. The Northern Sea Route saw 9.7 million tonnes of cargo shipped through it in 2017, according to the Russian Federal Agency for Maritime and River Transport. There were 615 voyages along the Northern Sea Route this year through July 15, about the same as in 2017, said Mr Balmasov. The Russian government is targeting cargo traffic through that route totalling 80 million tonnes by 2024.

“The main difference to 2017 is LNG deliveries from the port of Sabetta,” Mr Balmasov said. “Our data show that as of early July, 34 tankers were dispatched from Sabetta towards European ports, and one voyage was east-bound.”

Since then, two more ships have moved from Yamal to Asian markets in the east, though the most icy part of the Northern Sea Route.

And the number looks set to only increase.