Live updates: follow the latest news on Russia-Ukraine

Oil prices soared above $130 a barrel in early trading on Monday, their highest since 2008, after the US said it is considering banning the import of Russian crude and is discussing such a move with its European allies, in a bid to freeze the world's second largest energy exporter out of global markets and isolate Moscow economically for its military offensive in Ukraine.

Brent, the global benchmark for two thirds of the world's oil, hit $139.13 a barrel and West Texas Intermediate (WTI), the gauge that tracks US crude, jumped to $130.50 in early trading.

Both key benchmarks receded by 4.10pm UAE time, but remained high, with Brent up 6.16 per cent at $125.4 per barrel and WTI 6.33 per cent higher at $123.

Brent hit a record high of $147.02 on July 11, 2008 amid the global financial crisis, while WTI soared to $146.90.

"We are now in very active discussions with our European partners about banning the import of Russian oil to our countries, while of course, at the same time, maintaining a steady global supply of oil," US Secretary of State Antony Blinken said in an interview on NBC's Meet the Press show.

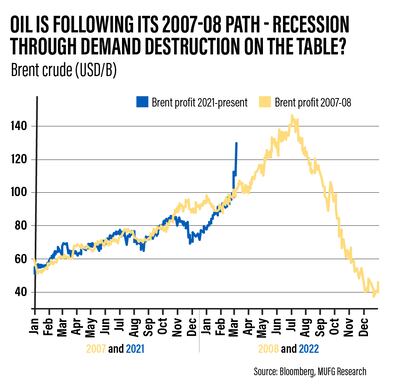

Oil prices could hit $180 a barrel and cause a global recession, according to Japan's largest lender MUFG Bank.

"Should the prevailing Russia-Ukraine conflict intensify in the coming weeks and broaden to include energy sanctions, we would be increasingly convicted that the sheer velocity of Russian crude and refined products exports off the table would march the front end of the oil price curve to $180 a barrel by the summer if not earlier," said Ehsan Khoman, head of emerging markets research at MUFG.

Oil prices at such levels will lead to demand destruction and consumer energy spending plummeting, which happened in the early 1980s and mid-2000s, leading to global recessions in 1982 and 2009.

"The prospect of history repeating itself is substantial," Mr Khoman said.

The world could be on the brink of an energy crisis rivalling the 1970s, according to Daniel Yergin, vice chairman of IHS Markit and a renowned author and energy market historian.

“This is going to be a really big disruption in terms of logistics, and people are going to be scrambling for barrels,” Mr Yergin said last week. “This is a supply crisis. It’s a logistics crisis. It’s a payment crisis, and this could well be on the scale of the 1970s.”

In addition to the US rattling markets with its announcement, oil prices also rallied as Moscow "inserted some hefty last-minute demands on the US in the small print of the almost-finished Iran nuclear deal," said Jeffrey Halley, senior market analyst at Oanda. "With the latter in jeopardy, and the former sure to lead to higher domestic prices, it is no surprise that Asian traders, a region heavily reliant on imported energy, pushed the panic button."

On Saturday, the International Monetary Fund said the Russia-Ukraine conflict and the sanctions imposed on Moscow as a result, will have a "severe impact" on the global economy.

The continuing conflict has already driven up energy and commodity prices, adding inflationary pressures from supply chain disruptions and sending a wave of more than one million Ukrainian refugees to neighbouring countries.

"While the situation remains highly fluid and the outlook is subject to extraordinary uncertainty, the economic consequences are already very serious," said Kristalina Georgieva, the IMF's managing director.

"The sanctions on Russia will also have a substantial impact on the global economy and financial markets, with significant spillovers to other countries."

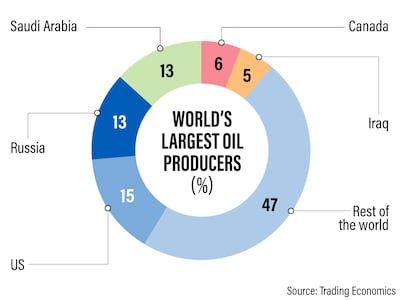

In 2020, Russia produced about 10.2 million barrels a day of crude oil and natural gas condensate, placing it second after the US, with Saudi Arabia in third place, according to the 2021 BP Statistical Review of World Energy. It is also the second-largest producer of natural gas in the world. Russia is also a major producer of metals including aluminium, platinum, copper and palladium, and their prices have climbed because of the crisis.

Multi-year high oil prices have already raised transport costs, exacerbating already high inflation levels that are driving up the prices of basic goods and denting the tentative growth of the global economy that was just recovering from the Covid-19 pandemic.

After rallying 60 per cent last week, wheat prices are at their highest since 2008 on concerns that the Russia-Ukraine conflict will disrupt supplies from two major breadbaskets. Wheat futures on the Chicago Board of Trade (CBOT) rose more than 7 per cent on Monday. Combined, the Ukraine and Russia export 29 per cent of the world’s wheat through the Black Sea, where many shipping firms have suspended operations after attacks on cargo ships.

Meanwhile, corn futures which gained 15 per cent last week are up 3 per cent and soybeans gained more than 1 per cent.

Metals have also rallied with Aluminium, which gained 15 per cent last week on the London Metal Exchange, rising to a record $4,000 a tonne on Monday receded to $3,930. Nickel, which increased 19 per cent last week, was up 17 per cent on Monday to $33,820 a tonne.

Russia produces about 6 per cent of the world's aluminium, about 7 per cent of global nickel and around 3.5 per cent of copper.

Gold, the precious metal that is a traditional safe haven and hedge against inflation, hit $2005.4 an ounce on Monday on the CBOT at 2.41pm UAE time. It edged lower to $1991 an ounce at 4.23pm.

"The answer to the question whether gold is still cheap or already expensive as an insurance ... very much depends on the future trajectory of the war," said Carsten Menke, head of next generation research at the Swiss lender Julius Baer. "A further escalation would likely lift prices further. The latter would likely have a more lasting impact, as it could push the world economy towards a stagflation scenario, which we see as very bullish for gold."

The conflict in Ukraine could reduce the level of global gross domestic product by 1 per cent by 2023, or about $1 trillion, and add up to 3 per cent to global inflation in 2022 and about 2 percentage points in 2023, said the UK’s National Institute for Economic and Social Research.

Western sanctions on Russia have targeted its central bank, disconnected its key banks from the global Swift payments network and banned the country from doing business in the US dollar, euro, yen and pounds. Punitive measures against Russia also include freezing Moscow's assets and denying it access to western financial markets, curtailing its ability to raise funding.

The Moscow stock exchange was closed all of last week after it fell more than 45 per cent before closing 33 per cent lower the last week of February, making it the fifth-worst plunge in stock market history. The country's rouble was trading at 112.5 to the US dollar on Monday, well beyond its 75 range to the greenback. Year to date the currency is down about 50 per cent.