Oil prices surged overnight after the Opec+ 23-member alliance of producers stuck with its production plans for April and the Ukraine-Russia crisis continued to weigh on markets.

Brent, the global benchmark for two thirds of the world's oil, surged 5.6 per cent to $119.3 per barrel at 11.44am UAE time on Thursday. West Texas Intermediate, the gauge that tracks US crude, rallied 4.96 per cent to $116.1 a barrel, its highest since 2008.

Brent hit a record high of $147.02 on July 11, 2008 amid the global financial crisis, while WTI soared to $146.90.

"The vertiginous surge in global commodities has surpassed even our above consensus expectations that we laid out in our annual 2022 outlook," said Ehsan Khoman, head of emerging markets research at Japan's largest lender MUFG Bank.

"The rally will stoke a torrent of inflationary pressures as the building blocks of the global economy gets ever more costly. It is this premise that we believe commodities are now marching to levels where demand destruction – through still higher prices – will become prevalent."

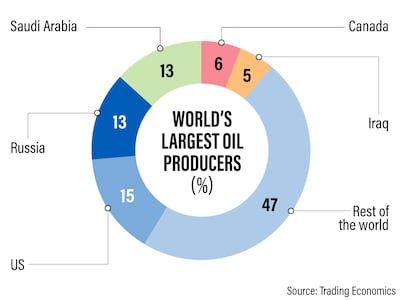

The US and EU have levied a slew of sanctions against Russia, which is a major global energy producer and leads the Opec+ 23-member alliance along with Saudi Arabia.

The wave of punitive measures against Moscow aim to cripple its economy but have not targeted its energy and commodity industries. That is largely a result of the country's clout as an oil producer and commodity exporter, which if singled out, could have reverberations on the global economy which is recovering from the pandemic.

While Russian gas continues to be supplied to customers, the sanctions against Russia have induced self-sanctioning among countries and customers who fear being punished.

Buyers and shipbrokers are "skittish to move Russian seaborne oil given the ambiguity of what's legally permissible, concerns surrounding reputational repercussions and/or merely for moral obligations. Global gas markets are facing a similar fate as with oil, with sustained higher gas prices bracing European authorities to bring forward disaster planning for next winter", Mr Khoman said.

Jeffrey Halley, senior market analyst at Oanda said “even if Western sanctions appear to be allowing energy payments to continue, Western financial institutions are taking no chances”.

“Geopolitics is driving markets and not traders. Brent crude is now in shouting distance of my initial $120 a barrel target and with markets unable to magically replace $5 million bpd of Russian oil exports, it seems when and not if it will hit this level. WTI could also potentially move to $120.00 in the sessions ahead.”

Despite the Ukraine conflict, an already tight market because of years of underinvestment in the energy industry and high demand due to the global economy recovering from the pandemic, Opec+ on Wednesday kept to its 400,000 barrel-a-day production increase plan that was scheduled for April.

“The decision had seemingly no dissent and the ministerial meeting was completed in a brief period. Critically, the statement following the meeting made no mention of the war in Eastern Europe nor of any threat to Russian exports of oil that could come as a result of its invasion of Ukraine,” Emirates NBD said in a note on Thursday.

The April production levels are the last before new higher baseline levels come into effect that will allow relatively larger monthly increases from some producers, including the UAE.

Russia’s military offensive in Ukraine could wipe out 1 million bpd of regional oil demand, affecting global balances, according to Rystad Energy.

“The economic fallout from the war — in addition to the humanitarian crisis — is going to be sweeping, both for Russia and Ukraine, and the region’s oil demand is going to take a severe hit if the conflict is prolonged and recently enacted sanctions remain in place,” says Sofia Guidi Di Sante, oil market analyst with Rystad Energy.