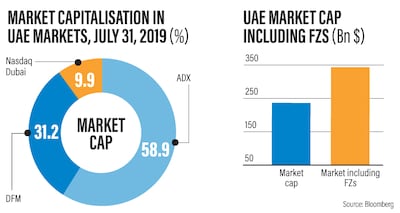

The UAE’s three stock markets – the Abu Dhabi Exchange, the Dubai Financial Market and Nasdaq Dubai, have a total of 175 listed companies, with a combined market capitalisation of $230.6bn, or Dh846.8bn (as of 31 July), resulting in an equity to GDP ratio of 62.6 per cent. The markets are dominated by domestic retail investors but a number of measures can be taken to make them more dynamic and help further enable a transformation of the UAE into a more well-diversified, modern economy able to innovate and adapt to rapid technological change:

Allow free zone (FZ) companies to list on the exchanges to dynamise the markets

Several recent initiatives could be liberalising and market building:

- The One Free Zone Passport Initiative by the Dubai Free Zone Council allows firms to operate in multiple free zones on a single licence, lowering costs of establishment and increasing mobility. Details of how this will work in practice have yet to be announced.

- The Emirates Securities and Commodities Authority (SCA) announced that it was working with companies in free zones, and SMEs to facilitate access to finance through market listing (via a first-of-its-kind platform), through IPOs.

- Similarly, Abu Dhabi introduced a dual licensing scheme for onshore and free-zone firms last year, while the Dubai DED's MoU with the Dubai Free Zone Council makes it possible for FZ companies to operate onshore and DMCC announced in July 2019 that it was partnering with DED to introduce a dual licensing scheme.

The game-changing reform would be to allow the listing of FZ companies on the exchanges. This structural reform would strongly boost the growth, development and diversification of the UAE’s capital markets. Allowing the listing of FZ companies would reduce the existing concentration risk, enabling companies from a wide variety of sectors from banking and finance in the DIFC and ADGM, to trading, manufacturing and industry, to health, pharmaceuticals, media, digital services, in the FZs, to provide substantial investment diversification benefits to investors, reducing the overall risk of investing in UAE markets, as well as promising returns that are not strongly correlated with the domestic economy with its high dependence on the energy sector.

Economic importance of the free zones

The UAE developed FZ clusters as a major policy instrument for economic liberalisation and diversification long before its regional peers. It has one of the highest number of FZs in the world: some 45, of which about 30 are in Dubai including Jebel Ali Free Zone (JAFZA), a global trade and logistics hub linked by a customs free corridor to Al Maktoum International Airport and processing trade worth $83bn in 2017. JAFZA is home to more than 7,000 businesses originating from over 100 countries, and attracting an estimated 24 per cent of the UAE’s FDI. The Dubai Multi Commodities Centre hosts more than 15,000 companies and contributes less than 10 per cent of Dubai's gross domestic product. The DIFC is Dubai’s banking and financial FZ with 2003 active, registered companies, and contributed some 3.9 per cent to Dubai’s GDP last year. The bottom line is that the FZs are a major contributor, in excess of 45 per cent of Dubai’s economy and some 30 per cent of the UAE’s economy. More importantly, the FZs are the main hubs of innovation and adoption of modern technologies in the UAE and are the embodiment of economic diversification, complementing the oil and gas dependent domestic economy.

UAE capital markets can boom through the FZ companies

Despite their large economic contribution, the businesses in the FZs are not represented in the UAE’s capital markets. What if a fraction of FZs companies were allowed to list or tap the capital markets by issuing bonds, commercial paper, sukuk and other instruments? Inclusion of FZ companies would:

- Increase the size of the capital markets by some $85bn to a total capitalisation of $345bn (equivalent to 90 per cent of GDP), while the bond and sukuk markets could plausibly double in size.

- Lower risk by providing access to the more diversified economy including the FZs, attract foreign investors and FDI.

- Retain domestic saving that would otherwise be remitted abroad, thus widening the investor base and improving the balance of payments

- Widen access to equity and debt finance for FZ companies, support their development and growth, expand the size of the FZs and their contribution to the UAE economy and its diversification.

- Result in lower volatility/risk of market returns through the greater depth, breadth and liquidity of expanded markets.

The prospects are promising but opening the markets for FZ companies requires a number of building blocks: a robust legal and regulatory framework, including reforming listing rules and regulations to allow access for FZ companies; transparency and disclosure by the FZs providing data, statistics and information about FZ companies to allow comparative analysis on a regional and international basis. FZ companies would clearly need to disclose their audited financials, upgrade their corporate governance and comply with applicable international codes and standards, including AML/CFT.

The bottom line is that the UAE should open its capital markets to allow access to FZ companies that will boost capital formation, dynamise the markets, encourage domestic and foreign investment and help achieve the overarching objective of job creation and economic diversification.

Dr Nasser H Saidi is the Founder and President of the economic advisory and business consultancy Nasser Saidi & Associates