The Saudi Research and Marketing Group (SRMG), the largest publishing business in the Middle East and Gulf region, signed an agreement with Bloomberg to acquire an exclusive licence to launch Bloomberg Arabiya, a multi-platform news network to serve a growing global appetite for Arabic-language business and financial news.

The Riyadh-listed media and the publishing house, will pay approximately 33.75 million riyals (US$9 million) for the business and financial news service license annually for ten years, it said in a statement to Saudi Stock Exchange (Tadawul) where its shares are traded.

SRMG, which also publishes Arabic and English language dailies Asharq Al Awsat, Arab News and Aleqtisadiah, plans a 24-hour television and radio network and dedicated digital platform under the “Bloomberg Al Arabiya” brand. The firm will also publish Bloomberg Businessweek magazine in Arabic and launch a new conference and live events series, it said in a separate statement.

This the second time Bloomberg, a US-headquartered financial data and news services company, has entered a regional tie up to capture the Arabic-speaking audience in the regional markets. The company had earlier partnered with the Saudi billionaire Prince Alwaleed bin Talal to produce Al-Arab, an Arabic language news channel, which was aborted in 2015. Bloomberg was supposed to provide five hours of business news per day for the news channel.

Bloomberg Al-Arabiya will be a direct competition to agencies like Reuters and Agence France Presse (AFP) and television channels like Al Arabiya and CNBC Arabia that produce business news in Arabic. It will provide viewers news and analysis on companies, markets, economies and politics shaping the Middle East, according to SRMG statement, which did not say when the new multi-platform service will commence.

______________

Read more:

Prince Al Waleed and Bloomberg plan Arab news channel

______________

The Bloomberg Al-Arabiya team will be managed by SRMG with support from Bloomberg, and will draw on its financial and economic content and data as well as its 2,700 reporters and analysts globally. It will be headquartered in the Arabian Gulf region, SRMG said without specifying the location.

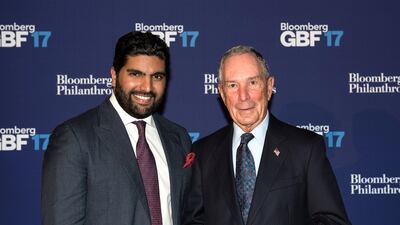

“We are very pleased with this promising partnership with Bloomberg. In addition to the many business opportunities this collaboration brings, we believe the partnership will greatly enhance the media landscape in our region,” Prince Bader bin Abdullah Al-Saud, chairman of SRMG said. “This is an exciting development for SRMG and a strong progression in our quest to offer the highest quality financial and business journalism from, and about the Middle East.”

“The Middle East is an important, economically diverse region and our agreement with SRMG allows us to deliver the sharpest global business and financial insights to a critical audience of business decision makers,” said Michael Bloomberg, the founder of Bloomberg.

The deal will give the regional media industry a boost and will help SRMG to expand into the international television business.

The agreement is “an integral part” of Bloomberg’s strategy of forming partnerships with leading news providers in markets that have a compelling economic growth stories and the company will continue to further expand its “localised international presence,” said Justin B. Smith, the chief executive of Bloomberg Media Group.

SRMG's share price rose 7.8 percent, almost 30 times the country's benchmark index on Thursday, according to Bloomberg. The shares climbed to Saudi riyals 75.20 from 69.78 riyals.